China’s capital markets have historically been cut off from the rest of the world. Chinese policymakers have viewed a closed capital account as key to maintaining financial stability and necessary for the effective management of the exchange rate. Over the past several years, however, several small but important channels have opened to allow capital to flow between China and global capital markets.

The newest of these channels is the Shenzhen-Hong Kong Stock Connect program, which complements a similar program involving the Shanghai and Hong Kong exchanges. The two programs now link stock exchanges with a combined market capitalization in excess of USD 10 trillion, the second largest equity market in the world taken as a whole. The stock connect programs have the potential to serve as important financial gateways for both institutional and individual investors. However, low utilization rates of both programs by investors are hindering their potential to serve meaningful openings.

The Shenzhen-Hong Kong Stock Connect was approved in August 2016 and officially launched on December 5. Investors in Hong Kong and the rest of the world will now have access to more than 800 stocks listed on the Shenzhen Stock Exchange. Mainland institutional investors are able to invest in more than 400 stocks listed in Hong Kong under the program.

The Shenzhen program is modeled after the Shanghai-Hong Kong Stock Connect. The Shanghai Stock Connect launched in November of 2014 and was a breakthrough in that it allowed foreign individual investors an avenue to invest in mainland A-shares for the first time. Previously, the only conduit was for foreign institutional investors via the Qualified Foreign Institutional Investors program (QFII). The breakthrough was less significant for mainland investors because only institutional investors and high net-worth individuals are allowed to use the program to invest in Hong Kong.

Mainland investors participating in the Shanghai program are allowed to purchase stocks of companies in the Hong Kong large and midcap indices as well as stocks listed on both the Hong Kong and Shanghai Exchanges. Hong Kong and global investors are permitted to purchase stocks on the SSE180 and SSE380 indices, the largest 180 and 380 stocks, as well as dual-listed stocks. Investment flows were limited to RMB 10 billion southbound and RMB 13.5 billion northbound per day, with an aggregate annual quota of RMB 250 billion and RMB 300 billion, respectively.1

Despite the similarities, there are a few key differences between the Shanghai and Shenzhen programs. Table 1 outlines the main features of both programs:

| Shanghai-Hong Kong Connect | Shenzhen-Hong Kong Connect | |

|---|---|---|

| Who Can Trade (Southbound) | Mainland institutional investors and individual investors with securities and cash accounts greater than RMB 500,000. | Mainland institutional investors and individual investors with securities and cash accounts greater than RMB 500,000. |

| Who Can Trade (Northbound) | All overseas and Hong Kong investors. | All overseas and Hong Kong investors. ChiNext Stocks are limited to institutional investors. |

| Eligible Stocks (Southbound) | 315 Stocks. Large Cap and Mid Cap Indices and dual-listed stocks. | 417 Stocks. Large Cap and Mid Cap Indices and dual-listed stocks. Stocks on the Small Cap Index with market capitalization above HK$ 5 billion. |

| Eligible Stocks (Northbound) | 574 Stocks Total. SSE 180 and 380 indices and dual-listed stocks. | 881 Stocks Total. SZE Component index and dual-listed stocks. Stocks on the Small/Mid Cap Innovation Index with a market capitalization above RMB 6 billion. |

| Daily Trading Limits (Northbound) | RMB 13 billion | RMB 13 billion |

| Daily Trading Limits (Southbound) | RMB 10.5 billion | RMB 10.5 billion |

Companies listed in Shenzhen tend to be smaller, faster growing, and command a higher premium in terms of price multiples than their counterparts in Shanghai. Institutional research coverage of Shenzhen-listed companies is more limited due to this higher proportion of small-cap stocks. The prevalence of small growth-oriented companies tends to make Shenzhen stock prices more volatile than those in Shanghai, no easy feat given the rapid movements of Shanghai equities.

Perhaps reflecting these differences, the Shenzhen-Hong Kong Stock Connect program permits investment in more small-cap stocks. Northbound investors can purchase shares of the Shenzhen Stock Exchange Small/Mid Cap Innovation Index, although the firm must have a market cap of greater than RMB 6 billion. There are also opportunities for southbound investors to invest in small-cap stocks. Mainland investors can purchase shares of companies in the Hang Seng Composite SmallCap Index that have market capitalization of greater than HKD 5 billion.

The most important change accompanying the Shenzhen Stock Connect is that the program has no initial aggregate quota restriction. Cross-border flows for the Shenzhen Stock Connect will only be limited to the daily quota restrictions. Coinciding with this announcement, authorities also removed the aggregate quota for the Shanghai Stock Connect. The move reflects authorities’ desire to boost long-term capital flows while restricting short-term speculative money.

Despite the lifting of the aggregate quota, the level of cross-border flows via both connect programs is low. Even the lifting of capital gains tax for foreign investors buying mainland stocks and for individual mainland investors buying Hong Kong stocks has not led investors to fully utilize the daily quota on more than a handful of occasions. Table 2 shows the average utilization rates for the stock connect programs since the first day of trading.

| Shanghai-Hong Kong Connect | Shenzhen-Hong Kong Connect | |

|---|---|---|

| Northbound Utilization | 6.2% | 8.2% |

| Southbound Utilization | 8.5% | 4.2% |

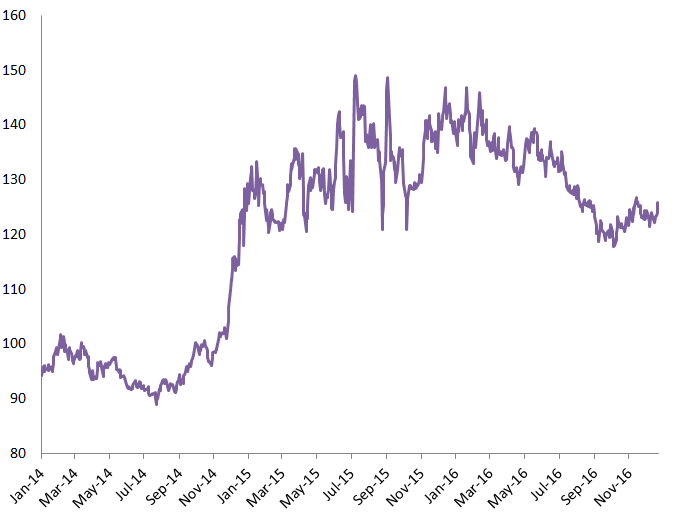

The low utilization rates help explain why price discrepencies continue to exist between the shares of companies that are listed on both mainland and the Hong Kong stock exchanges. There are over 60 stocks that are dual-listed, including many of China’s largest state-owned enterprises and banks. Figure 1 shows the Hang Seng China AH Premium Index, an index that was created specifically to track the value of A-shares relative to H-shares of the same companies. As the figure shows, the price divergence for dual-listed shares actually increased after the creation of the Shanghai-Hong Kong Stock Connect program.

What steps will be necessary to help ensure that these new programs fulfill their purpose of connecting China’s stock markets to global investors? For northbound investors, distrust of mainland stocks continues to linger following the August 2015 meltdown and government efforts to halt trading. The recent strengthening of certain capital controls adds to these concerns. The possibility of further depreciation of the renminbi also reduces the attractiveness of buying mainland stocks for Hong Kong and global investors. With respect to the southern channel, China’s institutional and high-net worth investors can already achieve significant international diversification without the connect program, making them unlikely to use it heavily. To increase southbound traffic, authorities will likely need to expand the program beyond the current participants to include more retail investors.

Further steps should include expanding the range of financial products available, removing some of the barriers on short-selling and increasing the number of stocks available for trading will increase the attractiveness of the connect programs. Regulators in China and Hong Kong have announced their intention to expand the programs, pending continued successful operations, to include ETFs and other financial products in the future. There are even proposals under discussion for the creation of a stock connect program between Shanghai and London, linking Chinese equity markets to the largest stock exchange in Europe.

The Shanghai and Shenzhen stock connect programs can play an important role in China’s quest for greater inclusion in global investment benchmarks. Chinese stocks have not yet been added in some of the key global emerging market equity benchmarks, a glaring omission given the size of China’s equity markets and the importance of its economy. Easing restrictions on the cross-border flow of capital is a key prerequisite of benchmark inclusion. The addition of the Shenzhen-Hong Kong Stock Connect and the removal of the aggregate quota for both programs have increased the scope for two-way capital flows. Further work to increase the daily utilization rate may ultimately help convince the benchmark gatekeepers that China’s stock markets are suitably integrated into world markets and ready for inclusion.

1. The daily quota is calculated on a “net buy” basis. This means that investors can always sell a security bought through the connect program or input order cancellation requests.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.