Reforms to the Chinese bond market are beginning to show results as several important government bond indices have taken steps to include China. Over the past several years, Chinese regulators have made a series of policy changes aimed at opening up the bond market to foreign investors. Most recently, in February the government began allowing foreign bond investors to hedge their currency risks in the onshore foreign exchange market, which has significantly greater liquidity than the offshore market foreign investors previously used. The cumulative effect of these reforms has led to a re-evaluation of the Chinese market by global bond index managers.

Global bond indices play a critically important role in shaping investment decisions and the cross-border flow of capital. Bond fund managers use the indices to guide their investment allocations, seeking to replicate or outperform the holdings of a particular index. The addition of a country to an index typically leads to an inflow of foreign funds into that country’s bond market as fund managers following the index update their holdings to reflect the change.

With more than $1.5 trillion of outstanding debt securities, China’s central government bond market is one of the largest in the world. The size of this market is expected to grow given continuing economic development, financial deepening, and ongoing government deficit spending. Chinese central government bonds are highly rated for an emerging market economy and offer relatively attractive yields compared to much of the rest of the global bond market, which is mired in negative rates. In addition to central government debt, there are nearly $1.8 trillion of policy bank bonds, issued by China’s three policy banks and rated highly due to their strong levels of government support. The combination of a large market with a variety high quality sovereign and quasi-sovereign issuers means that China should be a good match for institutional investors seeking to diversify.

Despite the size and importance of China’s government bond market, the country has had a limited presence in the major global bond indices. Index managers provide China specific bond indices, but for the most part the country is absent from the primary emerging market and global government bond indices. A range of factors have prevented inclusion, including China’s use of capital controls, restrictions on foreign investors, poor hedging tools, lack of liquidity, and a nascent domestic ratings industry. The lack of representation in bond indices is mirrored by China’s unsuccessful attempts to be added to global equity indices as well.

JP Morgan’s Government Bond Index–Emerging Markets Global Diversified Index is one of the most widely tracked indices for emerging market debt. China is not part of the index, but in March 2016 JP Morgan announced that it had placed China under review for inclusion in the main index. Many analysts believe that JP Morgan may decide to include China in the index soon.

Over the past several weeks, two additional major bond indices have taken steps to incorporate China. Bloomberg launched two modified versions of its indices that include China, the Global Aggregate + China Index and the Emerging Market Local Currency + China Index. As shown in Figure 1, China will account for around 5 percent of the global index and the largest share of the emerging markets index by a wide margin.

Citi also moved to add Chinese bonds to three existing indices: the Emerging Markets Government Bond Index (EMGBI), the Asian Government Bond Index (AGBI), and the Asia Pacific Government Bond Index (APGBI). As shown in Figure 2, the sheer size of the Chinese market tends to overwhelm these indices, occupying a large proportion of the total. As a result, there are also “capped” indices where the Chinese share of the total is limited.

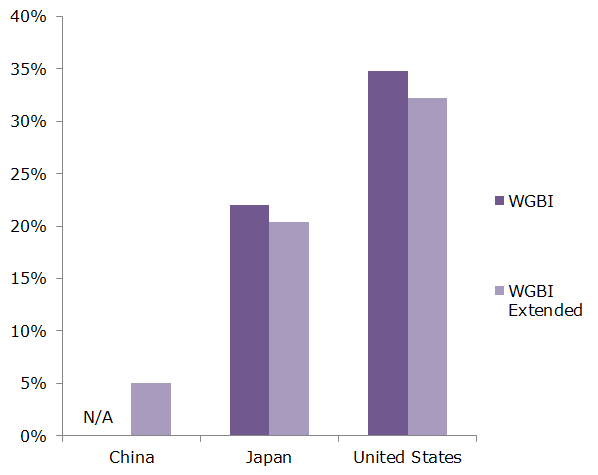

China, however, has yet to enter Citi’s most important index, the World Government Bond Index (WGBI). Instead, as with the Bloomberg indices, a half-step was taken by creating a new WGBI-Extended index that includes China. As shown in Figure 3, China will initially account for around 5 percent of the index, a number that is likely to grow over time.

Outside analysts have projected that full inclusion in the above indices could lead to as much as $250 billion in new inflows. The current half measures may result in fewer inflows as investors wait for China to be added to the main indices. Nonetheless, it’s clear that the Chinese government bond market is becoming more connected to the global debt market and will play an increasingly important role in global bond benchmarks in the future.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.