Economic and financial developments in several corners of the globe this year have ignited broader concerns over emerging market vulnerabilities. Global investors and policymakers alike are closely monitoring Argentina and Turkey especially, following large currency depreciations and capital outflows in both countries and open questions about spillover effects on the rest of the world.

Some researchers could be forgiven for feelings of déjà vu. In both economies, high and rising levels of external debt were symptomatic of growing domestic vulnerabilities, including Asia’s financial crisis in the late 1990s and Argentina’s traumatic collapse in 2001 (from which the country has yet to recover). With these specters in mind, this blog post takes stock of external indebtedness across Asia, including comparative analysis regarding the situations in Argentina and Turkey. There’s special attention given to foreign currency-denominated debt, which has played an important—and often catalytic—role in prior crises. In that sense, Asian economies generally look like they are sitting on more stable ground. However, our research points to certain exposures that warrant close monitoring over the near- and medium-term.

Large External Indebtedness Mirrors Asia’s Financial Hubs and Largest Economies

To set the stage, it’s helpful to start with South America and Europe. Both Argentina and Turkey have high and rising stocks of debt owed to nonresidents (“external debt”), which has exacerbated both countries’ fragilities. In Argentina, foreign liabilities increased sharply in 2017 as authorities financed large government deficits through foreign borrowing. Turkey has a longer record of rising external liabilities, with foreign borrowing climbing 50 percent—equal to $160 billion in foreign obligations—between 2012 and 2018.

External Debt

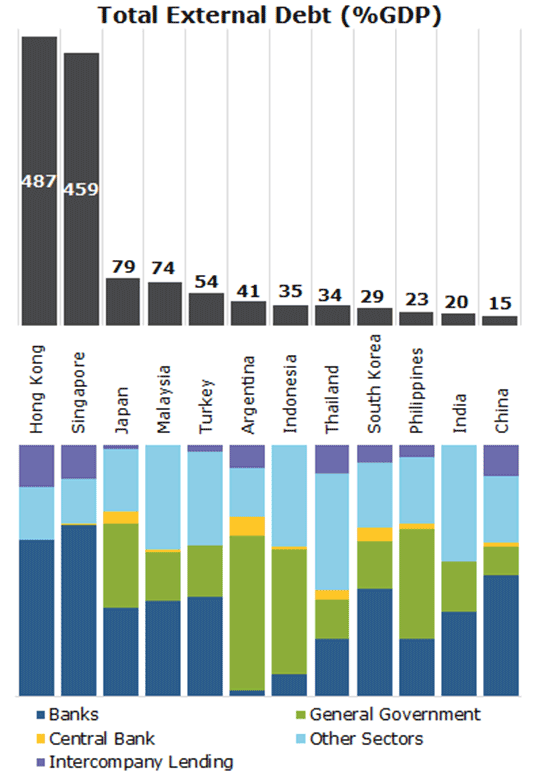

Compared to Argentina and Turkey, only a handful of Asian economies have particularly large stocks of external debt (Figure 1: External Debt). The largest are either global financial hubs (Hong Kong and Singapore) or major economies (Japan and China). In Hong Kong and Singapore, large stocks of foreign-held debt reflect their status as a central portal for global financial transactions: the value of total external debt eclipses that of each country’s GDP (by nearly five times in both economies), and the vast majority of liabilities are owed by the financial sector.

Compared to the global financial hubs, the picture is quite different in Japan and China, where external debt represents only a small fraction of total credit to the domestic economy. Despite nominally large foreign debts—$3.9 trillion in Japan and $1.8 trillion in China—most of each country’s total liabilities are in fact held domestically. At the end of 2017, total credit to Japan’s nonfinancial sector (a narrower assessment compared to the aforementioned foreign debts to all sectors) reached nearly US$18 trillion, whereas in China total credit to the nonfinancial sector surpassed US$32 trillion. Between these two behemoths, the profile of domestic credit allocation also differs. Similar to the global financial hubs, China’s banking sector accounts for the lion’s share (nearly 50 percent) of all external debt, and has been responsible for driving growth in foreign liabilities over the last several years. By contrast, Japan’s external obligations are more dispersed across sectors, with external obligations roughly split between the banking, nonfinancial (corporates and households) and government sectors.

Malaysia’s High External Debt Warrants Monitoring, But Strong Fundamentals Mitigate Risks

Some other, smaller Asian economies actually appear more risky. For example, Malaysia’s external debt to GDP is particularly high compared to its peers, reaching nearly 74 percent of GDP as of June 2018. The bulk of external liabilities (nearly 80 percent) is split between banks and domestic corporates, and the remaining debt is held by the government. Despite the relatively high level of foreign debt, the country’s external obligations remain manageable thanks to improving economic fundamentals and stronger buffers among domestic corporates. In recent years, the government has consolidated fiscal deficits, building a stronger fiscal position that provides additional capacity to buffer against and respond to a potential debt crisis. An ongoing cyclical economic upswing—thanks to higher oil prices, as well as strengthening global demand and trade—serves to buoy domestic firms’ revenues and improve their ability to pay down debt. Compared to the Asian Financial Crisis two decades prior, Malaysian corporates are also more resilient to external shocks. Having built up a majority of the country’s international assets, those funds are largely available for use in times of need.

Foreign Currency Debt Burdens Lower in Asia, But Short-Term Risks Exist

One other vulnerability in Malaysia’s debt profile—albeit manageable—is its significant stock of foreign currency-denominated debt. Roughly two-thirds of the country’s external debt is denominated in foreign currency, equal to almost 50 percent of GDP. However, the country maintains regulatory oversight and prudential standards to mitigate this exposure: the foreign currency debt, held primarily by the banking system, is subject to the central bank’s management, including liquidity management, hedging requirements, and frequent liquidity stress tests.

Foreign Currency Denominated Debt

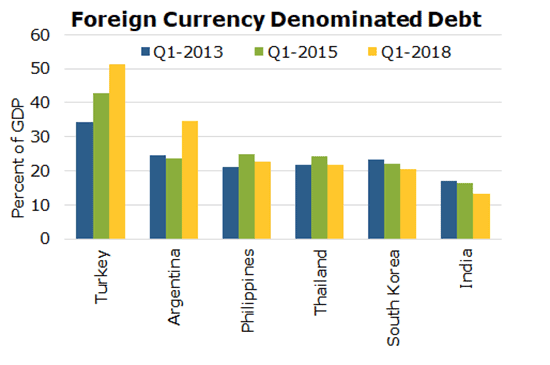

Elsewhere in Asia, risks related to foreign currency debt appear much lower, with a few notable exceptions (Figure 2: Foreign Currency Denominated Debt). This includes the Philippines, where virtually all of the country’s external debt is denominated in foreign currency. However, the Philippines’ overall exposure to foreign currency risk is relatively small compared to domestic GDP (and falling): as of early 2018, the country’s foreign currency debt is equal to roughly 23 percent of GDP. Additionally, the vast majority of foreign currency debt is long-term (maturity greater than one year), mitigating near-term risks of rolling over debt at less favorable exchange rates.

In Thailand, vulnerabilities are more closely tied to rollover risk. Nearly half of the country’s foreign currency debt is due within one year, meaning that a significant adjustment in the currency over the next year could materially raise the cost of rolling over maturing debt. Like the Philippines, however, Thailand’s aggregate exposure is small relative to GDP (11 percent, with total foreign currency debt below 22 percent) and falling. However, the small relative size of foreign currency risk does not exempt them from concern: a sharp currency adjustment in the near term or further deterioration in the external position could amplify these risks.

By comparison, foreign exchange rate risks in Argentina and Turkey are more acute. At the end of the first quarter of 2018, a remarkable 95 percent of Turkey’s external debt was denominated in foreign currency, equivalent to over 50 percent of Turkey’s GDP in 2017. Not far behind, roughly 87 percent of Argentina’s external liabilities are in foreign currency. The scale of these numbers illustrates the vulnerability these countries face if their domestic currencies depreciate and inflate the value of external debt any further. To that point, these are prominent near-term risks: the share of short-term foreign currency debt—which matures within one year—has jumped up over the last year in both countries. At the end of the first quarter of 2018, Turkey had to pay back one fifth of foreign currency debt—nearly 20 percent of its annual economic output—within the coming year, while Argentina faces maturity and redemptions of roughly one-third of its foreign currency debt over the same timeframe.

In next week’s Pacific Exchange blog, we’ll look further into how external imbalances factor into countries’ ability to manage their foreign debts. We’ll also take a look at foreign exchange coverage, and the role countries’ currency policies play in cushioning external adjustments.

*All figures denoted as share of GDP are scaled to the country’s 2017 nominal GDP in U.S. dollars.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.