Robert G. Valletta, associate director and senior vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of December 5, 2024.

- The U.S. economic expansion has slowed this year but remains solid. Cooling of the overall economy has helped bring supply and demand conditions in the labor market into better balance and supported the progress of inflation toward the Federal Reserve’s 2% longer-run goal.

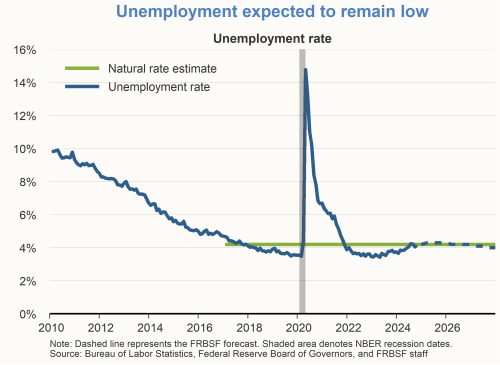

- The unemployment rate in early 2023 had fallen to 3.4%, its lowest level since 1969. Since then, it has risen above 4% and moved unevenly in recent months, registering at 4.1% in October. This is slightly below the Federal Open Market Committee’s (FOMC’s) median estimate of the long-term natural rate, suggesting that the labor market is at or near the Fed’s maximum employment goal and hence largely in balance.

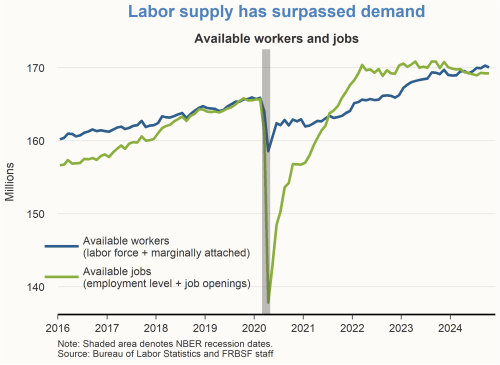

- The balance between supply and demand in the labor market also is reflected in measures of available workers relative to available jobs. In the aftermath of the pandemic, the excess of available jobs over available workers reached unprecedented levels. This gap closed steadily as solid labor force growth over the past few years pushed up worker availability, which now slightly exceeds available jobs.

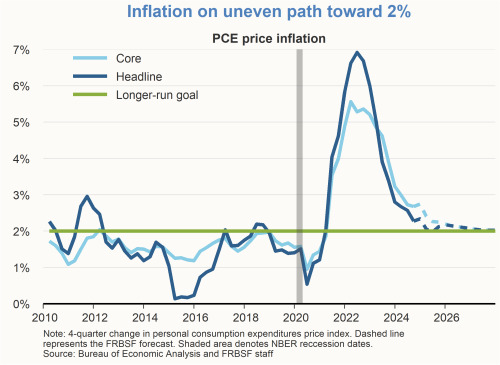

- While the cooling economy and labor market have helped reduce inflation, progress toward the Fed’s 2% longer-run goal has been slow and uneven this year. Following its surge to a 40-year high in 2022, the 12-month core personal consumption expenditures (PCE) inflation rate fell rapidly, from 5.6% in September 2022 to 3.0% in December 2023. Since then, core PCE inflation has fallen only two-tenths percentage point to 2.8% in October 2024.

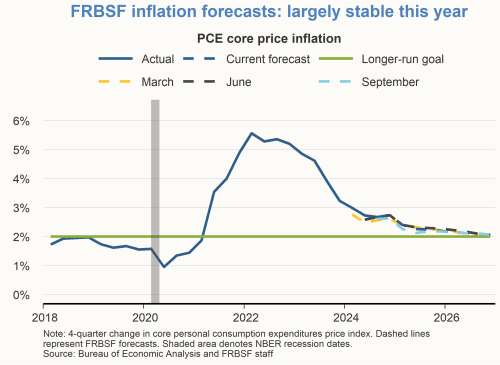

- Our projected inflation path has changed little since the start of the year. Inflation was slightly higher than our initial projection in early 2024, but subsequent data confirmed its downward path. We expect progress on the 2% inflation goal to remain quite slow and uneven. This specific forecast does not incorporate any changes to federal policies, given prevailing uncertainty about their form and extent.

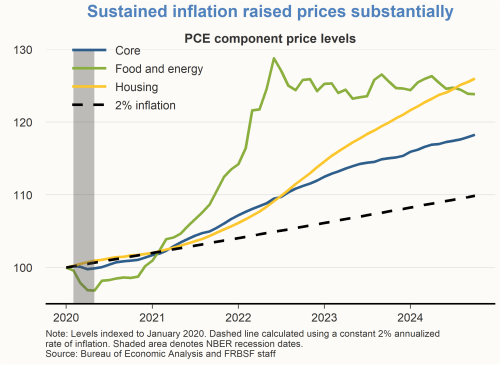

- Despite the progress in reducing inflation, a sustained period of high inflation has raised many prices well above their pre-pandemic levels. The initial price surge was especially severe for the volatile food and energy components of the overall PCE price index. Prices for these components have since flattened out, while prices for the housing services component have risen steadily. Overall prices in the economy are up about 20% on average since just before the pandemic. The average masks wide variation, however, with prices of some products and services up much more.

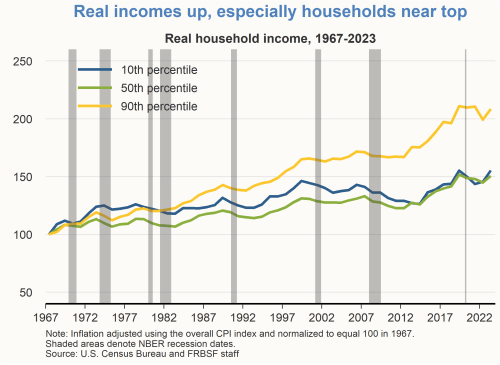

- Real household incomes, incomes adjusted for inflation, have risen substantially since the late 1960s. The largest cumulative growth has been for households near the top of the income distribution. Real incomes for households at the 90th percentile of the distribution, meaning that only one in ten households have more income, have risen about twice as much as real incomes for households at the median, the 50th percentile, or households near the bottom, the 10th percentile.

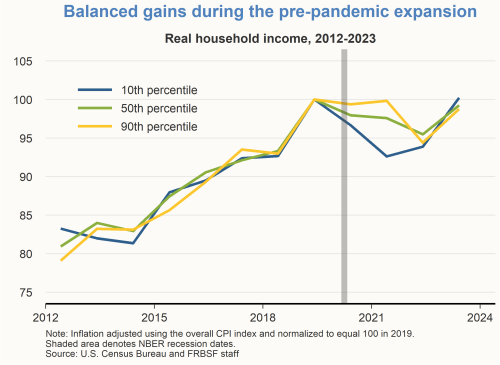

- Data show that during the long expansion following the end of the Great Recession in June 2009, the gains in household real incomes were more evenly distributed, with across-the-board growth of about 20 to 25% from 2012 to 2019.

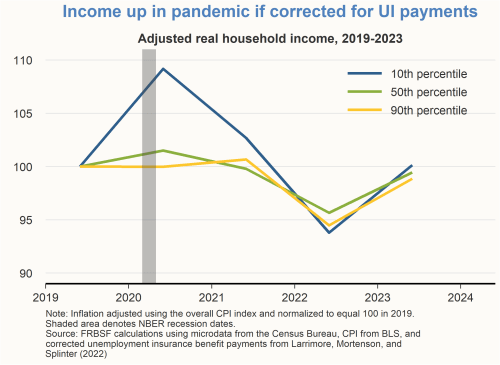

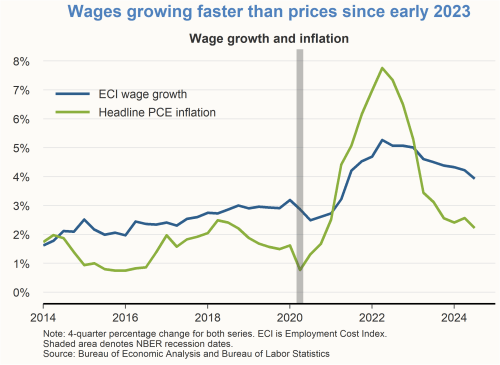

- The same data show that real household incomes fell during the COVID-19 pandemic and its aftermath, pulled down initially by the pandemic recession and then by surging inflation that exceeded the pace of nominal wage gains. The story changes, however, when we correct the underreporting of household income from pandemic-related unemployment benefits during 2020-21. After making this data correction, households in the 10th percentile of the distribution are found to have experienced a real income surge in 2020 that was partly sustained in 2021. Subsequently, however, real incomes for all income groups declined in 2022, as temporary unemployment benefits and other pandemic stimulus payments waned, and inflation eroded household purchasing power across the board.

- Real household incomes resumed growth for all income groups in 2023 as the pace of wage growth once again exceeded inflation. Continued growth in real household incomes is likely as the economic expansion proceeds and inflation declines further toward the 2% goal.

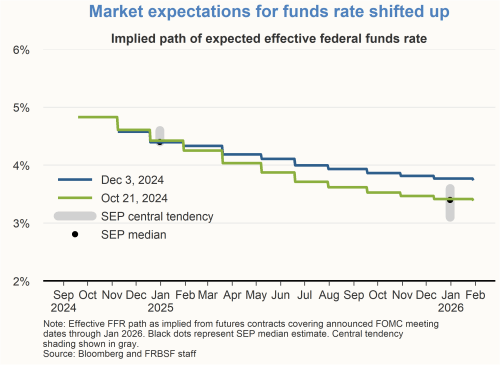

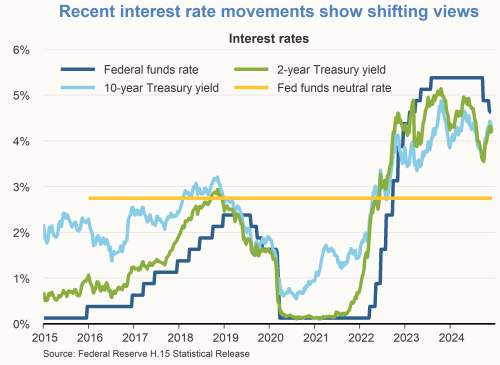

- In this context and given recent data, financial market expectations for the path of the federal funds rate have shifted upward in recent weeks. Market expectations in late October were aligned with the FOMC’s median policy path in the September 2024 Summary of Economic Projections (SEP). The September SEP showed a reduction of a full percentage point in the federal funds rate for both 2024 and 2025, bringing it down to 3.25 to 3.50% at the end of 2025.

- In contrast, more recent market expectations imply fewer rate cuts, with the funds rate falling to a level slightly below 4%. This shift in expectations is reflected in higher yields on 2-year and 10-year Treasury securities, which reversed a decline from earlier this year.

Charts were produced by Deepika Baskar Prabhakar.

About the Author

Robert G. Valletta is senior vice president and associate director of research in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Robert G. Valletta

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.