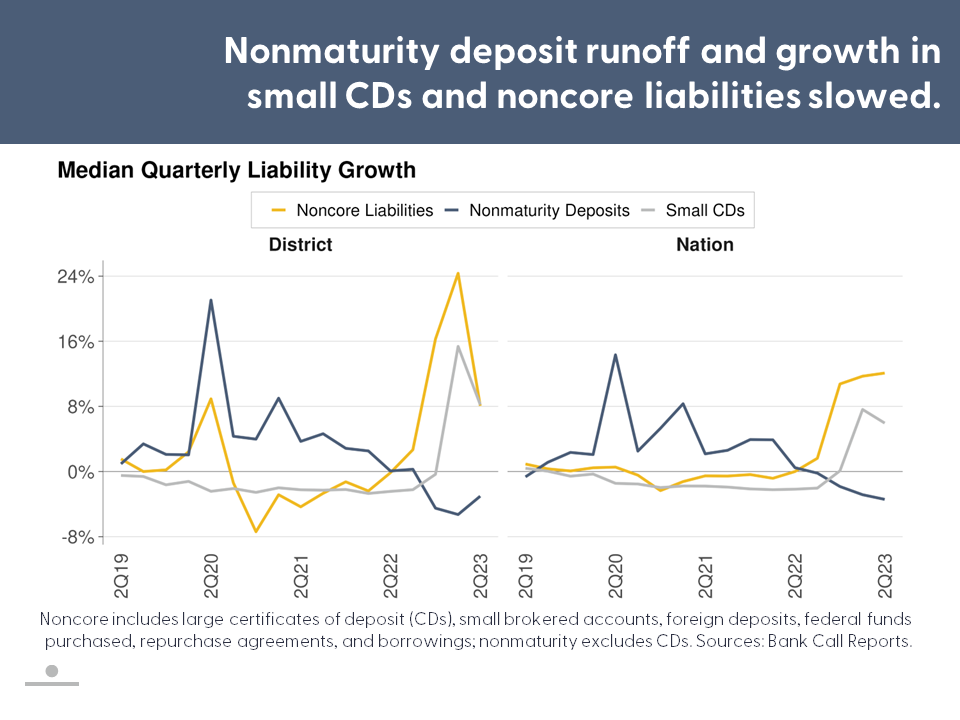

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. Although most of the District’s banks remained profitable, narrower net interest margins weighed on earnings. Continued, albeit slowing, growth in costlier time deposits and noncore funding sources drove much of the trend. Meanwhile, bond portfolio values weakened slightly, causing persistent pressure on banks’ liquidity options and “book” equity. Regulatory capital ratios generally improved, but performance varied somewhat by bank size. Problem loan levels in the District remained low overall and median loan growth was positive. Still, some surveyed bankers expected credit standards to tighten given economic uncertainties and concerns around collateral valuations and CRE credit quality.

Overall, District job growth was solid but slowed mildly during 2Q23, and unemployment rates were generally stable-to-lower in most District states. Home prices, permit activity, and homebuilder sentiment were boosted by limited resale inventories, which sustained demand for newly built homes. Commercial real estate (CRE) markets remained a concern, particularly in the office sector. Many CRE owners continued to face flat or declining property prices, weakening fundamentals, tightening credit conditions, and/or rising debt service costs and operating expenses.