Here at the SF Fed, we talk a lot about “full employment,” which our president John Williams describes as the situation where everyone who wants a job is able to find one. Although this is a critically important goal from a macroeconomic standpoint (and part of the Fed’s dual mandate), it doesn’t speak to the quality of those jobs or consider the changing nature of work itself and the resulting impact on the financial well-being of workers and families. Whether it’s part-time workers unable to find full-time jobs or low-wage workers displaced from neighborhoods near job centers, it’s becoming increasingly clear that, when it comes to financial stability, simply having a job is not enough.

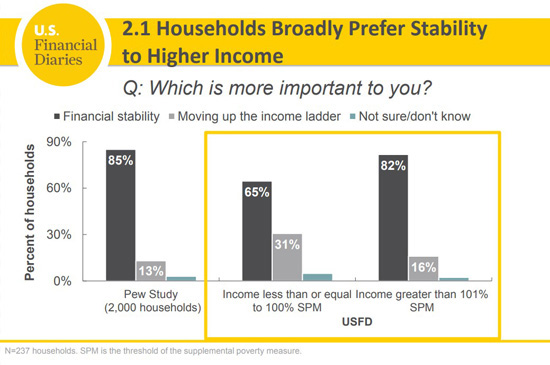

In an effort to explore how these issues are playing out in the Bay Area, the SF Fed, in partnership with the Center for Financial Services Innovation, the Citi Foundation, and the San Francisco Office of Financial Empowerment, hosted a regional conversation on “Building Financial Resilience in the Bay Area,” centered on the recently released book The Financial Diaries: How American Families Cope in a World of Uncertainty. Rachel Schneider of CFSI and Jonathan Morduch of New York University, the book’s authors, kicked off the discussion by peeling back the layers of the standard measures we so often rely on, such as annual income or poverty and unemployment rates. By following the day-to-day financial lives of 235 families from across the country, The Financial Diaries paints a vivid portrait of the rise of income and expense volatility and the importance of a predictable paycheck and a savings cushion (not in the traditional sense of a retirement nest egg, but rather a resource to draw down in the near-term when income and expenses inevitably get out whack). In fact, a majority of American households would prefer financial stability to a higher income.

A panel of local experts reflected on these themes through the lens of the Bay Area, hitting on topics such as soaring housing costs and increasing homelessness, the difficulties of low-wage jobs in a high-cost area, and the need to foster equitable economies that work for people of all races and incomes. Charise Fong, COO of the East Bay Asian Local Development Corporation, described the incredible volatility in the Oakland housing market over the past decade, from the home price run up in the mid-2000’s to the devastation of the foreclosure crisis that wiped out generations of wealth building efforts in West and East Oakland, as well as the most recent crisis of homelessness increasing 39 percent over the last two years in Alameda County, all in the face of increasing financial fragility at the household level. “This level of housing and income volatility and instability is translating into a public health crisis,” said Fong. Speakers also pointed to possible interventions and solutions, such as how employers need to be engaged to improve the pipeline of lower-income workers into good paying jobs, efforts such as San Francisco’s Retail Workers Bill of Rights, and the necessity of improving the safety net for low-income people.

It was evident across the entire discussion that the issues of financial instability, housing, jobs, health, education, and financial services are deeply interwoven and must be considered holistically. “There is no magic pill we can take to fix everything—but if we continue to work in silos we will never reach our North Star,” said Brandee McHale, President of the Citi Foundation. The SF Fed is committed to fostering cross-sector approaches that expand economic opportunity for lower-income Americans, and regional conversations like this one are critical for evolving our collective understanding of how to change the narrative around economic insecurity and build financial resilience for all.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.