Over the past two decades, China’s nonfinancial sector debt has grown rapidly from a small base. According to Bank for International Settlements (BIS) data, the government, corporate, and household sectors collectively had $ 26.6 trillion in outstanding debt as of 2015. At 255 percent of GDP, China now has one of the highest leverage ratios among emerging economies.

Rising leverage is a phenomenon observed in a number of emerging economies, not just China, after the 2008-2009 global financial crisis. Still, judging by the rate of credit growth, China clearly stands out in the past decade. Credit growth slowed after 2010, but the outstanding balance of nonfinancial sector debt continued to increase by an annualized 18.1 percent between 2010 and 2015, consistently outpacing nominal GDP growth (Figure 1).

The Chinese government and household sectors are only moderately leveraged compared to other emerging markets. As of end-2015, household debt stood at 35 percent of GDP and general government debt at 44 percent. In contrast, China’s corporate leverage is much higher than other emerging economies and most advanced economies (Figure 2). Between 2006 and 2015, corporate debt grew roughly five fold in dollar terms, from $3 trillion to $17.8 trillion. While state-owned enterprises (SOEs) are heavy users of leverage and account for most of the credit growth during this period, they are not the whole story. A number of privately owned property developers are also among the highest leveraged Chinese corporates.

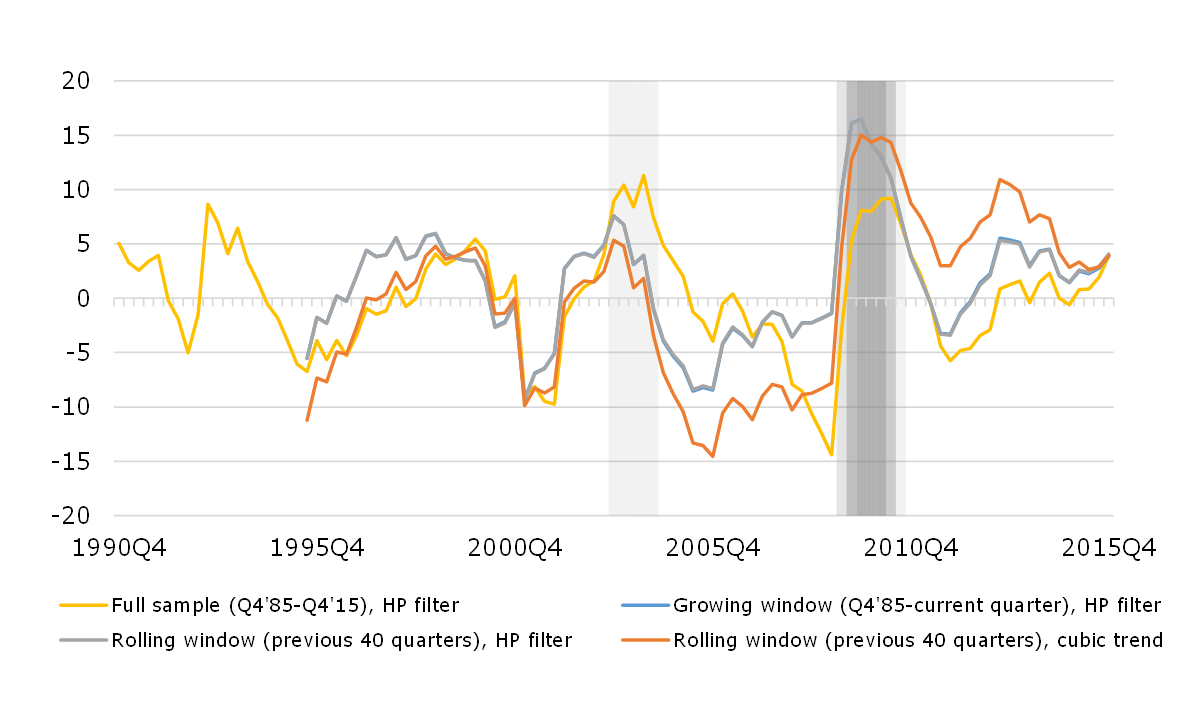

According to the IMF, a high level credit-to-GDP ratio sustained over a long period can be a prelude to a banking crisis. China has experienced these very conditions in recent years. Interestingly, the credit-to-GDP gap—another key measure that economists link to subsequent banking crises—does not indicate an extraordinary credit boom in China at the moment. Unlike many countries that have experienced a full-fledged banking crisis in the past, China’s credit-to-GDP ratio is relatively high but has not deviated too much from its trend in recent years. Comparing the credit-to-GDP ratio to its trend only suggests one major credit boom over the past decade in 2009-2010 (Figure 3). This is partially due to China’s credit-fueled growth model, but also reflects the fact that credit growth is often associated with periods of strong economic growth and financial liberalization reforms.

In recent years, some signs of stress have surfaced as growth slows, corporate sector performance weakens, banking sector nonperforming loans increase, corporate bond defaults emerge, and capital outflow continues. Still, a full-fledged banking crisis remains unlikely for now. For a crisis scenario to become reality, a lot will need to go wrong in terms of the quality, timing, and execution of policy making. In fact, as long as effective capital controls are in place, as a last resort China will have the option to use monetary easing to reduce debt repayment pressure and halt an imminent systemic crisis without incurring massive capital flight.

There are also quite a few mitigating factors. The Chinese government owns a substantial stake in the banking sector and some of its shakiest SOE corporate clients, which makes it possible to push for debt restructuring on a large scale. Moreover, Chinese corporates currently hold a large amount of liquid assets. Even though companies’ funding conditions differ significantly, these cash reserves may facilitate industry consolidation (in which firms with a strong cash position acquire weaker firms), which will reduce overall repayment risks.

Importantly, China’s debt is mostly funded domestically and denominated in renminbi. According to a study by Reinhart and Rogoff in 2013, “Domestic debt issued in domestic currency typically offers a far wider range of partial default options than does foreign currency–denominated external debt.” As of 2015, China’s external debt amounted to $1.4 trillion, less than 15 percent of GDP. Of this amount, $760 billion was foreign currency debt. For Chinese corporates, outstanding external debt stood at $223 billion—or 1.3 percent of their total debt—at year end-2015. It is unclear what percentage of external corporate debt is denominated in foreign currency, but judging from the limited exposure, the overall corporate debt-at-risk for nonresidents is not substantial. Moreover, China’s outstanding external debt has also declined steadily over the past five quarters by $415 billion, or 23 percent, from end-2014 to Q1 2016.

In March, the Governor of the People’s Bank of China (PBoC), Zhou Xiaochuan, noted in a public speech that corporate debt as a share of GDP is on the high side and that a highly leveraged economy was more prone to macroeconomic risk. Chinese authorities appear to be well aware of the risks associated with high levels of debt, but in the first half of 2016 the government actually returned to using more credit extension to stabilize short-term growth. Given the imperative of maintaining stable economic growth, large-scale deleveraging still looks unlikely in the near future. Still, the debt overhang poses visible challenges to China’s economic transition and makes it increasingly necessary for the economy to deleverage in a meaningful and orderly way.

To achieve this, the authorities will likely need to use a mix of strategies including debt reduction through restructuring or forgiveness (debt-for-equity swap, debt defaults, and restructuring/bankruptcy of zombie companies) and austerity measures (cutting overcapacity and limiting local government borrowings) to improve debt repayment capacity over time. The key challenge is to ensure that deleveraging does not lead to excessive deflationary pressure on the economy, a task that requires a delicate balance among various policy options. China’s imminent challenge is to effectively improve allocation of capital to support the ongoing economic transition and structural reforms. If this succeeds, the corporate sector will eventually achieve organic deleveraging as their fundamentals and operational efficiency improve.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.