Asian bank profitability has been squeezed in recent years, driven to some extent by intense competition among the large number of banks in the region. To boost profitability, banks from some developed Asian economies have expanded operations into Southeast Asia by setting up branches and investing in local institutions. What began as a search for yield is likely to persist because banks’ strategies to increase profits align with their governments’ initiatives in the region.

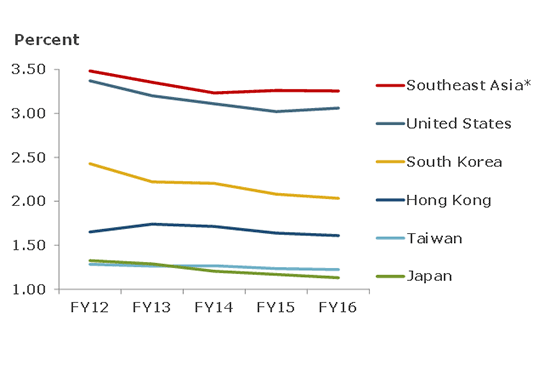

Declining Net Interest Margins among Asian Banks

Traditional banks derive a major source of their income from the spread between interest earned on their lending activities and the interest expenses incurred on their deposit taking activities. The key indicator of this source of profitability is the net interest margin (NIM) ratio, defined as net interest income as a percentage of average earning assets. NIM is useful for measuring the profitability of the bank’s primary activities because it focuses strictly on assets that generate income rather than the entire asset base.1

Banks’ NIMs can be influenced by a variety of factors, including how their balance sheets are structured, the interest rate environment in the regions in which they operate, or the banking institutions’ pricing strategy for loans and deposits. For the past decade, global NIMs have registered a declining trend due in part to a historically low interest rate environment.2

The NIMs of Asian banks reflect the same global pattern (Figure 1). The NIM of banks in larger, more developed Asian economies averaged about 1.50 percent, half of the U.S. average of 3.06 percent in 2016.3 One possible cause for the tight NIM in these economies is that there are too many banks in their markets leading to intense competition.

Trend of Average Net Interest Margin (NIM)

Source: SNL.

Overbanking in Some Asian Economies

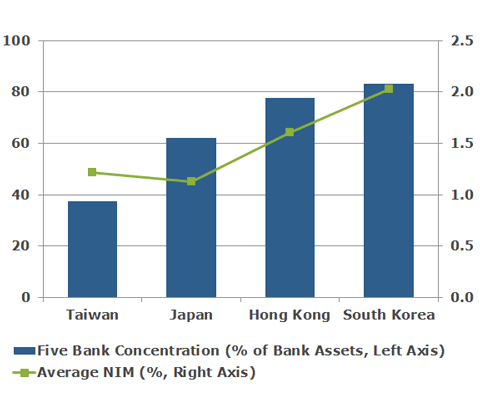

Bank concentration, which refers to the percentage of assets held by the largest banks, and branches per capita are useful proxies to measure overbanking in a market. As Figure 2 indicates, banking markets in Taiwan and Japan are relatively more competitive, and the two economies correspondingly have lowest NIMs among developed Asian economies.

Figure 2

Banking Sector Competitiveness and Net Interest Margin (NIM)

Data as of 12/31/2016.

To address the trend of narrowing net interest margin that led to low profitability, these Asian economies adopted a similar strategy of venturing into lesser developed economies. Banks from South Korea, Japan and Taiwan have expanded into Southeast Asia, while banks from Hong Kong have focused on Mainland China. Notably, while not included in this study, the banks from the more developed economies in Southeast Asia, such as Malaysia, Singapore and Thailand, are also spreading out into the lesser developed neighbors.

Venturing into Southeast Asia

There are many good reasons behind developed Asian banks’ strategic moves into the Southeast Asian markets, including the region’s robust economic growth, its emerging middle class, high demand for financial services, rising need for infrastructure financing, and the presence of banks’ existing corporate customers in these markets. In addition to these market trends, regional governments opening of local banking markets to foreign bank entry also has provided a strong incentive. For example, the Philippine authorities adopted legislation in 2014 allowing full entry of foreign banks. Of the ten Asian banks approved to provide full banking services in the Philippines, nine are from Japan, South Korea, and Taiwan.4

The confluence of decreasing domestic profitability along with the opening up of prime banking markets in the region encouraged various Japanese, South Korean, and Taiwanese banks to seek out opportunities in Southeast Asia. These expansions have taken different forms, ranging from equity stakes to joint ventures, and in some instances coincide with banks’ home government’s attempts to diversify political and trade alliances.

Japan

Faced with sluggish credit demands and tight NIMs at home, Japanese banks, and in particular three megabank groups–Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group, and Mizuho Financial Group–have been actively expanding their presence in Southeast Asia during the last decade. They have taken equity stakes in local banking groups and established joint ventures with these financial institutions. The most notable examples include MUFG acquiring a majority stake in the Bank of Ayudhya in Thailand in 2013 and most recently PT Bank Danamon Indonesia (Bank Danamon). Reportedly, MUFG’s eventual plan is to acquire up to 73.8 percent of Bank Danamon. While existing banking regulations in Indonesia allow single entity ownership of up to 40 percent only, press reports indicate that approvals for a majority stake may be granted on a case-by-case basis depending on the financial soundness of the applicant. This appears to be another example of the incentives and flexibility provided by Southeast Asian countries in opening up of the banking market to foreign entry.

South Korea

Similar to the Japanese banks, Korean banks also face intense competition domestically. While the South Korean NIM has been higher than its peers, it has also fallen more drastically. As banks experienced the same dwindling profitability at home, they have to seek increased returns from other sources. A key focus has been Indonesia where three of South Korea’s major banks (Woori, Shinhan and KEB Hana Bank) have established operations in the region’s largest economy. A catalyst for Southeast Asia expansion also has been Korean companies’ forays into the region to take advantage of cheaper and skilled labor.5 This rationale is most clearly at work in Vietnam where Samsung, South Korea’s largest conglomerate, has invested an estimated $17 billion in the past 10 years. The expansion is consistent with the current administration’s “New Southern Policy” that aims to expand the economic influence of South Korea in the region and diversify its trading partners beyond the United States and China.

Taiwan

As discussed in an earlier post, Taiwan has an overabundance of banks relative to the size of the domestic market, leading to excessive competition and low levels of profitability. In fact, Taiwan has the lowest concentration among Asian banks (see Figure 2 and the earlier post for additional country comparison). As a result, the authorities have encouraged bank consolidation and international expansion as strategies to address the problem. With domestic banking consolidation facing a variety of challenges (e.g., opposition from political parties and labor unions), the current administration has expedited the push for Southeast Asia expansion via the “New Southbound Policy.” Although their presence is limited in Indonesia and Thailand (perhaps due to the dominance of Korea and Japan), Taiwanese banks have built a significant banking presence in Southeast Asia, including a footprint in every country in the region. Reportedly, the expansion strategy has helped Taiwanese banks boost their overall earnings last year, especially from Vietnam and Cambodia.

Conclusion

While the low interest rate environment has somewhat depressed net interest spreads around the world, overbanking has likely contributed to low net interest margins in some developed Asian markets. Too many banks increase competition which, in turn, lowers overall profitability. Political realities and other considerations have made consolidation in the banking sector in these jurisdictions unlikely in the short term. As a result, banks in developed Asia will likely continue to pursue growth in Southeast Asia in search of better returns.

1. Average earning assets represent items such as loans, securities, and interest-bearing balances at other financial institutions, and exclude non-earning assets such as cash and bank premises.

2. Different studies have discussed the behavior of NIM in response to changes in interest rates. See for example “Are Banks More Profitable When Interest Rates Are High or Low?” May 6, 2016, Federal Reserve Bank of St. Louis.

3. When gathering data to calculate NIM, an attempt has been made to use the same definition to ensure comparability of financial data across different jurisdictions. More precisely, the NIM ratio is comprised of annualized total interest income on a tax equivalent basis, less total interest expense, divided by average earning assets.

4. Japan (Sumitomo Mitsui Banking Corporation); South Korea (Shinhan Bank, Industrial Bank of Korea, and Woori Bank); Taiwan (Cathay United Bank, Chang Hwa Bank, First Commercial Bank, Hua Nan Bank, and Yuanta Commercial Bank). Information as of August 28, 2017.

5. As of September 2017, 2,785 manufacturers including Samsung, LG and their suppliers were operating in Vietnam, as well as 1,080 Korean manufacturers in Indonesia, and 98 in Myanmar.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.