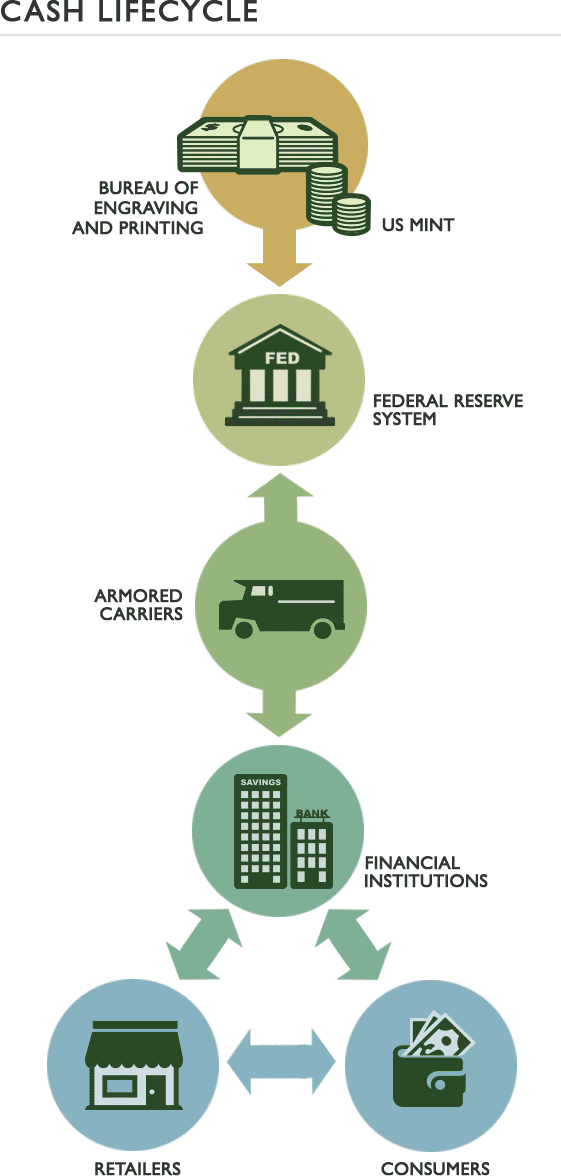

Every day, we use cash to purchase goods and services. But where does it come from and what happens to it once it leaves our wallets?

The lifecycle of U.S. currency and coin is a shared system, with the Federal Reserve Board of Governors, the 12 regional Federal Reserve Banks, the U.S. Treasury’s Bureau of Engraving and Printing, and the U.S. Mint having important and unique responsibilities.

Financial institutions, armored carriers, and other service providers also play an important role, working to provide currency to consumers and merchants.

Federal Reserve System

The Federal Reserve System is overseen by the Board of Governors, which is the issuing authority for U.S. currency and supervises the 12 regional Reserve Banks that provide services to financial institutions to assist in the effective distribution of currency and coins to better serve the public. The Federal Reserve’s Cash Product Office is responsible for strategic leadership to Reserve Bank cash departments to ensure that cash operations meet strict controls for the quality and integrity of U.S. currency and coin.

Financial Institutions

Financial institutions manage the day-to-day transactions with the public by supplying currency and coin to their customers and accepting deposits. When financial institutions need currency for their customers, or have more currency than they need, they can place an order or make a deposit with their local Federal Reserve Bank.

Retailers and Consumers

During its time in circulation, a single note can move back and forth between you, a store, restaurant, bank, and the Federal Reserve many times. Think about how many times you’ve passed currency and coin today. As you can see, this is an interwoven and shared responsibility.

Bureau of Engraving and Printing and U.S. Mint

Two agencies in the U.S. Department of the Treasury actually produce our nation’s supply of currency and coin. The Bureau of Engraving and Printing (BEP) manufactures the currency notes, and the U.S. Mint produces coins. It is the responsibility of the Federal Reserve to process and distribute coin and currency to financial institutions.

Armored Carriers

Financial institutions coordinate with armored carriers to deliver their deposits and pick-up their orders with the Federal Reserve Banks.

Introduction

Every day, we use cash to purchase goods and services. But where does it come from and what happens to it once it leaves our wallets?

The lifecycle of U.S. currency and coin is a shared system, with the Federal Reserve Board of Governors, the 12 regional Federal Reserve Banks, the U.S. Treasury’s Bureau of Engraving and Printing, and the U.S. Mint having important and unique responsibilities.

Financial institutions, armored carriers, and other service providers also play an important role, working to provide currency to consumers and merchants.

Join us as we follow the money from production to destruction and learn how each organization plays a role in providing the currency and coin we use for our day-to-day transactions.

Federal Reserve System

The Federal Reserve System is overseen by the Board of Governors, which is the issuing authority for U.S. currency and supervises the 12 regional Reserve Banks that provide services to financial institutions to assist in the effective distribution of currency and coins to better serve the public. The Federal Reserve’s Cash Product Office is responsible for strategic leadership to Reserve Bank cash departments to ensure that cash operations meet strict controls for the quality and integrity of U.S. currency and coin.

Financial Institutions

Financial institutions manage the day-to-day transactions with the public by supplying currency and coin to their customers and accepting deposits. When financial institutions need currency for their customers, or have more currency than they need, they can place an order or make a deposit with their local Federal Reserve Bank.

Retailers and Consumers

During its time in circulation, a single note can move back and forth between you, a store, restaurant, bank, and the Federal Reserve many times. Think about how many times you’ve passed currency and coin today. As you can see, this is an interwoven and shared responsibility.

Bureau of Engraving and Printing and U.S. Mint

Two agencies in the U.S. Department of the Treasury actually produce our nation’s supply of currency and coin. The Bureau of Engraving and Printing (BEP) manufactures the currency notes, and the U.S. Mint produces coins. It is the responsibility of the Federal Reserve to process and distribute coin and currency to financial institutions.

Armored Carriers

Financial institutions coordinate with armored carriers to deliver their deposits and pick-up their orders with the Federal Reserve Banks.