Data and Indicators

The Center for Monetary Research provides recurring updates to interactive data series on specific topics in monetary economics and macro-finance. Data sets on this page include interest rate distributions, market-based monetary policy uncertainty, policy-path charting, high-frequency monetary policy surprises, and Treasury term-premium estimates.

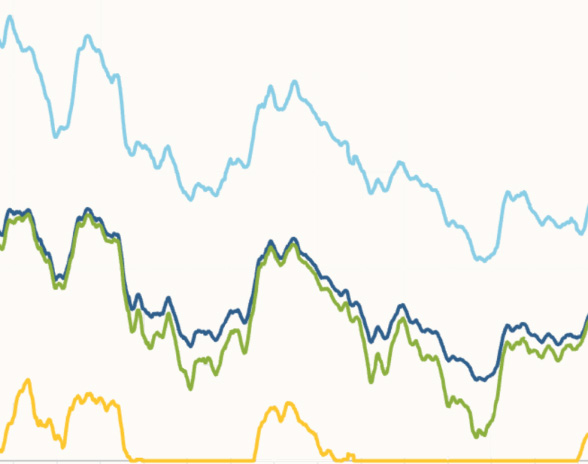

Interest Rate Probability Distributions is a daily measure of the distribution of future short-term interest rates, calculated from prices of fixed-income derivatives.

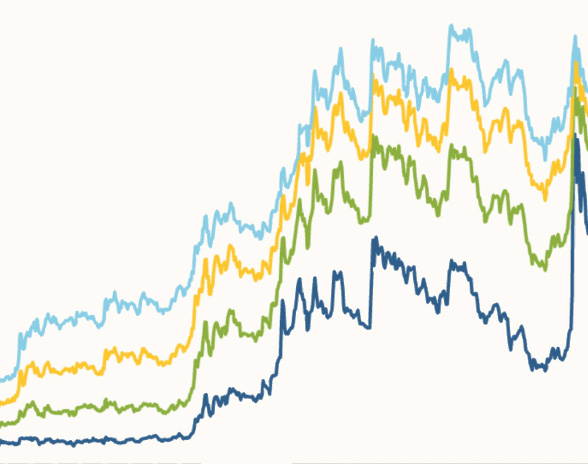

Market-Based Monetary Uncertainty provides daily indicators of the uncertainty about future short-term interest rates based on prices of money market derivatives.

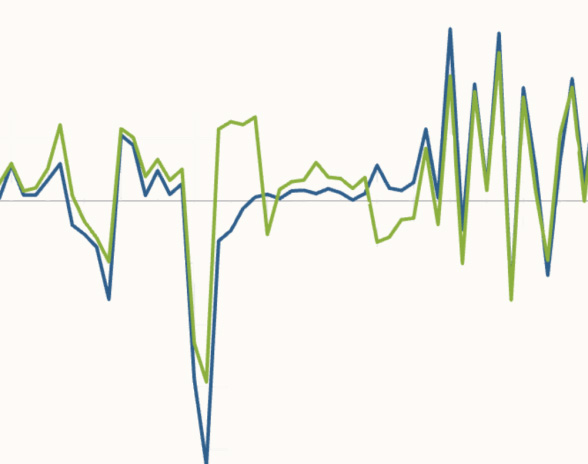

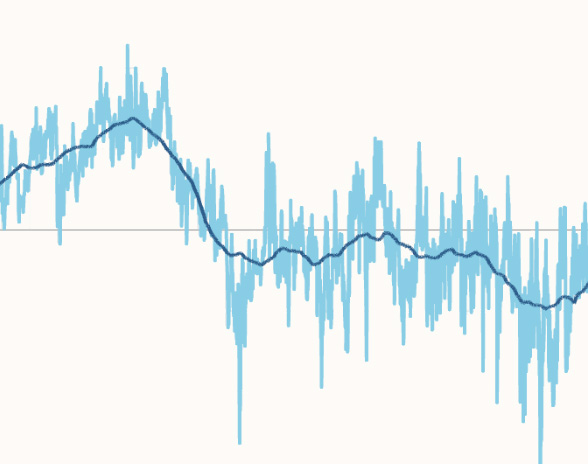

Monetary Policy Surprises data capture the exogenous changes in interest rates over tight windows around FOMC monetary policy announcements.

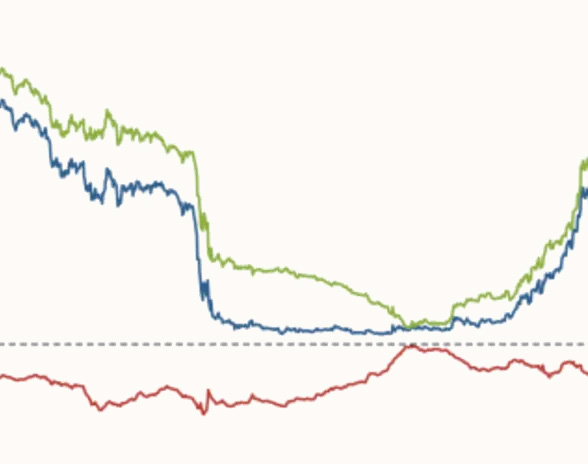

The Proxy Funds Rate uses a broad set of financial market indicators to assess the stance of monetary policy.

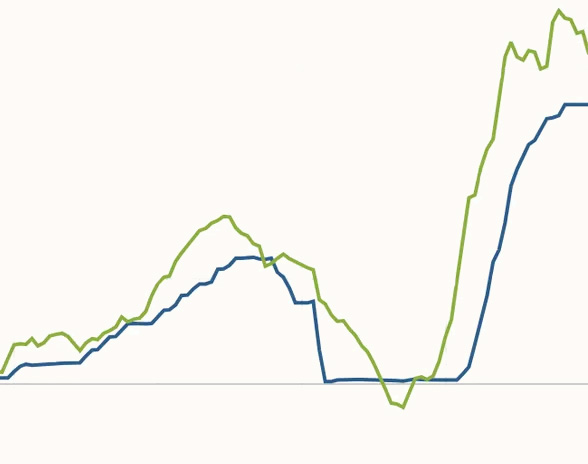

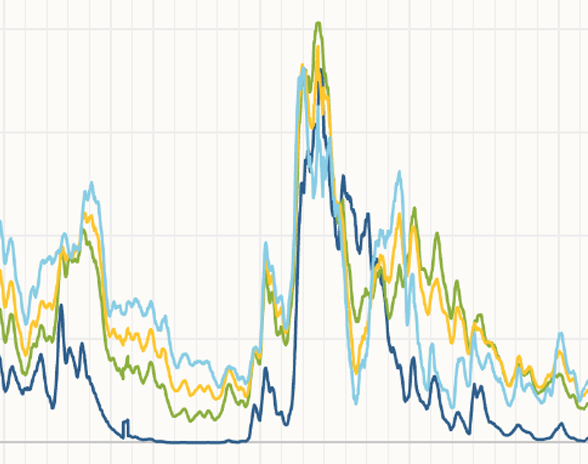

The Treasury yield premium model breaks down nominal bond yields of various maturities into three components: expectations of the average future short-term interest rate, a term premium, and a model residual.

Treasury Yield Skewness is a daily indicator measuring the risks to the future outlook for interest rates based on prices of Treasury derivatives.

Zero Lower Bound Probabilities at Different Time Horizons uses prices of fixed-income derivatives to create a daily measure of the likelihood that future short-term interest rates will be constrained by the zero lower bound.