More than a year after the shock of demonetization, Indian consumers continue to adopt digital payments as an alternative to cash. Though overall transaction volumes remain small relative to cash, the growth of mobile payment products indicates growing trust. Recent successes in promoting new products could also point the way to greater merchant adoption, providing insight for India and a number of other countries transitioning to new payment technologies.

Mobile Payments Growth Shows Resilience

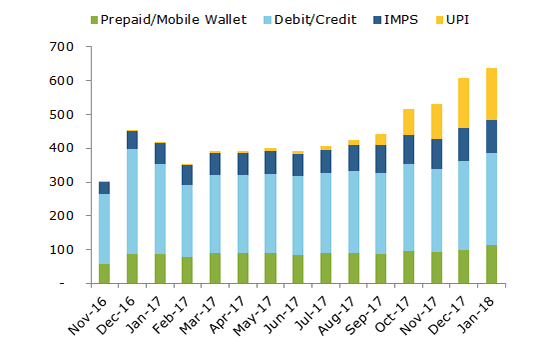

Mobile payment products grew rapidly in the aftermath of the November 2016 demonetization, when the Indian government withdrew roughly 86 percent of cash in circulation, shocking an economy where cash made up an estimated 99 percent of retail transactions. That trend has continued over the past year even as normal levels of cash returned to circulation, meaning mobile payments are taking a more significant share of non-cash consumer payments in India (see Figures 1 and 2).

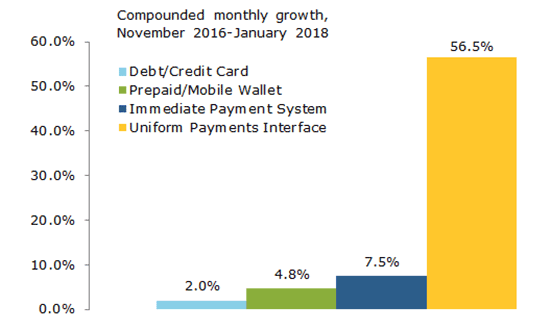

Select Digital Payment Growth Rates Following Demonetization

Select Digital Payment Volumes (Millions of Transactions)

New payments infrastructure established by the Indian government deserves credit for the expanding mobile payments. Most of the growth since demonetization came from the Uniform Payments Interface (UPI), launched by the National Payments Corporation of India in 2015 to support a range of mobile payment applications that enable free and instant transfers between users’ bank accounts, including the government-sponsored BHIM and Google’s Tez. The Immediate Payment System (IMPS) has provided a similar service since 2010, though transfers involve a fee. Mobile wallets (considered prepaid instruments under law) represent the third major rail for mobile payments. Altogether, the infrastructure is connected to and interoperable with 800 million bank accounts, indicating the potential for further growth. This is distinct from a country like China, where mobile payments grew rapidly over the private infrastructure of technology firms like Alibaba and Tencent.

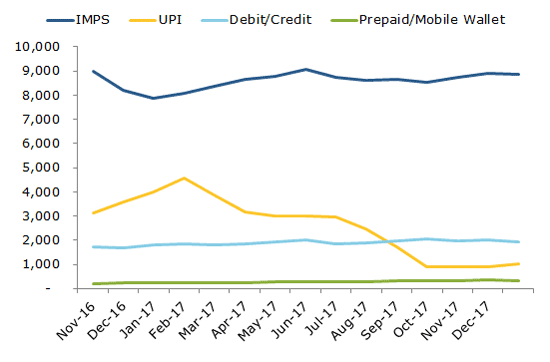

While UPI’s success has been driven in part by its convenience and free usage, the largest share of recent growth has come from new entrants like Tez, which uses the UPI payment rail, offering promotional cash for new customers. Some of these customers are reportedly churning low value peer-to-peer transactions among their personal network for the chance at cash awards. The declining value per transaction on UPI infrastructure is evidence of this trend (see Figure 3). Whereas even in mid-2017, the value of UPI transactions averaged over INR3,000 ($46), by January 2018 the figure had fallen by roughly two-thirds to INR1,025 (see Figure 3). Notably, both UPI and IMPS transactions have been higher in average value than those made by mobile wallets.

Average Transaction Values (Indian Rupees)

Some analysts argue that the recent turnover of low-value transactions shows that much of the mobile growth is a mirage, with new users likely to abandon digital payments once promotions end. Even though promotions may attract some transient users, UPI-based payments were still growing rapidly prior to the launch of Tez. Meanwhile, other entrants with powerful networks and deep pockets are looming, with Facebook’s WhatsApp planning payments integration for its Indian users, estimated at an average 230 million per day. Other mobile payment products have also shown strong growth over the past year—IMPS transactions and pre-paids (mobile wallets) are up 175 percent and 93 percent, respectively, since demonetization.

The criticism of promotional marketing strategies also likely undersells the significance of the growth, as Tez alone is now processing a similar number of digital transactions as Axis Bank, the fourth largest processor among Indian banks, according to analysis from Credit Suisse, which estimates overall digital payments could reach $1 trillion over the next five years. Small promotions could be providing the behavioral nudge new customers need to try digital payment products, helping develop trust among users and broader social acceptance. Building this trust is crucial if digital payments are to overcome an overwhelming cultural preference for cash.

Nudging Users to Overcome Distrust of Cash Alternatives

The marketing of new financial technologies is a tricky business, particularly when an existing product works well for the target customer. Cash remains reliable and convenient for most Indians. It may pose greater risk for theft, but there are costs associated with digital alternatives, particularly if the user lacks a smartphone or the technical knowledge to use an app. Even in technologically advanced markets like the United States, consumers used to payment cards may hesitate to adopt new alternatives like mobile payments for similar reasons: their payment cards already work, and they may worry that they will make a mistake with the new product—or worse, have their information stolen via a cybersecurity vulnerability.

While these fears may be exaggerated—mobile payments are arguably more secure and perhaps easier than carrying cash or swiping a card—they underscore a crucial ingredient in the adoption of any new financial technology: trust. Consumers have to trust both the product and themselves when transitioning to new financial technology. The involvement of major technology and financial institutions should help build trust in mobile payment products over time, but new alternatives must still compete with the overwhelming trust placed in existing products—in India’s case, cash. Consumers also need to believe in their own ability to use the product even if they understand its value. For example, consider a cautious customer that prefers paper checks in lieu of now decades-old payment cards at a grocery store.

While marketing campaigns to educate consumers on the benefits of new technology are typical, sometimes the behavioral nudge required to overcome this hesitation is as basic as the allure of “free money.” Credit card companies often attract new customers with substantial sign-up rewards. In the same way, the recent promotions for UPI transactions could be just what Indian consumers need to overcome their inertia and initial distrust of non-cash payments.

Merchant Adoption Required for Broader Network Effects

While recent data indicates the mobile payment companies can successfully establish a customer base that begins to use—and hopefully trust—the product, the next step in establishing a robust digital payments network will be entrenching consumer-to-merchant payments. Much of the early growth has been based on peer-to-peer transactions; only 25 percent of transactions over UPI have involved merchants, for example and, according to one estimate, 40 million Indian merchants currently do not accept digital payments. As they attempt to consolidate these new users into a regular customer base, payment companies will need to focus on merchant adoption to drive digital payments across the economy.

For India’s many small merchants, simple cash promotions like those targeted at new UPI consumer users could help, but the greater near-term barrier is limited ownership of smartphones that enable the new digital payments infrastructure. India is already the second largest smartphone market in the world behind only China, with roughly 350 million estimated smartphone owners as of 2017, but that still leaves a majority of the country without a smartphone. The market continues to grow rapidly, with another 100 million new users expected to come online by 2020. Economic growth and the declining price of smartphones will naturally drive this adoption, but payment company support for small merchants to purchase smartphones (e.g. through interest-free financing) might help stimulate uptake and drive consumer-to-merchant payments.

With smartphones in hand, merchants can offer a range of payment options given the increasingly interoperable digital payments network. Wider merchant adoption of smartphones will also make it easier to consolidate and standardize existing payment options. In September, the government asked banks with UPI apps to make them compatible with BharatQR, a system launched earlier in 2017 by major credit companies in collaboration with the National Payments Corporation of India. This means that merchants with smartphones can take UPI and credit card payments using the QR code system. Meanwhile, the mandated interoperability of mobile wallets and UPI-based apps will provide additional convenience for merchants accepting digital payments.

Good Progress on the Road to a “Less Cash” Future

Digital payments still represent a small fraction of overall payments in an Indian economy long dominated by cash, but growth in non-cash payments shows resilience more than a year after demonetization’s stimulus. Payments companies may have found a way to use basic promotions to overcome consumers’ hesitation to use new products, laying the groundwork for cultural acceptance and deepening trust of cash alternatives. To build on recent progress and deepen network effects across the economy, payment companies will need to grow merchant adoption. With expanding interoperability in the digital payments system and a growing user base of consumers and merchants, India can make real progress towards a “less cash” economy.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.