Similar to many countries in Asia, Korea’s household debt increased considerably after the global financial crisis. As of year-end 2014, household debt as a percentage of GDP was 76% and increased 15 percentage points since 2008. Concerns have risen as the growth rate of household debt has exceeded that of income and the broader economy for a prolonged period. In a recent semiannual survey of managers at banks, non-banks, and foreign asset firms conducted by the Bank of Korea (BOK), household debt rose to the top of the list of systemic risks present in South Korea’s economy. Moreover, in a June 2015 speech to commemorate the BOK’s 65th anniversary, Governor Lee Ju-yeol stated that “The general perception is that household debt will not threaten economic stability immediately, but it if keeps increasing at a swift rate it may restrain household spending and create unrest in the financial system.” Currently, Korea’s household debt-to-disposable income is greater than 160% and exceeds the OECD average of 135% by a wide margin.

The average growth rate of household debt in Korea was 6.6% between 2011 and 2014. In the first quarter of 2015, household debt accelerated and increased 7.3%, year-on-year. As of March 31, 2015, household debt totaled KRW 1.1 trillion (USD 995 billion) and appears to be on pace to reach 79% of GDP assuming the economy expands at 2.8% and household debt increases by 6.5%, year-on-year.

Figure 1: Household Debt-to-GDP

Mortgage debt accounts for approximately half of household debt in Korea and policymakers face the difficult challenge of slowing the surge in mortgage lending while avoiding a sharp decline in home prices as approximately 70% of household wealth is concentrated in the real estate sector. Since loan-to-value (LTV) and debt-to-income (DTI) limits were introduced in 2002 and 2005, respectively, regulators have tightened or relaxed these macro-prudential tools in order to temper volatility in the housing market. In April 2011, the government took measures to slow the rapid rise of mortgage debt by capping the DTI ratio to 50% in Seoul and 60% in the Seoul Metropolitan area and lowering the LTV ratio to 40% in speculative zones. The tightening of regulatory limits halted the rapid accumulation of mortgage debt and enhanced lending standards. However, the housing market deteriorated sharply as the apartment home price index contracted during 20 out of the next 25 months and home prices depreciated approximately 25% from peak-to-trough in the Seoul Metropolitan area.

Figure 2: Apartment Housing Market Price Index, Seoul Metropolitan Area

(Transaction Based Sales Price Indices, % change m-o-m)

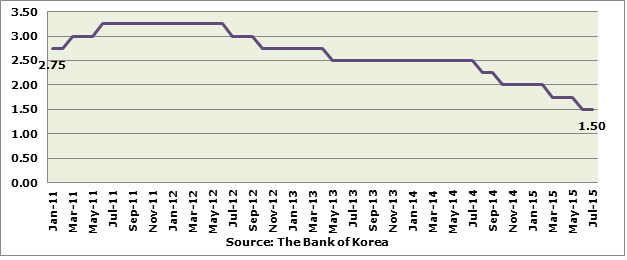

In August 2014, policymakers relaxed these macro-prudential measures and the LTV and DTI limits were raised to 70% and 60%, respectively. In addition, the BOK lowered the monetary policy rate by a cumulative 175 bps between July 2012 and June 2015. The impact on mortgage loans was stark as lending accelerated and household loans surged by KRW 10.1 trillion (USD 1 billion) in April 2015 which was the highest monthly increase ever recorded by the BOK. In July 2015, the housing market continued its robust trajectory as apartment transactions in Seoul totaled 11,634 units which represented an 89% increase, year-on-year. Furthermore, expectations for a rate cut have risen among market participants due to the weaknesses in export figures over the last several months. With lower interest rates, the upward trajectory of household debt may sharpen.

Figure 3: The Bank of Korea Policy Rate

Policymakers are faced with the seemingly competing goals of supporting the housing market and preventing a large increase in household debt. Finding the right balance is easier said than done; however, regulators have previously demonstrated that skillful adjustments to macro-prudential measures can help achieve this goal. This view finds support from a July 2015 international credit rating agency’s opinion, which indicated that the latest measures to contain the country’s high levels of household debt will have a positive effect on Korea’s financial stability. In addition, the IMF’s Financial System Stability Assessment indicated the commercial banking system would remain sound even under extreme but plausible stress scenarios.

The most basic lending principles are centered on the credit worthiness of the borrower, debt service capacity, collateral, and capital. Presently, 70% of the household debt is held by high income households who have the willingness and capacity to service debt as demonstrated by the low levels of past due and non-performing loans during the housing market correction in 2012. Credit risk is mitigated by low LTVs and DTIs, and as of year-end 2014, the average LTV for mortgage loans was 50% and the average DTI was 35%. In addition, the Korea Financial Services Commission indicated that households’ value of financial assets is twice that of financial liabilities. Further, when including real estate assets, the value of household assets increased to five times that of liabilities outstanding.

Although the level of household debt is not an imminent threat to Korea’s economy, policymakers are keenly aware of the risks and have implemented measures to guide the speed and trajectory of household debt in Korea.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.