The Economic Research Department provides recurring updates of specific data sets related to its research. Topics include inflation, excess savings, productivity, employment, news sentiment, and other areas of research.

Featured Data Series

Treasury Yield Skewness

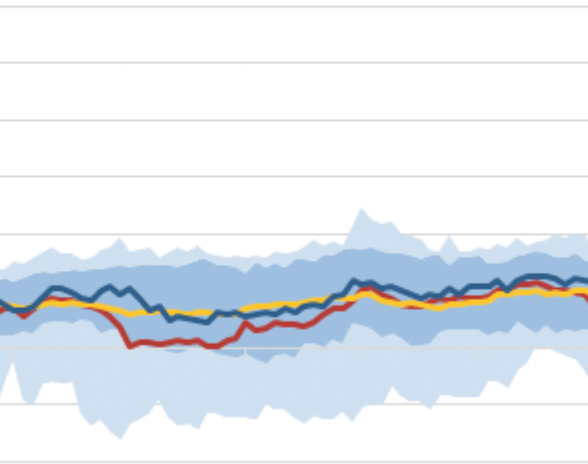

Treasury Yield Skewness provides daily indicators measuring the risks to the future outlook for interest rates based on prices of Treasury derivatives.

Charting New Stories with the SF Fed Data Explorer

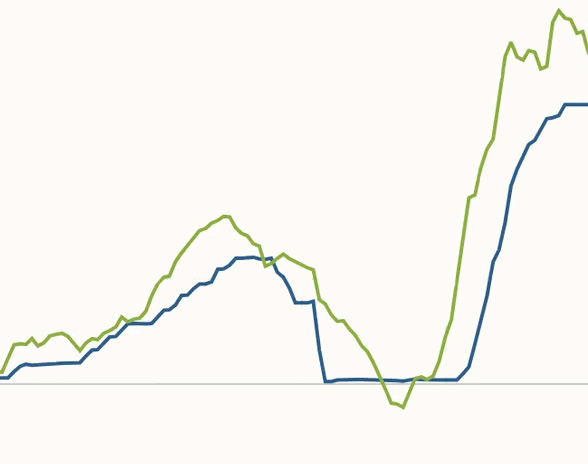

The China Cyclical Activity Tracker, China CAT, is an alternative measure of China’s economic growth based on research in Fernald, Hsu, and Spiegel (2019).

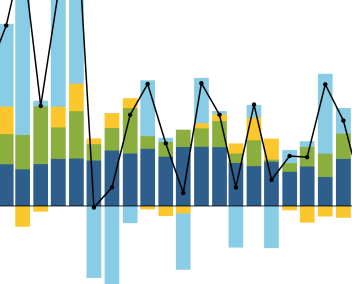

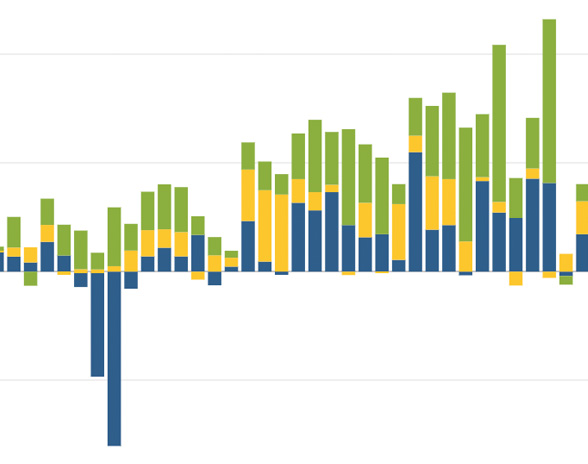

CPI Inflation Contributions from Goods and Services updates price changes of the typical goods and services that U.S. households consume to understand their role in driving changes in overall consumer price index (CPI) inflation.

Cyclical and Acyclical Core PCE Inflation divides components of core personal consumption expenditures according to whether they move in tandem with economic cycles or are independent of the state of the overall economy.

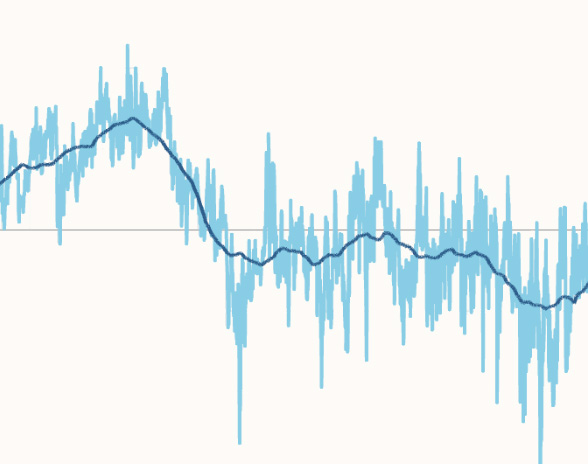

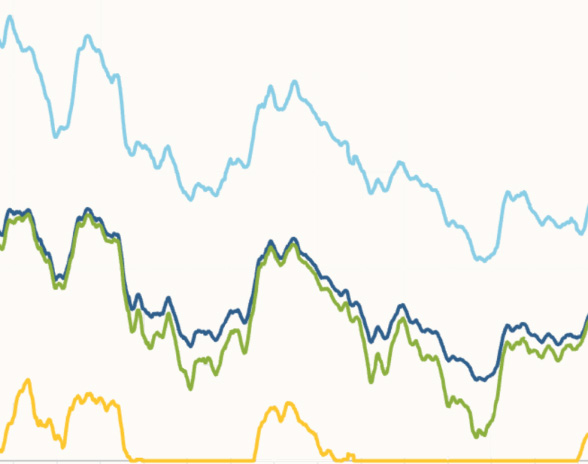

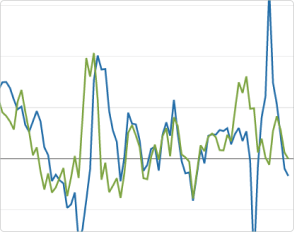

The Daily News Sentiment Index is a high frequency measure of U.S. economic sentiment based on lexical analysis of economics-related news articles.

Interest Rate Probability Distributions is a daily measure of the distribution of future short-term interest rates, calculated from prices of fixed-income derivatives.

Market-Based Monetary Uncertainty provides daily indicators of the uncertainty about future short-term interest rates based on prices of money market derivatives.

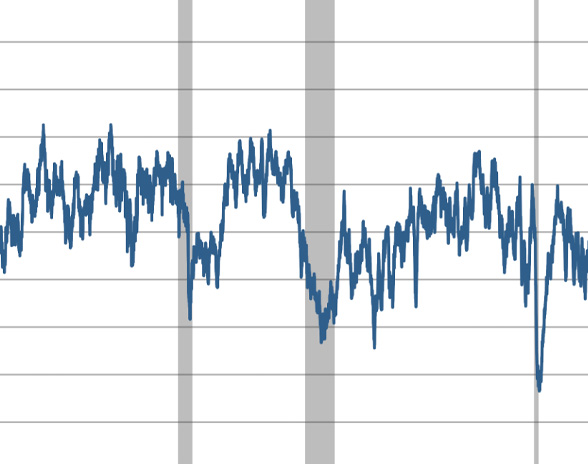

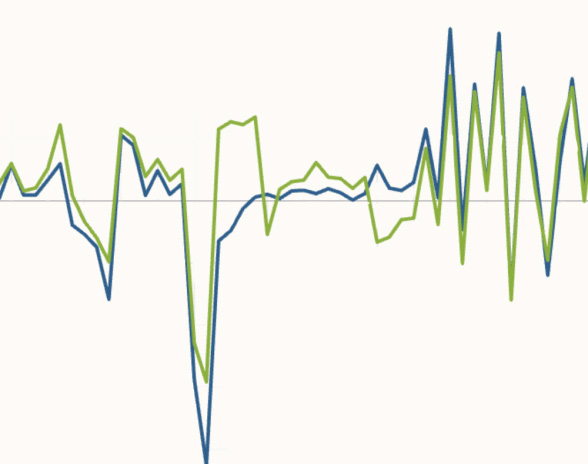

Monetary Policy Surprises captures the exogenous changes in interest rates over tight windows around FOMC monetary policy announcements.

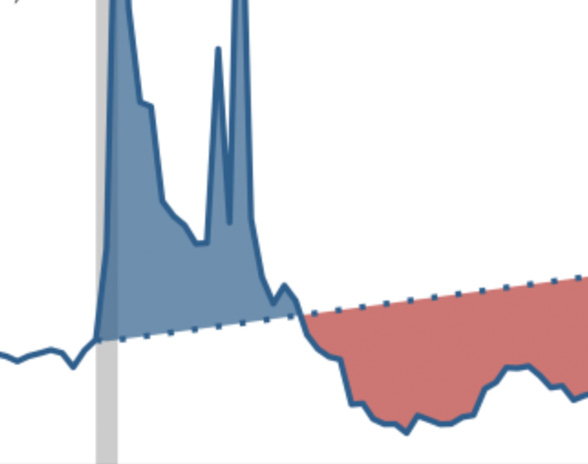

Pandemic-Era Excess Savings updates estimates of the remaining stock of aggregate excess savings in the U.S. economy, defined as the difference between actual savings and the pre-pandemic trend.

PCE Inflation Contributions from Goods and Services provides monthly updates on price changes for the broad categories of goods and services that U.S. households consume to understand their role in driving changes in overall personal consumption expenditures (PCE) inflation.

PCE Inflation Dispersion statistics present a more detailed summary of the personal consumption expenditure price index (PCEPI), a measure of U.S. inflation. Included are measures of the distribution of price changes across categories and diffusion indices.

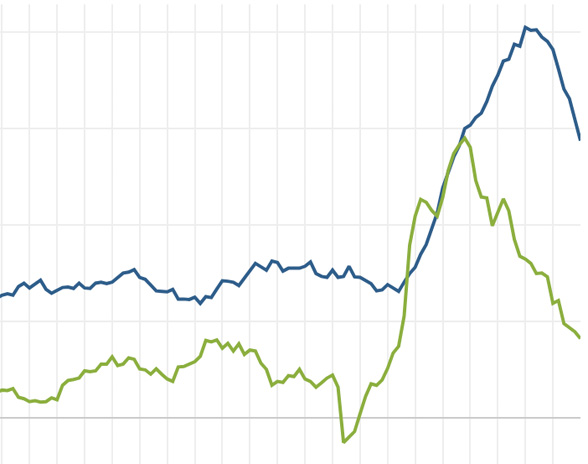

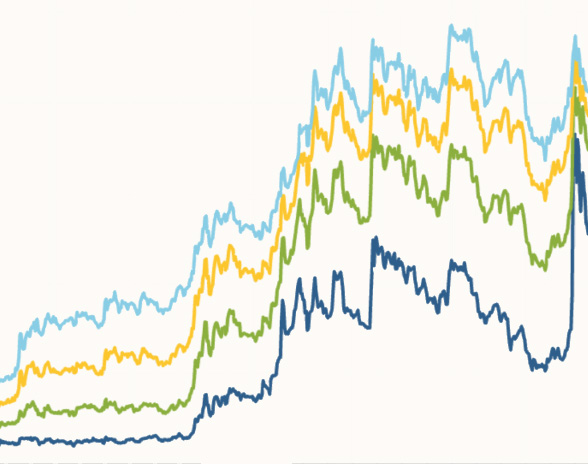

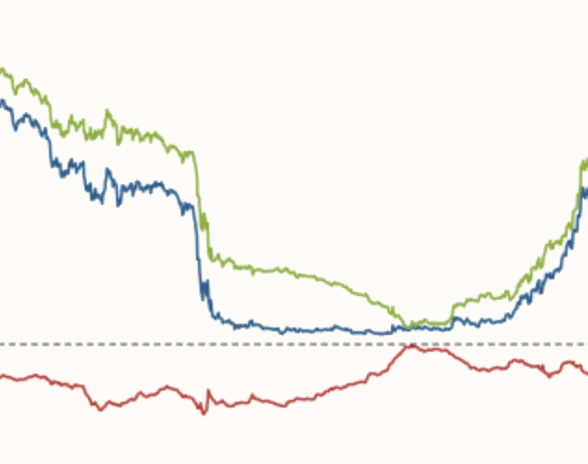

The Proxy Funds Rate uses a broad set of financial market indicators to assess the stance of monetary policy. The proxy rate can be interpreted as indicating what federal funds rate would typically be associated with prevailing financial market conditions if the federal funds rate were the only monetary policy tool being used.

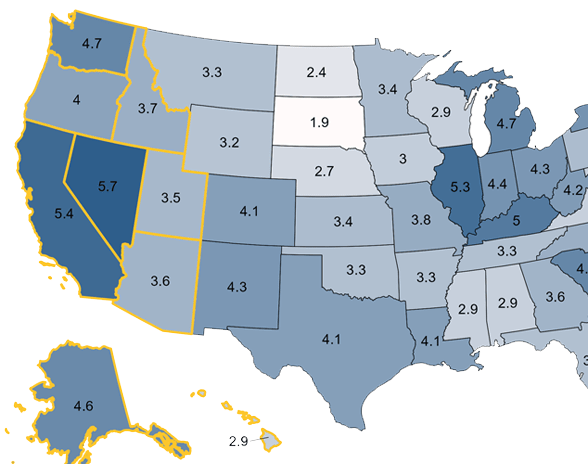

Regional data provide indicators measuring characteristics of the dual mandate across the nation. This page provides data on labor market conditions, prices, and earnings for the 50 states and the District of Columbia and also for selected metropolitan areas within the SF Fed’s 12th District.

The SF Fed Data Explorer is an interactive tool that gives users the ability to explore, analyze, and download detailed data for various groups of people in the U.S. labor market. The data come from responses to the monthly Current Population Survey (CPS).

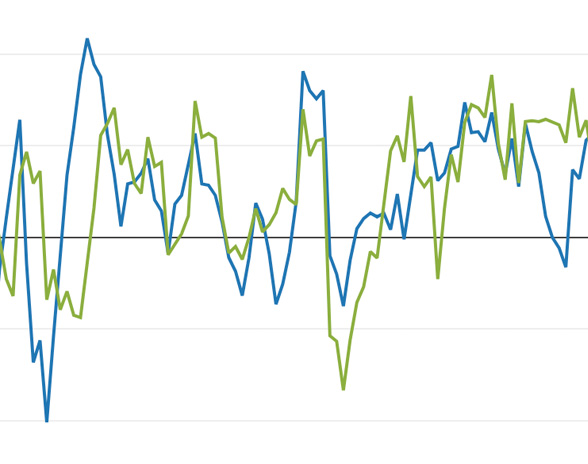

Supply- versus Demand-Driven PCE Inflation determines the monthly contributions to both headline and core personal consumption expenditures (PCE) inflation from supply-driven versus demand-driven components.

Total Factor Productivity (TFP) presents a real-time, quarterly data series for the U.S. business sector, adjusted for variations in factor utilization—labor effort and capital’s workweek.

The Treasury yield premium model decomposes nominal bond yields of various maturities into three components: expectations of the average future short-term interest rate, a term premium, and a model residual.

Treasury Yield Skewness provides daily indicators measuring the risks to the future outlook for interest rates based on prices of Treasury derivatives.

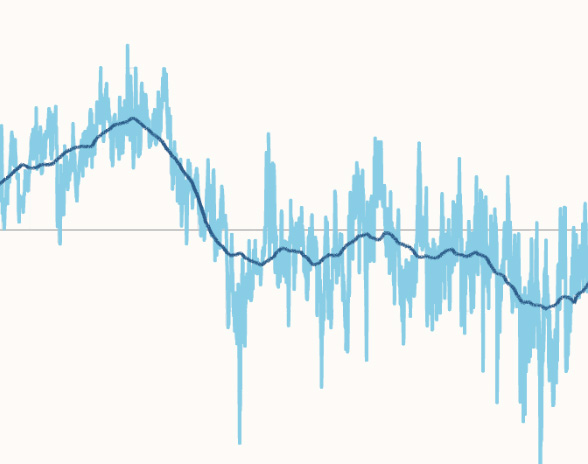

This page provides estimates of weather-adjusted employment change in the United States for the past six months. The estimates are aggregated from county-level estimates of weather’s employment effects, which were derived from a county-level analysis of the short-run effects of unusual weather on employment growth.

Recent Updates

PCE Inflation Contributions from Goods and Services

SEP

27

Charts and downloadable data

SEP

27

Charts and downloadable data

SEP

24

Charts and downloadable data

Community Development Data

Disruptions from Wildfire Smoke: Data Portal and 12th District Regional Snapshots

2021 Small Business Credit Survey Reports: Arizona, California, Hawaii, Oregon, and Washington

Featured Economists

Meet the authors of the research and data analysis featured on this page.

View All Economists