SF Fed Blog

-

Economic Letter Video: Pandemic-Era Demand Squeezed Housing Inventories

Housing prices surged as housing inventories dropped to historically low levels in the first two years following the onset of the pandemic. In our Economic Letter, “Pandemic-Era Demand Squeezed Housing Inventories”, we find that the decline in housing inventories during these years was driven by an exceptionally high demand for housing rather than a low […]

-

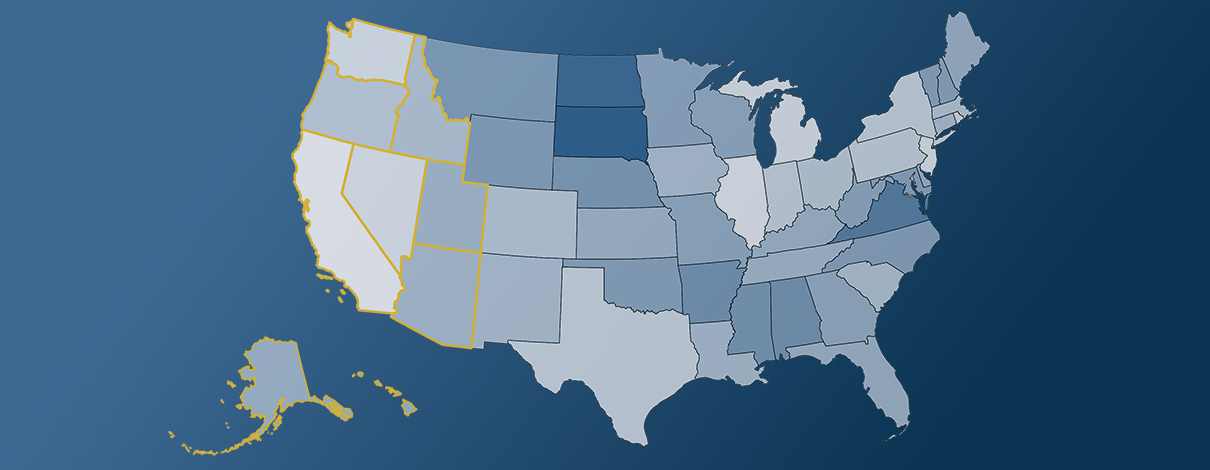

Regional Data Page Shows How Economy Varies Across the U.S.

How much variation in labor market conditions and inflation rates is there at the sub-national level? Our Regional Indicators page maps out labor market, price, and earnings data across the country.

-

Economic Letter Countdown: Most Read Topics from 2024

With the new year fast approaching, here’s a countdown of our own to close out 2024. Check out the list of our most widely read FRBSF Economic Letter topics in 2024, featuring research and insights from SF Fed economists.

-

Economic Letter Video: Productivity During and Since the Pandemic

Watch our Economic Letter video with Huiyu Li, research advisor, to learn more about productivity growth and its cyclical patterns.

-

Immigration Surge Has Slowed: Updated Estimates of Net International Migration

Updated analysis using new and revised data suggests that the flow of immigrants into the United States slowed in late 2024. Despite this drop, recent immigration flows remain three times the historical average.

-

A Deep Dive into the Drivers of CPI Inflation: Introducing Our New Data Page

Our new data page, CPI Inflation Contributions from Goods and Services, details the evolution of inflation using the consumer price index.

-

Inflation Decline Continues to Support a Soft Landing Along the Nonlinear Phillips Curve

Fifteen months of new data since May 2023 continue to track closely along the path of a fitted nonlinear Phillips curve. This confirms earlier work that portrays the nonlinear empirical relationship between inflation and a particular measure of labor market slack: the ratio of the unemployment rate to the job vacancy rate.

-

Listening to and Learning from our 2024 Interns

What is it like to be an intern at the SF Fed? We asked our interns and this is what we learned.

-

Economic Letter Video: Pandemic-Era Liquid Wealth Is Running Dry

In our recent Economic Letter, “Pandemic-Era Liquid Wealth Is Running Dry,” we look at the accumulation of extra liquid wealth by U.S. households during the pandemic and its eventual depletion.