Scientific and technological advancements are essential components in the effort to manage climate risk and develop a more sustainable society. As important as such advances are, they are only part of the story. Integrating these new technologies into business practices and getting them into the hands of consumers are just as vital.

To better understand these issues and their implications for the broader economy, Sylvian Leduc, Executive Vice President and Director of Research at the SF Fed, and Laura Choi, the Bank’s Senior Vice President for Public Engagement, sat down with leaders from the Twelfth District’s clean-tech sector. They discussed overall trends in consumer and business adoption of clean technologies and the outlook for the period ahead.

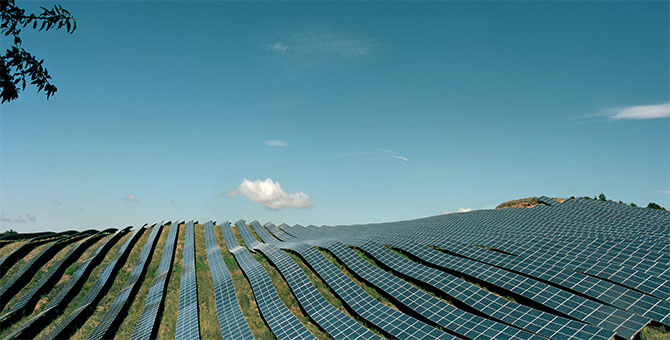

The roundtable participants were generally optimistic about the durability of the overall trend toward building a greener economy. They noted the strong consumer demand for electric cars and household solar technology. One participant forecasted that within a decade fully 30 percent of homes in California and 10 percent nationally will have converted to solar energy.

At the same time, the sector representatives tempered their optimism by pointing to the complex technological, economic, policy and social processes that structure adoption.

Batteries are a useful illustration of this complexity. Battery supply is a key variable determining the speed of the transition to cleaner energy. Participants noted that demand for batteries outstrips supply by a significant margin. Ramping up battery production can address this imbalance.

However, there are still technological hurdles to overcome to increase capacity, charging speed, and useful life. Additionally, participants highlighted current tariff and trade policies and the role they have played in increasing the costs of batteries and other clean energy components.

Besides batteries, participants also emphasized that the reliability of the nation’s power grid was a key variable to consider. Factors like the increase in adverse events such as wildfires and more intense storms have increased questions about the grid’s reliability. From the perspective of the industry leaders at the roundtable, these concerns are driving both demand for greener energy solutions and questions about whether the grid could support the clean power transition.

Asked about the future, several participants anticipate that recent legislation at the state and federal levels that create tax credits and other incentives for businesses and households may provide a boost to the clean-tech sector and help address large-scale issues such as power grid reliability. Leaders pointed out that the transition to clean energy will take decades, so it will be important to address climate risks using current technology while continuing to develop new technologies.

In providing these insights, the roundtable participants deepened what the San Francisco Fed learned from its recent climate risk survey of nearly 100 businesses across the Twelfth District. The first of its kind conducted by the Bank, the survey found businesses adopting formal risk mitigation strategies, including monitoring climate-risk exposure and reducing carbon dependence. To learn more about the survey findings, read our Economic Letter, “How Are Businesses Responding to Climate Risk?”

You may also be interested in:

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.