As we move towards economic recovery at the national level, consider this question: How is your household managing financially? According to a new report by the Federal Reserve Board of Governors, 60 percent of Americans describe themselves as “Doing okay” or “Living comfortably.” The 2013 Survey of Household Economics and Decision Making provides a glimpse into the self-perceptions of household financial well-being in America. While the majority of households seem to be faring well, a quarter of respondents said they were “just getting by” financially while 13 percent said they were “finding it difficult to get by.”

But those are the figures for the sample as a whole. How do the responses break down when we consider household income? As expected, lower-income households are more likely to be experiencing financial hardship. Among households earning less than $25,000, 25 percent of respondents reported they were finding it difficult to get by; this figure drops to four percent among households earning between $75,000 – $99,000 and two percent among households earning more than $100,000. As we already know, there is a consistent relationship between household income and feelings of economic security.

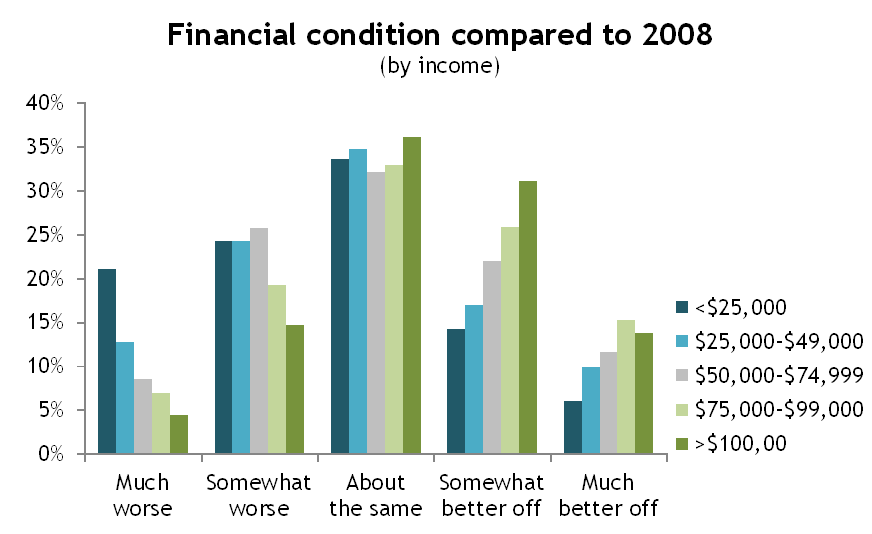

Another question asked respondents to compare their current financial condition to five years ago (2008). Roughly a third of respondents said their finances were about the same, while another third reported being either somewhat worse or much worse.

Again, when we break it down by income, we can see that low-income households were more likely to report being worse off. Among households earning less than $25,000, 21 percent of respondents consider their financial condition to be “much worse” than in 2008, compared to seven percent of households earning $75,000-$99,000 and four percent of households earning more than $100,000.

The report addresses other aspects of household financial stability, covering topics such as homeownership, credit, student debt, medical expenses, savings, and retirement. A few key findings from the report include:

- Just over half of respondents were putting some portion of their income away in savings, although about one-fifth were spending more than they earned.

- Thirty-one percent of non-retired respondents reported having no retirement savings or pension, including 19 percent of those ages 55 to 64.

- While 31 percent of survey respondents had applied for some type of credit in the prior 12 months, one-third of those who applied for credit were turned down or given less credit than they applied for.

- 34 percent of respondents reported going without some form of medical care in the prior 12 months because they could not afford it.

While the worst of the Great Recession is behind us, it’s clear that low-income households are still struggling in the aftermath. No single community development program or solution can bring these households to economic security; we must continue to push for cross-sector efforts that work to address the root causes of poverty.

Learn more about the survey and read the report.

Detailed breakdowns of the data by race, gender, and income are also available.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.