The internationalization of the renminbi has been heralded as a transformative event with the potential to create a new multilateral global currency regime and replace the current dollar-dominated system. As renminbi internationalization began to accelerate at the beginning of this decade, many analysts forecast that the renminbi could quickly become a global reserve currency and challenge the dollar’s position as the dominant international currency. One prominent economist forecast in 2011 that “the renminbi could rival or even overtake the dollar as the primary reserve currency as soon as the early years of the next decade.”

More cautious observers pointed to a long list of reforms that would need to occur before the renminbi could truly compete with the dollar. A smaller number of skeptics highlighted the key role that currency appreciation played in driving the internationalization of the renminbi and noted that a slowdown in the pace of appreciation would negatively impact internationalization.

Recent events have given support to these more skeptical views. A more volatile exchange rate and dampened growth expectations for the Chinese economy have halted, and in some cases led to reversals in, the renminbi’s path towards becoming an international currency.

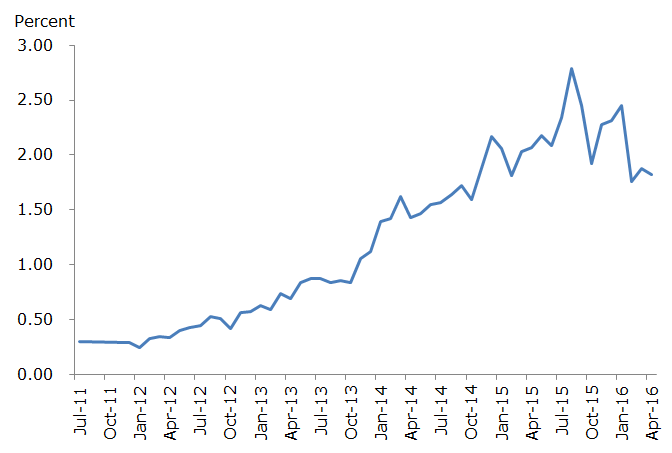

Internationalization can be benchmarked by looking at several key indicators, including offshore renminbi deposits, renminbi trade invoicing, and overseas payments made in renminbi. Figures 1-3 show that for each of these indicators growth has slowed or declined over the past 12 months.

Another way to measure the rise of the renminbi is by its share of foreign exchange reserves held by foreign central banks. Since its inclusion in the International Monetary Fund’s Special Drawing Rights, many analysts have forecast a significant uptick in the share of global foreign exchange reserves held in renminbi. Unfortunately, it is difficult to construct a time series for this data as information is only reported intermittently and by different sources. Current estimates put the renminbi’s share between 1% and 2% of global reserves. The dollar, euro, and pound sterling, by comparison, represent 64%, 20%, and 4.8% of foreign exchange reserves, respectively.

Tracking the renminbi’s role in foreign exchange reserves will become easier in March 2017 when the International Monetary Fund begins separately identifying the renminbi in its official foreign exchange reserves database. Nevertheless, it is clear that the renminbi does not yet occupy a significant proportion of global foreign exchange reserves.

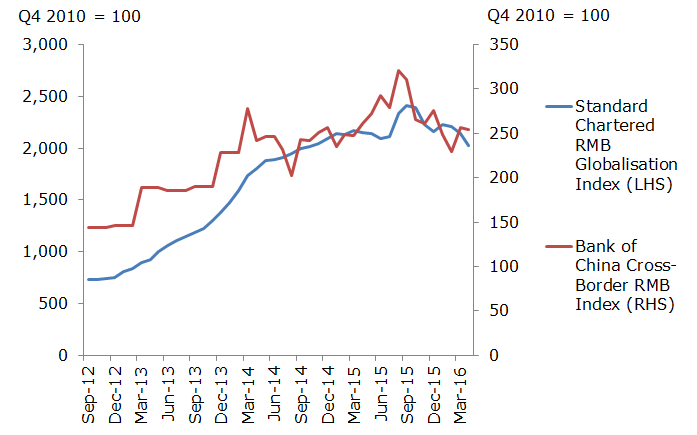

The slowdown in the pace of internationalization is also visible in the composite indices that synthesize various indicators into an overall gauge of the progress towards internationalization. In Figure 4, the Standard Chartered Renminbi Globalization Index and the Bank of China Cross-Border Renminbi Index both show that the renminbi’s overseas expansion has slowed significantly in recent quarters.

Why has the internationalization of the renminbi slowed so noticeably? A key reason is that the renminbi has depreciated against the USD and other currencies over much of the past year. Additionally, the slowdown in the Chinese economy means that the currency is less likely to return to the heady days of steady and predictable appreciation. Finally, heavy intervention in the foreign exchange markets by Chinese authorities has soured many investors who faced losses after being caught on the wrong side of the trade. Faced with this reality, investors outside of China seem less eager to accept and hold renminbi assets.

Although these factors have led to a slowdown in the pace of internationalization, long-term trends still point towards a more global renminbi. China’s capital markets are gradually becoming more open and China’s new international payment system will make using the renminbi more convenient for cross-border transactions. China will also continue to grow as a share of global GDP, albeit at a slower pace, which should over time lead to greater demand for renminbi.

The predictions of a swift rise of the renminbi seem unlikely to be fulfilled. Recent events make clear that the process of renminbi internationalization will be bumpier and longer than many expected. When times are tough, investors still flee the renminbi in search of safe harbors. The most recent example is the sharp depreciation of the renminbi during the financial volatility following the Brexit vote. For the time being, the dollar seems secure in its position as the world’s premier global currency.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.