Emerging Asia registered sizable capital outflows in 2014 and 2015, with China accounting for the largest share. While capital outflows for most of the region slowed in 2016 except for China, policy shifts in the advanced world and U.S. interest rate increases represent challenges on the horizon. However, Asian economies are generally well positioned to weather moderate volatility in capital flows. Asia’s financial resilience stems from a stronger external position, more developed capital markets, proactive regulatory efforts, and improved banking sector conditions.

The global economic environment of the past several years has been among the most challenging for the region since the Asian Financial Crisis of 1997, but Asian economies have generally improved their economic fundamentals and enhanced financial stability since then. Asia was a bright spot for global growth over this period, with governments implementing structural reforms that promoted more balanced, consumption-based growth.

With the exception of Indonesia and India, emerging Asian economies are running persistent trade surpluses, adding to the strength of their external positions and providing a buffer against capital outflows. As shown in Tables 1 and 2, emerging Asia’s foreign exchange reserve levels are sufficient compared to short-term external debt and imports. Yet, some analysts have raised concerns regarding Malaysia where the short-term external debt-to-reserve ratio is relatively high, and Vietnam where foreign exchange reserves are still insufficient to cover 3 months of imports. Notwithstanding these pockets of weakness, emerging Asian economies as a whole are in a much better position to weather capital outflows than on the eve of the 1997 Asian Financial Crisis. Also as shown in Tables 1 and 2, short-term external debt levels are generally lower and foreign reserves are higher in Asia today compared to just before the Asian Financial crisis.

| 1996 | Q3’16 | |

|---|---|---|

| China | 22.7 | 28.2 |

| Indonesia | 176.6 | 49.8 |

| Korea | 203.2 | 29.6 |

| Malaysia | 41.0 | 91.4 |

| Philippines | 79.5 | 16.4 |

| Taiwan | 21.3 | 36.2 |

| Thailand | 99.7 | 32.6 |

| Vietnam | 216.3 | 42.4* |

Table 2: Foreign exchange reserves (months of imports)

| 1996 | Q3’16 | |

|---|---|---|

| China | 9.1 | 24.4 |

| Indonesia | 3.6 | 9.9 |

| Korea | 2.3 | 11.0 |

| Malaysia | 3.6 | 6.8 |

| Philippines | 4.0 | 11.0 |

| Taiwan | 8.7 | 23.6 |

| Thailand | 5.5 | 10.7 |

| Vietnam | n/a | 2.7 |

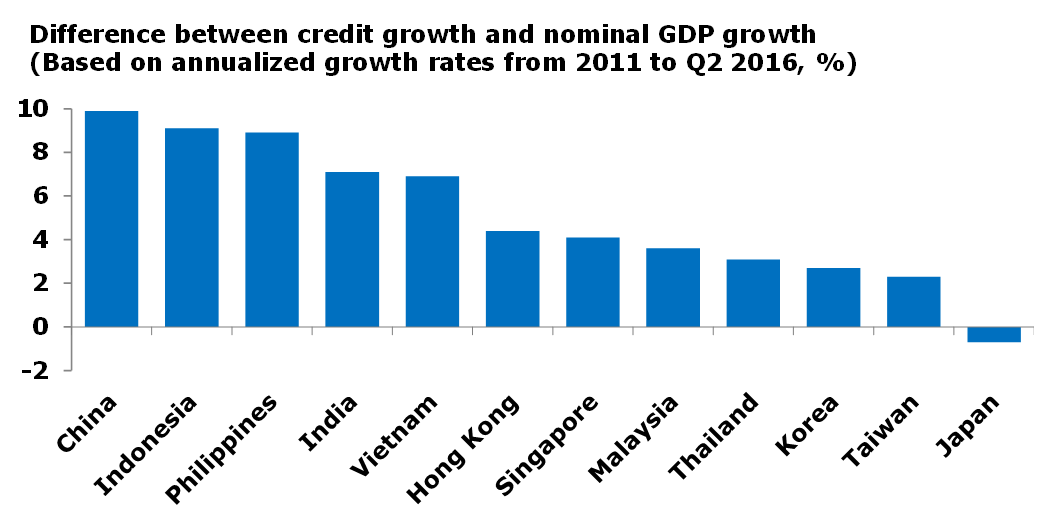

Nonetheless, high debt levels are a valid and growing concern for financial stability across the region. Throughout emerging Asia, credit to the private sector has been expanding at double digit rates on average since 2010. Credit growth was the fastest in China, Indonesia, and the Philippines during this period. The pace of credit extension slowed notably after 2014, but private sector credit-to-GDP ratios remain high as of mid-2016 and far exceed the levels in 1996 in most economies. High debt levels do not necessarily suggest an impending crisis. In fact, in the case of Japan, where domestic savings support high leverage, the debt-to-GDP ratio has remained stable at elevated levels for more than two decades. Other Asian economies might also be able to maintain higher levels of debt on the back of high saving rates and fast-growing income. Still, rapid debt growth from an already-substantial base raises doubts about the sustainability of a country’s economic growth in the long run.

Compared to two decades ago, Asian banks also are now in far better shape, which should partially mitigate concerns over leverage. In view of rising debt levels and capital inflows after the global financial crisis, Asian banking regulators actively used macroprudential tools to enhance underwriting standards and rein in excessive risks in the banking sector. At the moment, banking sector capital levels are healthy and reported asset quality measures are satisfactory across the region. In particular, nonperforming loan (NPL) ratios are now at much lower levels than in 1999 (Table 3), even though most Asian regulators now require more stringent reporting of nonperforming loans. Loan loss reserves are abundant and will serve as a buffer during the next credit cycle downturn. However, recent studies cite high levels of corporate debt-at-risk—which are at odds with the low reported NPL ratios—that can potentially put Asia’s resilience to test in the near future.

| Pre-crisis (1996) | Post-crisis (1999) | 2016 | |

|---|---|---|---|

| China | 14.0 | 28.5 | 1.7 |

| Hong Kong | 3.0 | 7.2 | 0.8 |

| India | n/a | 14.7 | 9.1* |

| Indonesia | 13.0 | 32.9 | 2.9 |

| Japan | n/a | 5.8 | 1.4* |

| Korea | 8.0 | 8.3 | 1.3* |

| Malaysia | 10.0 | 16.6 | 1.6 |

| Philippines | 14.0 | 14.6 | 1.9 |

| Singapore | 4.0 | 5.3 | 1.1 |

| Taiwan | 4.0 | n/a | 0.3 |

| Thailand | 13.0 | 38.6 | 2.8 |

| Vietnam | n/a | n/a | 2.6** |

Going forward, strong external positions and solid economic performance will help Asian economies buck headwinds from the normalization of monetary policy in the advanced world, rising geopolitical risks, and lackluster global trade outlook. Achieving balanced, more diversified and sustainable growth is crucial to boosting the region’s financial resilience, and such resilience will in turn benefit regional and global growth.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.