Banks across Asia are venturing overseas in a search for yield. As highlighted in a previous post, Japanese banks have begun expanding into Southeast Asia and Australia in an effort to boost earnings. Taiwanese banks are following a similar strategy as part of the government’s New Southbound Policy. As the name implies, the policy is targeted at 18 nations in Southeast Asia and South Asia as well as Australia and New Zealand. The initiative has the potential to boost the financial position of Taiwanese banks, but overseas expansion also brings new risks and challenges.

Announced by the Tsai Ying-wen Administration in 2016, the New Southbound Policy is an effort by Taiwan to strengthen its connections with other economies in the Asia-Pacific. The overarching motivation behind the policy is a desire to diversify Taiwan’s economy away from over-reliance on Mainland China. Taiwan currently exports more to Mainland China then the 18 New Southbound Policy countries combined. Additionally, Mainland China is the largest destination for Taiwanese direct investment and represents one of the largest overseas exposures for Taiwanese banks.

Taiwan’s efforts to broaden its economic ties can be traced back to policies enacted more than two decades ago. A “Go South” policy was first promoted by the Lee Teng-hui Administration in the mid-1990s and was concentrated on promoting trade and investment with the ASEAN countries. The effort produced some results, but was ultimately curtailed by the economic fallout from the Asian financial crisis of 1997. The Go South policy was revived under the Chen Shui-bian Administration in the early 2000s at a time when Taiwanese investment in Mainland China was taking off. During this period, the overwhelming economic gravity of Mainland China made it difficult for Taiwan to achieve meaningful economic diversification, even if Taiwanese investments in Southeast Asia have continued to grow.

The New Southbound Policy, effectively the third version of the Go South policy, differs from its predecessors primarily due to its wider geographic focus. Beyond Southeast Asia, the policy added Australia, New Zealand and South Asia as target markets. The New Southbound Policy also includes a greater emphasis on the role to be played by Taiwanese banks, with regulators setting explicit goals for credit growth and providing support through various incentives.

Taiwanese banks have long played a critical role in helping Taiwanese business expand overseas. Following their corporate customers to new markets has been a key motivation for Taiwanese banks to establish foreign branches. At the same time, Taiwanese banks have also been motivated to expand abroad due to their oversaturated home market. The large number of banks relative to the size of the economy has led to fierce competition in the Taiwanese banking sector. As a result, Taiwanese banks face thin margins, low profitability, and difficulties growing domestically.

In contrast, most of the New Southbound Policy countries offer more attractive banking environments. Net interest margin, the spread banks earn between the cost of liabilities (deposits) and the interest earned on assets (loans), in most of these countries are significantly higher than in Taiwan. For example, the net interest margin in Taiwan is around 1.35 percent compared to 5 percent in Indonesia. Credit growth also tends to be faster in the New Southbound Policy countries. While banking assets in Taiwan grew a respectable 6 percent in 2016, in Vietnam they grew by nearly 16 percent. In frontier markets such as Cambodia and Myanmar, Taiwanese banks have expertise that many local banks lack, making them natural partners for Taiwanese companies and other multinationals doing business in these countries. Local regulators are often welcoming as they believe foreign banks can help increase the sophistication of domestic banking services.

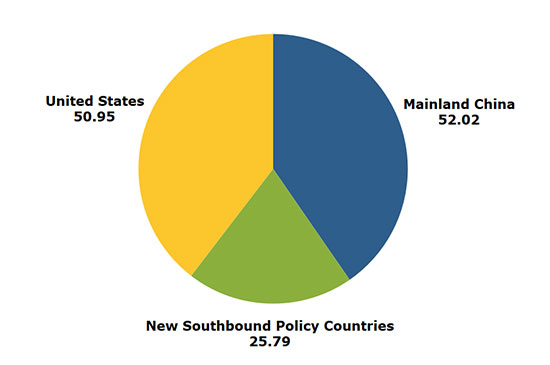

So how are Taiwanese banks doing in making inroads to these markets? According to the Financial Supervisory Commission (FSC), at the end of 2016, credit extended to the region by Taiwanese banks was around NTD 781 billion (USD 26 billion), equivalent to around one-fifth of the foreign assets of Taiwanese banks. Figure 1 shows the claims of Taiwanese banks on Mainland China and the United States in comparison to the New Southbound Policy countries.1 While exposures to Mainland China are still more than twice as large, the geographic distribution of foreign assets may become more balanced over time as Taiwanese banks continue to expand their presence in the region.

Overseas Claims of Taiwanese Banks

One indicator of the growing presence of Taiwanese banks across the region is the proliferation of new branches, subsidiaries, and representative offices. Figure 2 shows the concentration of Taiwanese banking locations in the New Southbound Policy countries. Growth is accelerating, as more than one quarter of these locations were established during the past three years.

Branches, Representative Offices, and Subsidiaries of Taiwanese Banks

New markets often come with new challenges. In many of the fastest growing markets in the region, key components of financial sector infrastructure are underdeveloped. For example, many countries lack effective credit rating systems, bankruptcy procedures for borrowers in default are expensive and slow, and information gaps make it difficult to comply with know-your-customer (KYC) requirements. Branches in these markets face hurdles in meeting the requirements of both the home office risk management function and home market regulators.

Additionally, untapped banking markets may be a thing of the past as even frontier markets are quickly becoming more competitive as large foreign banks arrive. As mentioned above, Japanese banks are already expanding aggressively across the region. Mainland Chinese banks are also undertaking their own global push as part of the One Belt One Road Initiative, which targets many of the same countries in the New Southbound Policy. Even within Southeast Asia, banks from the more developed economies are expanding into the frontier markets. Finally, local banks in these markets are growing quickly and have important home field advantages when competing with foreign entrants.

Taiwan’s New Southbound Policy is the resumption of a long-standing push to diversify its economic ties with the rest of the Asia Pacific Region. Banks are playing a greater role than before in the new effort, expanding their presence across the region, especially in the rapidly growing economies of Southeast Asia. Success, however, is far from guaranteed given challenges in these frontier markets and the growing number of overseas and domestic competitors.

1. Claims on Mainland China and the United States are on an ultimate risk basis.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.