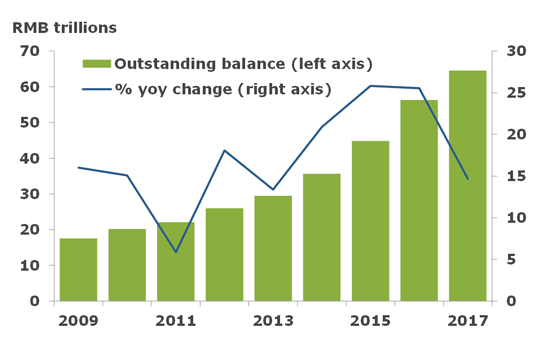

China’s bond market experienced some setbacks in 2017. Domestic bond issuance1 declined by 15.1 percent during the year, compared to a 24.7 percent increase in 2016 (Figure 1). With the smaller issuance, growth in outstanding onshore bonds decelerated to 14.7 percent, down from 25.5 percent growth in 2016 (Figure 2), according to data from China Central Depository & Clearing Co. (CCDC). Bond market trading volume growth also moderated to the slowest pace since 2013. Nonetheless, the products offered by the Chinese bond market continued to grow in sophistication. The investor base has also become more diversified as overseas investors and non-bank domestic investors play a bigger role. These developments will likely contribute to the resilience of the bond market in the long run.

China’s domestic bond issuance (2009-2017)

Outstanding balance of China’s domestic bonds (2009-2017)

Higher yields and regulatory changes upset domestic bond issuance

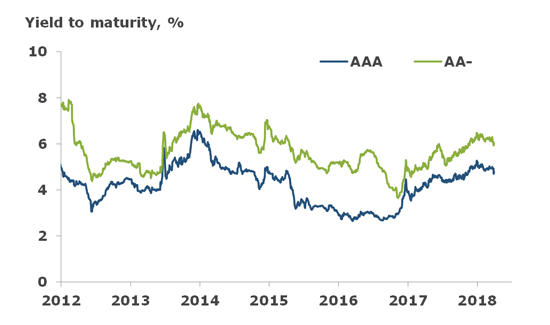

Higher costs of borrowing are a key reason behind the lackluster performance of the bond market in 2017. China’s central bank tightened interbank liquidity throughout the year to rein in financial sector risks. Consequently, bond yields and volatility trended up (Figure 3), deterring high-risk borrowers from issuing bonds. Reuters reported that potential borrowers delayed or cancelled the planned bond issuance of RMB 640 billion (US$98 billion) in 2017. For low-risk borrowers with good credit, bank loans have become more attractive, as prime lending rates are now more competitive than high-grade commercial paper yields.

One-year commercial paper yields

Regulatory changes have had an even greater impact. The Chinese authorities have taken measures to slow the growth of corporate leverage, which stood at 160 percent of GDP as of Q3 2017. Bank lending to risky industries, especially the real estate sector, has always been a focus of scrutiny. In October 2016, the Shanghai and Shenzhen stock exchanges announced measures governing bond issuance by property developers and borrowers in over-capacity industries. As a result, small private property developers are effectively banned from issuing bonds.2 Onshore property developer bond issuance, which historically accounts for the majority of corporate bonds, plunged by more than 60 percent in 2017.

Similar factors also led to a 27.9 percent decrease in local government bond issuance and a 4.4 percent decrease in policy bond issuance. Despite the slumps in the domestic bond market, offshore bonds have gained popularity among Chinese borrowers as they are relatively cheap. According to the Asia Securities Industry & Financial Markets Association (ASIFMA), Chinese issuers raised $203 billion in offshore bonds dominated in G3 currencies (U.S. dollar, euro, and yen) in 2017, nearly doubling total issuance in 2016. Going forward, offshore issuance is still on track to trend up as corporate borrowers refinance their debt to extend the wall of maturity.

Bond market grows in sophistication despite lackluster performance

Notwithstanding its lackluster performance last year, China’s domestic bond market continued to grow in sophistication. A wider range of fixed income products, including asset backed securities and derivatives, have become available for trading in recent years. The investor base is also changing. Commercial banks still own most of the government bonds and policy bank bonds, but the largest groups of investors in corporate bonds and asset back securities are investment funds, with a large chunk of the funding coming from retail investors.

Overseas investor interest in China’s onshore bond market is also growing. Foreign investors have long had the option to invest in offshore bonds issued by Chinese corporates in major international centers such as Hong Kong and Singapore, with the benefit of better liquidity and more hedging options. Still, a few recent developments have added to the popularity of China’s onshore market among investors.

In July 2015, the People’s Bank of China first allowed public sector institutional investors3 to invest in China’s interbank market through an onshore bond settlement agent, without any approval requirements and quota limits. The scope of qualified foreign investors was expanded in 2016 to include foreign investors that intended to hold their investments rather than speculate, including a wide range of financial institutions and investment conduits. Starting in July 2017, foreign investors were permitted to invest in the onshore market through the Hong Kong-China “Bond Connect” Program.

The broadened access led to a rapid increase in foreign investors’ holdings. As of February 2018, foreign investors held RMB 1.1 trillion in onshore Chinese bonds, 2.2 percent of the domestic balance. Foreign holdings of onshore Chinese bonds grew 42.3 percent over the past twelve months despite a bond market sell-off during that period.

As the renminbi has become part of the International Monetary Fund’s Special Drawing Right (SDR) basket, potential demand for onshore bonds from international reserve managers will likely remain strong. In March 2018, Bloomberg announced that it would include Chinese policy banks and government bonds into the Bloomberg Barclays Global Aggregate Bond index. China’s share will eventually grow to 5.5 percent of the index by April 2019. The decision will likely further attract global investor interests and result in fund inflows.

The increased participation of retail investors and foreign investors will contribute to the long-term development of the market structure. Traditionally, commercial banks represent the largest group of Chinese bond market investors. As banks tend to hold bonds to maturity with limited trading on the secondary market, the bond market behaves somewhat like an extension of bank lending, rather than an alternative or “spare tire.” Over time, the growing presence of retail and global investors should help reduce bond market’s reliance on banks.

Conclusion and outlook

As we covered in a previous post, the Chinese bond market is becoming larger and riskier over time. Its growth slowed in 2017 due to higher cost of funding and regulatory tightening of issuance. Corporate bonds were hit particularly hard, with issuance plunging by more than 60 percent. However, demand for bond financing will likely rebound as Chinese issuers face growing repayment pressure in the near future. While the market is still growing in depth and sophistication, the increased participation of global investors has the potential to help the market achieve higher levels of resilience by adding the much-needed diversification in investor base.

1. Excluding Negotiable Certificates of Deposit.

2. Qualified property developers include: publicly listed companies, central government-owned enterprises, province or large city government-owned companies, and the 100 largest privately owned, non-public listed property developers.

3. Including foreign central banks, monetary authorities, international financial organizations and sovereign wealth funds.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.