Policy makers have been interested in ways to support small businesses and understand the impact of the recession and resulting recovery on small businesses in the economy. In order to meet this need, the Federal Reserve System conducts a national survey to provide insight on small business patterns regarding financing needs, decisions and outcomes. The Small Business Credit Survey (SBCS) asks small business owners to detail their current business climate, financial needs and recent credit experiences. A new report (pdf, 181 kb) from the SF Fed summarizes key data at the state level for small businesses in California.

Heading into 2018, small businesses in California reported modest performance and anticipated growth in revenue and employment but a significant majority faced financial challenges, experienced funding gaps and funded their business through retained business earnings and personal finances. The following are key findings related to financing from the report:

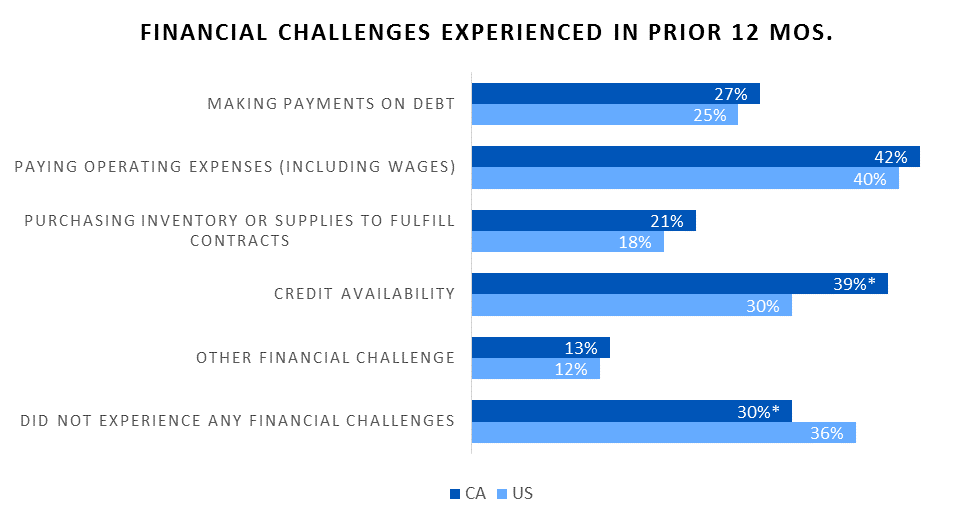

Operating expenses and credit availability were the top two financial challenges that small businesses faced in California.

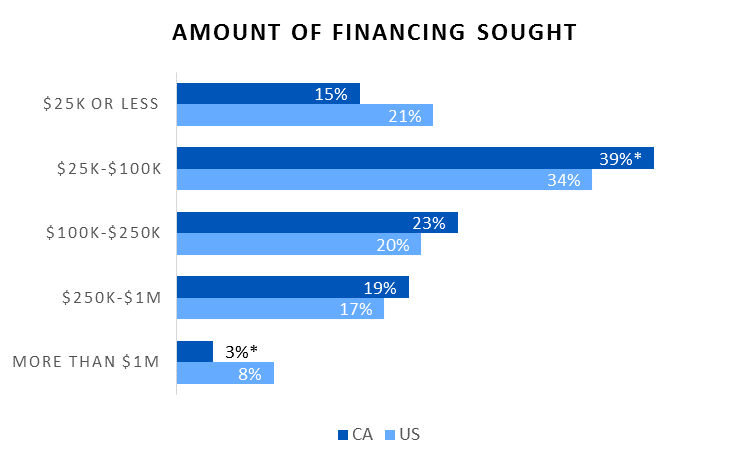

38 percent of firms applied for financing in the prior 12 months. Of those firms, most firms – 54 percent – applied for $100,000 or less in financing.

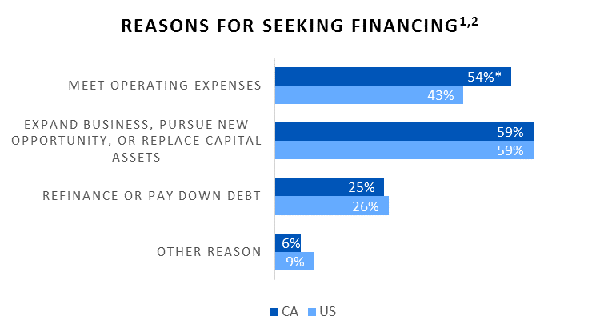

Most small businesses applied for financing to expand their business or meet operating expenses.

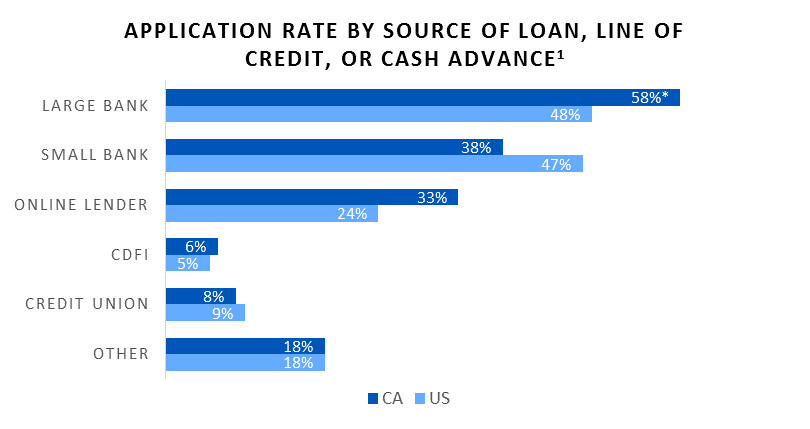

Large banks are the most common source of credit. Smaller firms also frequently applied for financing from online lenders and other sources. 33 percent of borrowers in California applied to online lenders such as Lending Club, OnDeck, PayPal, Cabbage, etc. whereas 6 percent applied to Community Development Financial Institutions (CDFIs).

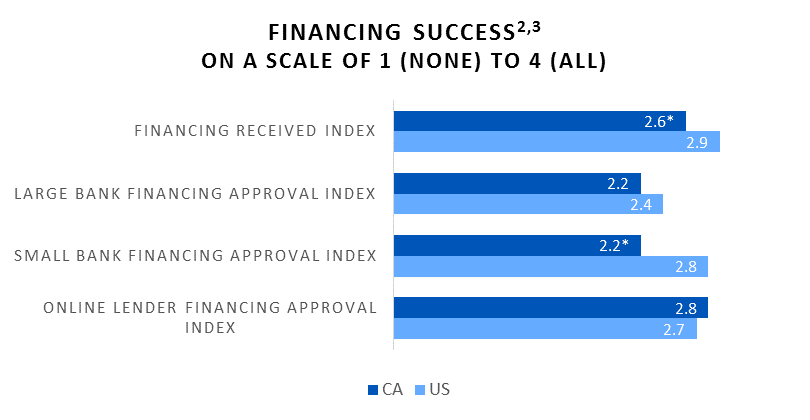

While banks were the most common source of credit, small businesses had higher financing success with online lenders than with large and small banks. Overall, small businesses in California had a financing received index of 2.6 compared to 2.9 nationwide. The index represents the share of financing received across all applicants by the average survey participant. 1 means the average respondent received none of the amount requested, 2 indicates some, 3 indicates most, and 4 means the average respondent received the full amount requested.

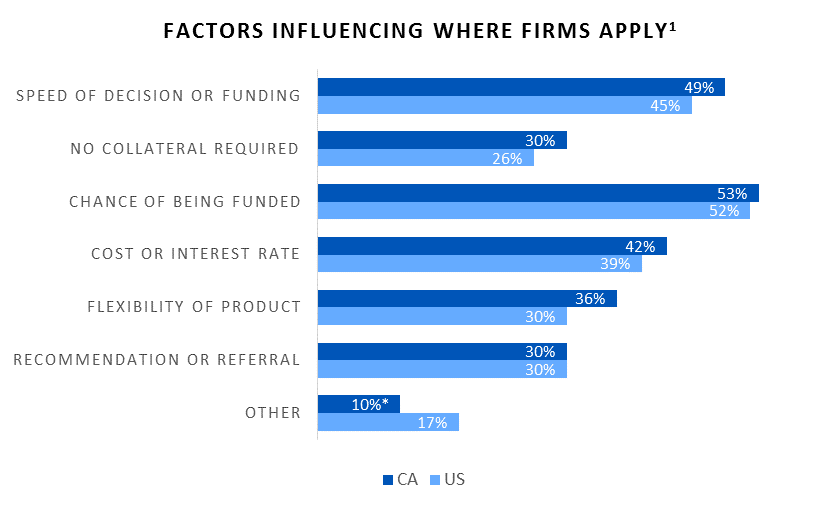

Chance of being funded and speed of decision or funding were the two greatest factors influencing where small businesses apply for financing.

The Rise of Online Lending: Implications for Small Businesses

As shown in the key results, small businesses in California continued to face financial challenges and financing shortfalls in 2017. With online lenders playing an increasing role in providing financing and credit to small businesses, small businesses are applying for financing from online lenders more than from Community Development Financial Institutions (CDFIs), credit unions and other sources. Their speed and underwriting data models allow online lenders to grant small businesses their capital quickly, which is an important factor influencing where small businesses apply for funding. Applicants that apply to banks or other sources were most dissatisfied with wait times for their credit decisions which can take up to weeks and sometimes months. In comparison, many online lenders review and approve loan applications in a matter of days, which highlights how online lenders can be attractive for businesses looking for fast turnaround times.

Through online lenders, small business borrowers have the benefit of receiving smaller dollar loan amounts that traditional banks may otherwise not lend due to perceived higher risk and underwriting costs. Some banks, particularly larger banks, have significantly reduced or eliminated loans below a certain threshold, typically $100,000 or $250,000, or simply will not lend to small businesses with revenue of less than $2 million.1 This is problematic as a majority of small firms in California (54 percent) sought loans of under $100,000.

Despite their ease of application and small dollar loan amounts, small business owners reported lower borrower satisfaction with online lenders than banks, CDFIs and credit unions and cited challenges with high interest rates and unfavorable repayment terms.2 Annual percentage rates (APR) for loans from online lenders can go as high as 99 percent, whereas the current rate for SBA 7(a) loans ranges from 6.75 to 9.25 percent. On the other hand, CDFIs have one of the highest borrower satisfaction rates yet less than 10 percent of firms in California applied for a loan through CDFIs. As mission-oriented lenders, CDFIs have a unique focus on helping underserved communities gain access to capital resources and technical assistance, and there is opportunity to continue to build the capacity of these institutions.

In today’s small business lending space, there are many credit products offered by various lenders, but they do not necessarily meet all the needs of small business owners. Findings from the report highlight financing trends and behaviors of small businesses on a state level, which can help community development practitioners, policy makers and lenders better understand how to best assist small businesses and their greatest needs. In particular, there is an opportunity for traditional banks and CDFIs to assess the rise of online lenders and consider the implications this may have on the small business community. CDFIs and mission-driven lenders can also think about how to support their small business clients in this changing lending landscape and how to differentiate themselves from online lenders and other alternative sources.

For more findings, read the 2017 Small Business Credit Survey: California Report (pdf, 181 kb).

1. Karen Gordon Mills and Brayden McCarthy, State of Small Business Lending, Harvard Business School.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.