Fifteen months of new data covering the period since May 2023 continue to track closely along the path of a fitted nonlinear Phillips curve that shows the empirical relationship between inflation and a particular measure of labor market slack: the ratio of the unemployment rate to the job vacancy rate.

The new data confirm that a relatively modest increase in the amount of labor market slack can coincide with a sizable decline in inflation—supporting the potential for a soft landing.

Updated data on labor market slack and inflation

The new data provide support to the findings published in our earlier Economic Letter, “Reducing Inflation along a Nonlinear Phillips Curve” (Crust, Lansing, and Petrosky-Nadeau 2023) and the findings reported in our previous update, “Staying on Course: Reducing Inflation along a Nonlinear Phillips Curve” (Lansing, and Petrosky-Nadeau 2024), which included 7 months of new data running from June 2023 through December 2023.

The current update includes additional data running from January 2024 through August 2024. In total, the 15 months of new data received since the Letter continue to track closely along the paths predicted by the fitted nonlinear Beveridge and Phillips curves.

The data covering the period from June 2023 through August 2024 provide an out-of-sample test. That is, applying the new data to our model confirms our results that the estimated relationship between job vacancies and unemployment—the Beveridge curve—and the relationship between inflation and labor market slack—the Phillips curve—have remained stable. Indeed, the 15 months of new data track closely along the original fitted curves.

New data on unemployment and job vacancy rates

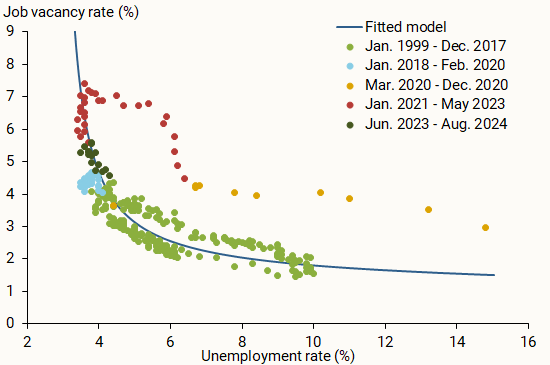

What do these curves mean for the U.S. economy? In May 2023, the unemployment rate was 3.7% while the job vacancy rate was 5.6%, yielding an unemployment-to-vacancy ratio of 0.66. A ratio below 1.0 implies a tight labor market because the number of job vacancies exceeds the number of unemployed workers who could potentially fill those vacancies.

During the subsequent 15 months ending in August 2024, the unemployment rate rose to 4.2% while the U.S. economy created about 204,000 jobs per month on average. Over the same period, the job vacancy rate declined to 4.8%, yielding an unemployment-to-vacancy ratio of 0.88. The increase in the unemployment-to-vacancy ratio from 0.66 to 0.88 indicates that the labor market has become less tight.

Figure 1 plots the new data relative to the original fitted Beveridge curve from the earlier Letter. The figure shows that the new data from June 2023 through August 2024 (dark green dots) have tracked closely along the nonlinear Beveridge curve. The curve is constructed using data for the more normal labor market conditions that preceded the pandemic, from January 1999 to February 2020.

Figure 1

Fitted Beveridge curve relationship

Source: Bureau of Labor Statistics and authors’ calculations.

New data on inflation and the unemployment-to-vacancy ratio

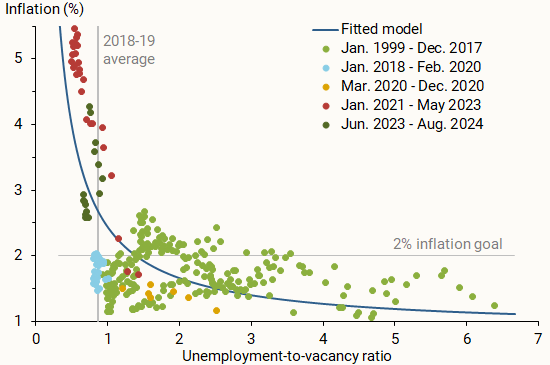

The 12-month core personal consumption expenditures (PCE) inflation rate in May 2023 was 4.7%. For the purpose of this update, we compare the new data to the Phillips curve that is constructed using data that were available at the time of the Letter’s original publication. During the subsequent 15 months ending in August 2024, the inflation rate declined a full 2 percentage points, ending at 2.7%.

Figure 2 plots the new data relative to the original fitted Phillips curve data from the Letter. The figure shows that the new data (dark green dots) have tracked closely along the nonlinear Phillips curve. The new data confirm that a relatively modest increase in the amount of labor market slack can coincide with a sizable decline in inflation. These patterns have helped maintain the possibility of a successful return of inflation to the Fed’s 2% goal without a substantial weakening of the labor market.

Figure 2

Fitted nonlinear Phillips curve relationship

Source: Bureau of Labor Statistics and authors’ calculations.

References

Crust, Erin E., Kevin J. Lansing, and Nicolas Petrosky-Nadeau. 2023. “Reducing Inflation along a Nonlinear Phillips Curve.” FRBSF Economic Letter 2023-17 (July 10).

Lansing, Kevin J., and Nicolas Petrosky-Nadeau. 2024. “Staying on Course: Reducing Inflation along a Nonlinear Phillips Curve.” SF Fed Blog (February 21).

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.