Robert G. Valletta, associate director of research and senior vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of November 30, 2023.

- With price pressures receding and the labor market gradually cooling, prospects have improved for a “soft landing” in the economy: a return of inflation to the Federal Reserve’s 2% longer-run goal without a contraction in economic activity or the labor market. Progress on these dual goals has been uneven, however, and a soft landing is not assured.

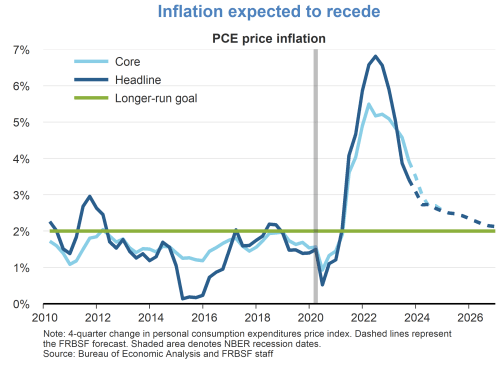

- Inflation surged in 2021 during the COVID-19 pandemic and reached a peak in the first half of 2022. Since then, substantial progress has been made in bringing inflation back down to 2%. We expect that diminished supply constraints and slower growth in overall demand will support inflation returning close to the Fed’s 2% goal over the next three years.

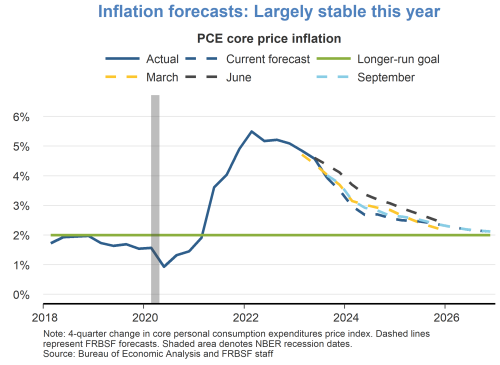

- Our San Francisco Fed inflation forecasts have been largely stable in 2023. After increasing the forecast trajectory midyear following inflation’s greater-than-expected persistence early in the year, we have moved our recent forecasts slightly below our March forecast trajectory. By contrast, repeated upside inflation surprises in 2022 led to substantial upward revisions to our inflation forecast trajectory last year.

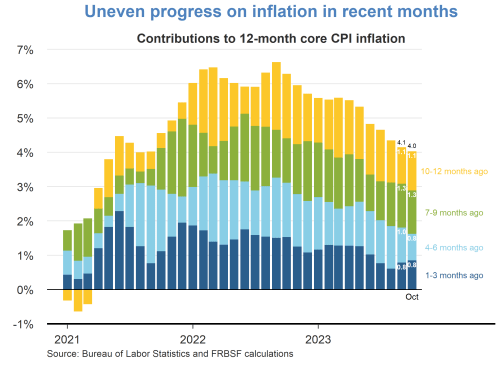

- Recent monthly inflation data show that progress on reducing inflation has been uneven. The 12-month core consumer price index (CPI), a measure of inflation that excludes food and energy components, has been declining slowly but steadily in recent months. However, price changes over the most recent three months have picked up slightly, and the contributions from housing and other core services remain elevated. Today’s release of the personal consumption expenditures (PCE) price index for October confirmed the ongoing decline in the 12-month pace of core inflation, to 3.5% by this measure.

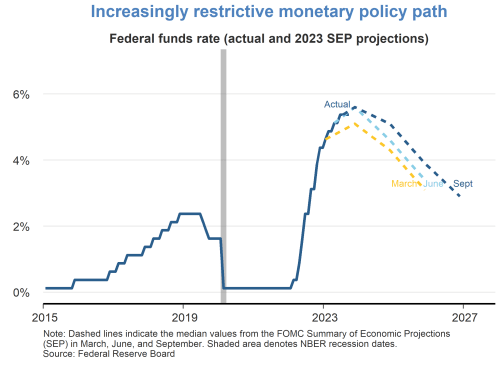

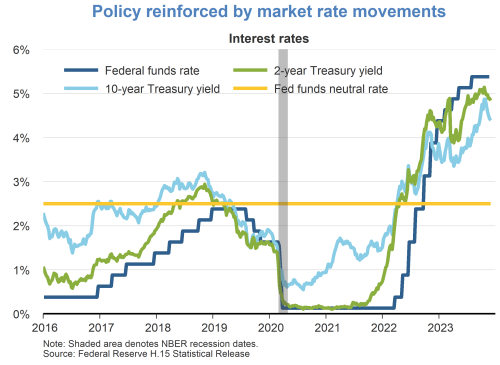

- The ongoing decline in inflation is partly linked to restrictive monetary policy. Following the fastest pace of tightening in four decades during 2022, the pace of funds rate increases slowed in 2023, with no changes made after the two most recent meetings of the Federal Open Market Committee (FOMC) that concluded in mid-September and the beginning of November. The median policy path from the FOMC’s Summary of Economic Projections (SEP) has moved progressively higher during 2023. The two most recent SEPs suggest that the funds rate is at or near its peak but likely to remain at restrictive levels through 2026.

- The restrictive stance of monetary policy has been reinforced in recent months by increases in longer-term Treasury yields. A portion of these increases have retraced recently, possibly reflecting greater optimism among financial market participants about continued inflation declines without the need for further increases in the funds rate.

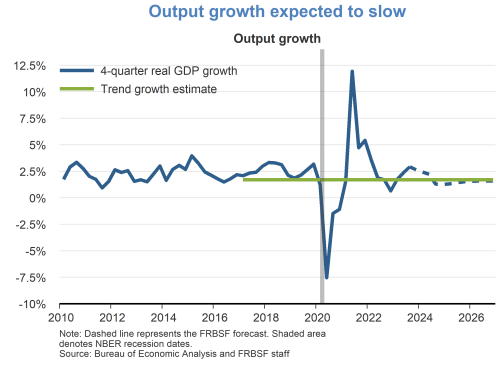

- Our forecast of declining inflation is based in part on a projected slowdown in economic activity. As measured by real GDP, economic activity grew rapidly at a 5.2% annualized rate during the third quarter. But as cumulative policy tightening continues to take effect, we expect growth to fall below trend in the current quarter and next year, followed by a gradual convergence back to trend.

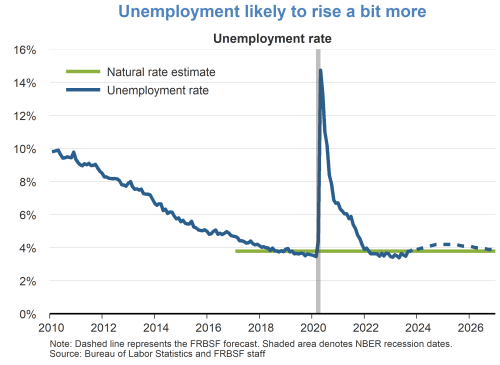

- As economic activity slows, we expect continued loosening of the historically tight labor market observed after the pandemic. This process has already started, with the unemployment rate rising by one-half percentage point over the past six months, ending at 3.9% in October. We expect the unemployment rate to rise a bit more during 2024 and stay above our estimate of the long-term natural rate of 3.8% through 2026.

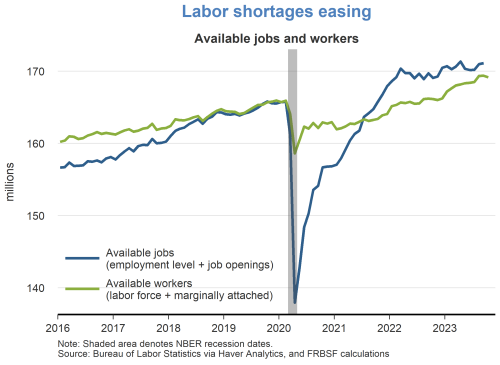

- The adjustment in the labor market has been orderly thus far. Labor demand growth has slowed and worker availability has grown rapidly, substantially shrinking the historically large excess of available jobs over available workers.

- The recent increase in the prime-age labor force participation (LFP) rate has been an important contributing factor for the increased availability of workers. The prime-age LFP rate from April through October has surpassed its highest level since the early 2000s, propelled largely by a surge in the participation rate for prime-age women to an all-time high.

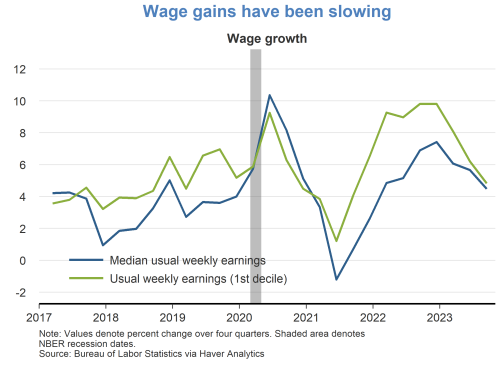

- Gains in prime-age LFP during the recoveries from the past two recessions were likely spurred by the relatively rapid wage growth for the lowest-paid workers. These workers are often on the margins of the labor market and tend to be especially responsive to changes in hiring conditions and wages. Relative wage growth for the lowest-paid workers has slowed recently, however, suggesting that LFP gains could slow as well.

- The growth in the foreign-born labor force also has been unusually rapid over the past two years. This growth surge has fully offset a slowdown in foreign-born labor force growth that occurred shortly before and during the pandemic.

- The gains in participation by prime-age and foreign-born workers have improved labor availability, keeping labor force growth well above its underlying trend that is determined by typical growth in the working-age population. If these factors wane, continued easing of labor market tightness likely will require a further slowing of labor demand.

Charts were produced by Deepika Baskar Prabhakar.

About the Author

Robert G. Valletta is senior vice president and associate director of research in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Robert G. Valletta

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.