Huiyu Li, research advisor at the Federal Reserve Bank of San Francisco, stated her views on the current economy and the outlook as of April 18, 2024.

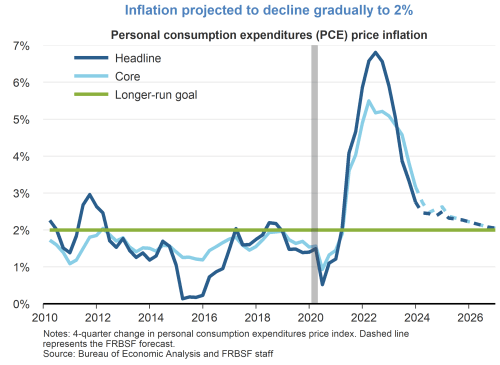

- After peaking in June 2022 at 7.1%, the 12-month change in the headline personal consumption expenditures (PCE) price index declined to 2.5% in February 2024. Over the same period, core PCE inflation, which removes volatile food and energy components, declined from 5.2% to 2.8%.

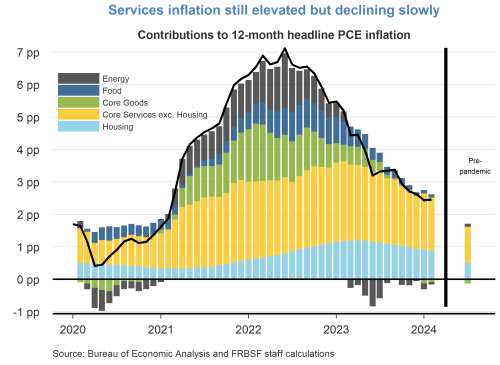

- Most of the decline in headline PCE inflation can be attributed to the easing of price pressures in the food, energy, and core goods categories. The contribution of these three categories to headline inflation declined from 3.8 percentage points in June 2022 to -0.1 percentage points in February 2024. Of the total 4.7 percentage point decline in headline PCE inflation since June 2022, these three categories accounted for 3.9 percentage points, or more than eight-tenths of the total inflation decline.

- The contribution of the core goods category to headline PCE inflation peaked in February 2022 and then started receding, eventually returning to its pre-pandemic level in January 2024. The contribution of the core services category, which includes housing, peaked at 3.6 percentage points in February 2023. The contribution of this category has since declined to 2.5 percentage points, but this value is still 0.9 percentage points above its pre-pandemic level. Going forward, we expect a gradual decline in the contribution of core services inflation to headline PCE inflation.

- Since July 2023, the federal funds rate target has remained between 5.25% and 5.5%, which is well above our 2.75% estimate of the neutral funds rate. As inflation declines, the implied real, or inflation-adjusted, federal funds rate has been rising, thereby increasing the degree of monetary policy restraint. Given the restrictive stance of monetary policy, we expect inflation to decline gradually to the Fed’s 2% longer-run goal over the next few years.

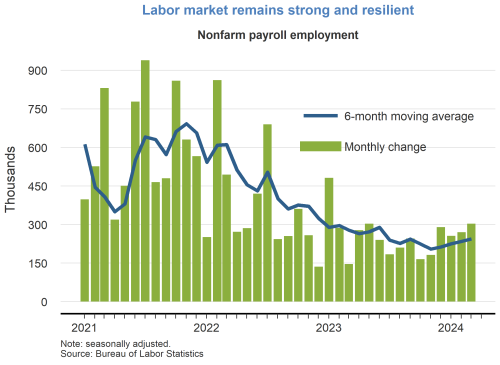

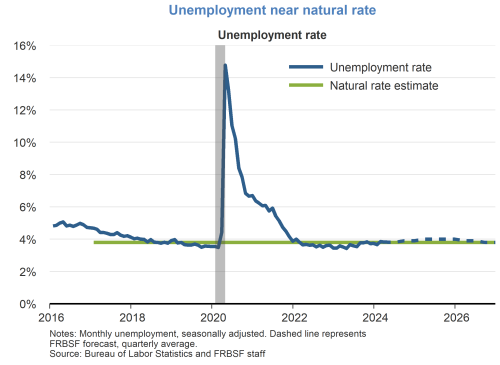

- The labor market has remained resilient, supporting the prospects of a “soft landing,” which means a return of inflation to 2% without a recession. Nonfarm payroll employment increased by 303,000 jobs in March 2024, which is above the six-month average pace of job growth. The unemployment rate declined slightly to 3.8% in March from 3.9% in February and remains close to our estimate of the natural rate of unemployment.

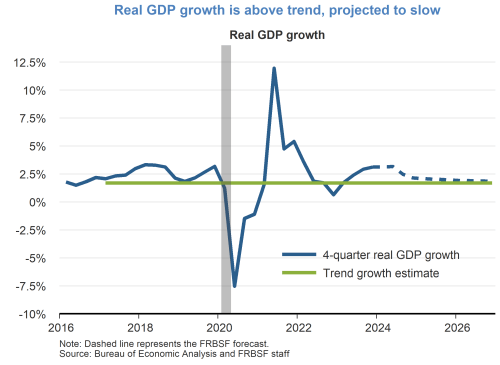

- Real gross domestic product (GDP) grew at a robust 3.4% annualized rate during the fourth quarter of 2023. From the fourth quarter of 2022 to the fourth quarter of 2023, real GDP grew at a rate of 3.1%, which is above our estimate of longer-run trend growth. Given the current stance of monetary policy, we expect real GDP growth to slow towards trend growth over the forecast horizon.

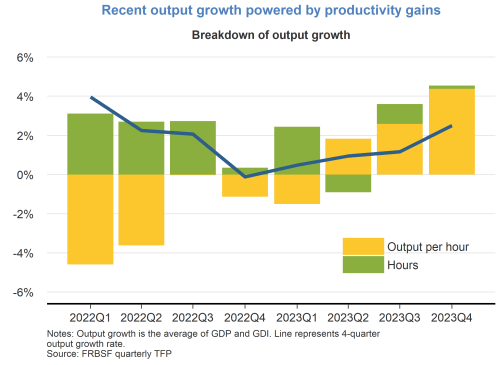

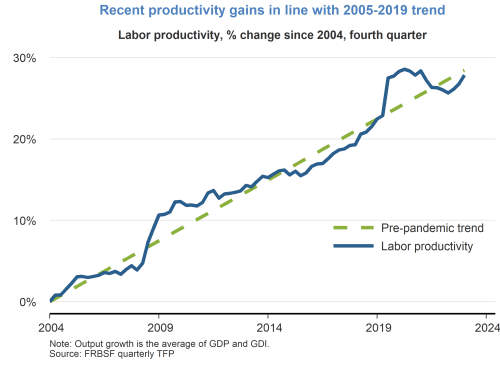

- Much of the momentum in real output growth in 2023 can be attributed to a rebound in the growth rate of labor productivity, measured as output per hour, relative to 2022 when output per hour declined. The rebound in labor productivity growth in 2023 brings output per hour in line with the pre-pandemic average growth rate from 2005 to 2019.

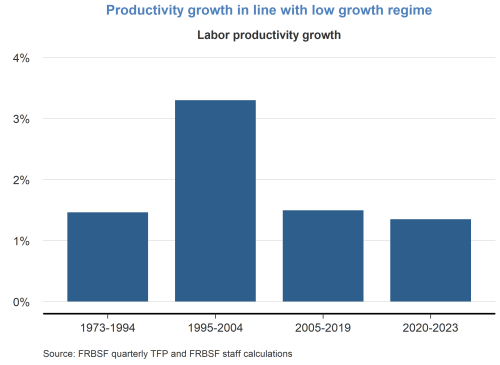

- Recent developments in artificial intelligence (AI) offer the possibility of a pickup in future productivity growth. The information technology revolution starting in the mid-1990s coincided with a period of rapid productivity growth. From 1995 to 2004, output per hour grew at an average annual rate of 3.1%. This growth rate is more than double the pace of 1.5% that was observed during the prior period from 1973 to 1994 and also during the subsequent period from 2005 to 2019.

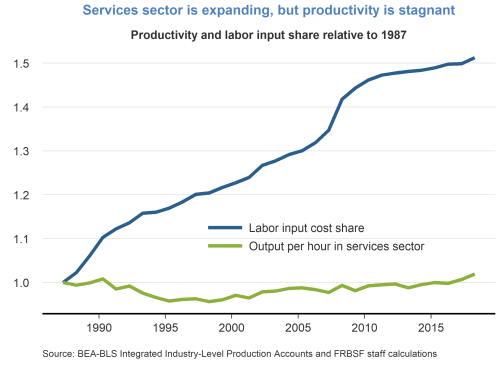

- The average growth rate of output per hour from 2020 to 2023 was 1.35%, slightly below the values recorded during the two low-growth “regimes” of 1973 to 1994 and 2005 to 2019. The high growth regime of 1995 to 2004 was supported by elevated productivity growth in both the manufacturing and trade sectors, but not the services sector. Going forward, switching back to a high-growth regime in output per hour is likely to require a pickup in productivity growth in the services sector because services now account for the bulk of total U.S. labor input, as measured by the cost of labor in the Integrated Industry-Level Production Accounts from the Bureau of Labor Statistics.

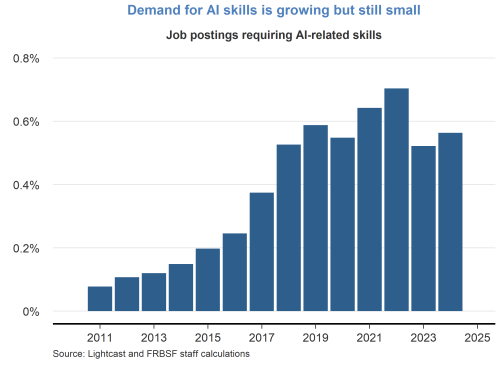

- Previous waves of innovation primarily served to automate tasks performed by workers in the agricultural and manufacturing sectors. Innovations in AI have the potential to automate tasks across a wide range of services. But such a development may take time, because although the demand for AI skills in the labor market has grown rapidly, it is still small.

Charts were produced by Brigid Meisenbacher.

About the Author

Huiyu Li is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Huiyu Li

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.