Mark M. Spiegel, senior policy advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of March 6, 2025.

The U.S. economy continued to advance at a solid pace in 2024 but is showing some signs of slowing. The labor market has cooled relative to conditions in early 2024 and appears to be largely balanced. However, progress on inflation has slowed in recent months. At its January 2025 meeting, the Federal Open Market Committee (FOMC) announced that the target range for the federal funds rate would be maintained at 4¼ to 4½%. Federal Reserve Chair Jerome Powell stated in his recent presentation to Congress on the semiannual Monetary Policy Report, “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance.”

Job growth remains solid, but some indicators point to further cooling

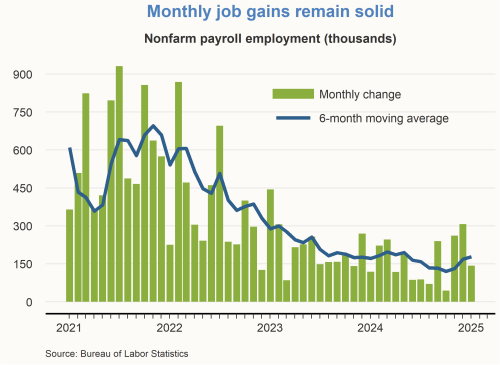

Real GDP growth and consumer spending over the past year have been robust. Although the labor market has cooled relative to conditions in early 2024, monthly job gains remain solid. The U.S. economy added 143,000 new jobs in January 2025, while job gains in November and December of 2024 were revised upward by 100,000 jobs. Real personal consumption expenditures grew at a robust pace in 2024, but January’s reading showed an unexpected decline relative to the previous month. Motor vehicle and existing home sales also fell in January, likely in part due to inclement weather. The University of Michigan’s Consumer Sentiment Index fell about 10% in February, and the Conference Board’s U.S. Consumer Confidence Index fell about 7%.

Progress on reaching full employment and price stability continues

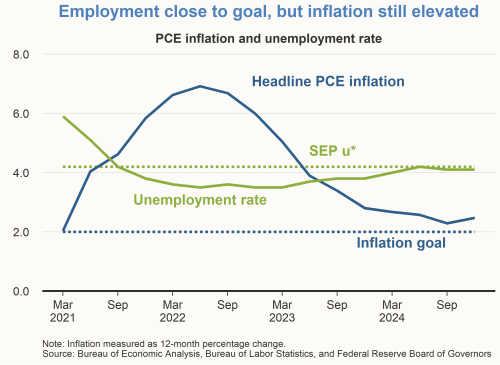

With continued job growth, the unemployment rate has remained close to the values associated with the maximum employment component of the Fed’s dual mandate. Although unemployment came in at 4.0% in January 2025, up from its low of 3.4% in April 2023, unemployment has remained quite stable over the past six months. The current 4.0% figure is below the median longer-run projection for the unemployment rate from the FOMC’s December 2024 Summary of Economic Projections (SEP). We expect the unemployment rate to increase modestly this year and remain above 4% over the medium term.

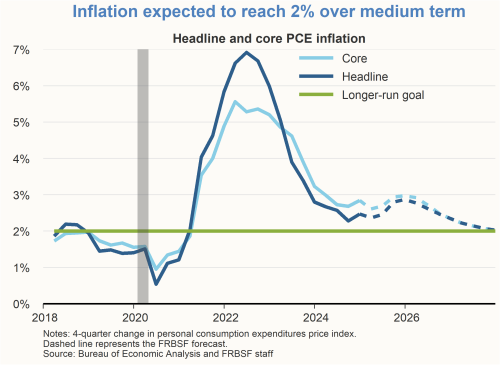

In contrast, progress on the Fed’s 2% inflation goal has been uneven and appears to have slowed over the past few months. The 12-month change in the headline personal consumption expenditures (PCE) price index was 2.5% in January 2025, down significantly from its mid-2022 peak of 7.2%. However, the latest reading is only one-tenth of a percentage point below the January 2024 inflation rate. While the 12-month core PCE inflation rate in January 2025 was 2.6%, inflation for various services categories, including shelter, health care, and insurance, remains elevated. Goods and energy prices have also ticked up recently after largely being flat or declining in the previous year.

The Bureau of Labor Statistics reported nominal wage growth, as measured by the 12-month change in average hourly earnings for all private-sector employees, remained elevated at 4.1% in January 2025, down only two-tenths of a percentage point from January 2024.

We expect inflation to pick up somewhat this year, after which we expect progress to resume, reaching the Fed’s 2% inflation goal by the end of 2027.

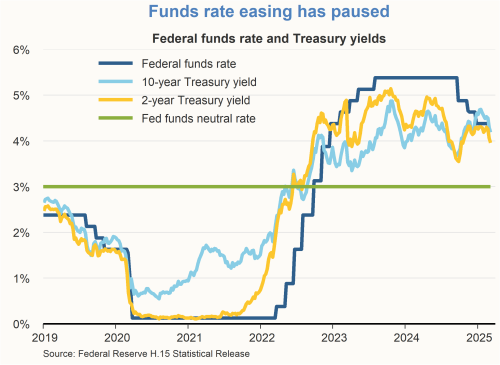

Monetary policy currently restrictive

In its January statement, the FOMC announced that the target range for the federal funds rate would be maintained at 4¼ to 4½%. This action follows previous moves starting in September 2024 to lower the target range by a full percentage point from its peak range of 5¼ to 5½% that had been maintained since August 2023. In prepared remarks during the post-meeting press conference, Chair Powell noted that policy was well positioned to adjust to the risks and uncertainties that the FOMC faces in the pursuit of its dual mandate, and that policy was not on a preset course.

When asked about the degree of restrictiveness of the federal funds rate range, the Chair noted that there is considerable uncertainty about the long-run neutral rate of interest. Nevertheless, he said almost all FOMC meeting participants view the current funds rate range to be above neutral and view the current stance of policy as “having meaningful effects in bringing inflation under control.”

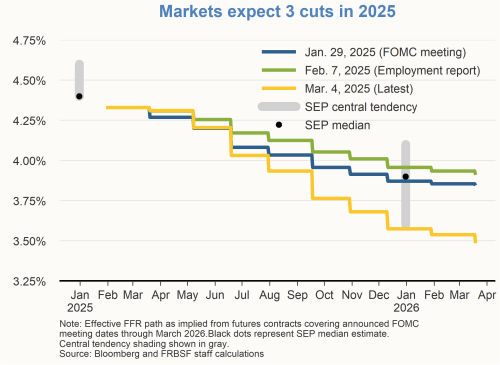

Markets expect further easing in 2025

Given that the current target range for the federal funds rate remains restrictive, market participants continue to expect that monetary policy is likely to ease during 2025. Projections from futures markets are for three rate cuts this year, with the first one in June, and the second in September.

There are notable risks to both the inflation and economic activity outlook. Inflation risks are tilted to the upside given recent trade policy announcements. There are output risks in both directions due to prospective regulatory and fiscal policy actions and some nascent indications of slowing consumption.

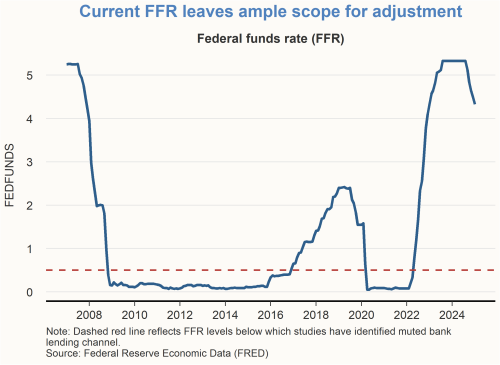

The current stance of monetary policy is well positioned to make adjustments in response to incoming data in either direction. In the event of positive surprises in output or inflation, monetary policy can always be tightened. However, the desire to ease monetary policy can face challenges when the federal funds rate is close to zero, as during the COVID-19 pandemic and from December 2008 to December 2015 in response to the Great Recession.

One component of conventional monetary policy’s potential limits at very low interest rates is the degree to which financial intermediaries, particularly banks, react to changes in the federal funds rate. When the federal funds rate moves, overall interest rates typically move in the same direction. Bank funding costs, particularly rates on deposits, tend to adjust less in response to these interest rate changes than do banks’ returns from new lending. Therefore, lower interest rates typically help to raise the profitability of new lending while higher rates serve to lower it. Furthermore, bank lending volume typically rises in response to a policy easing and declines in response to a policy tightening. This conceptual framework is known as the bank lending channel of monetary policy.

For example, when the federal funds rate was close to zero during the pandemic and the years after the Great Recession, changes in the funds rate were associated with only tepid responses in bank lending. Studies have estimated that these tepid bank lending responses are observed when short-term nominal interest rates fall below levels of around 50 basis points. However, a recent study demonstrates that recent bank lending does exhibit heightened responsiveness to movements in current policy rates, because current rates are well away from zero.

Even after the 1 percentage point reduction in the target range for the federal funds rate since September 2024, the current target range remains well above levels typically associated with disruptions in the bank lending channel. As a result, the current stance of monetary policy affords ample room for considerable adjustment in either direction in response to incoming data.

Charts were produced by Aayush Singh.

The views expressed are those of the author with input from the Federal Reserve Bank of San Francisco forecasting staff. They are not intended to represent the views of others within the Bank or the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. SF FedViews appears eight times a year. Please send editorial comments to Research Library.