This paper employs a standard asset pricing model to derive theoretical volatility measures in a setting that allows for varying degrees of investor information about the dividend process. We show that the volatility of the price-dividend ratio increases monotonically with investor information but the relationship between investor information and equity return volatility (or equity premium volatility) can be non-monotonic, depending on risk aversion and other parameter values. Under some plausible calibrations and information assumptions, we show that the model can match the standard deviations of equity market variables in long-run U.S. data. In the absence of concrete knowledge about investors’ information, it becomes more difficult to conclude that observed volatility in the data is excessive.

About the Authors

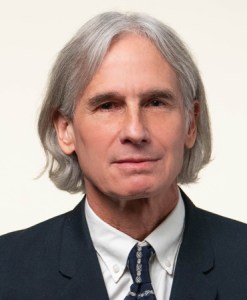

Kevin Lansing is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Kevin Lansing