I solve for the sequences of shocks (or wedges) that allow a standard real business cycle model to exactly replicate the quarterly time paths of U.S. macroeconomic variables and asset returns since 1960. The resulting shock sequences can be grouped into three main categories: (1) shocks that affect household sentiment and preferences, (2) shocks that appear in the law of motion for capital, and (3) shocks that appear in the production function for output. For most variables including output, no single shock category is clearly dominant in explaining the observed movements in U.S. data. While some variables are driven by a single dominant shock category, the dominant category is different for each of those variables. The results imply that there is no “most important shock.” Rather, U.S. economic outcomes have been shaped by a complex and time-varying mixture of fundamental and non-fundamental disturbances.

Suggested citation:

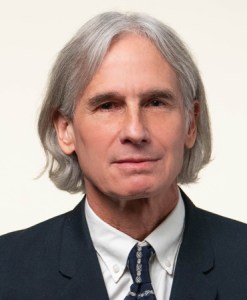

Lansing, Kevin. 2024. “Replicating Business Cycles and Asset Returns with Sentiment and Low Risk Aversion.” Federal Reserve Bank of San Francisco Working Paper 2021-02. https://doi.org/10.24148/wp2021-02