The way consumers shop today is much different than 10 years ago, largely due to the proliferation of new technologies like smartphones and tablets. Today’s new methods of shopping often blur the line between in-person and online purchases and influence how consumers choose to pay for their purchases.

How You Shop Affects How You Pay

How You Shop Affects How You Pay

The Federal Reserve’s Cash Product Office explores the way people shop and how various shopping methods influence consumers’ payment choices.

YOU’RE MORE LIKELY TO USE CASH IN PERSON

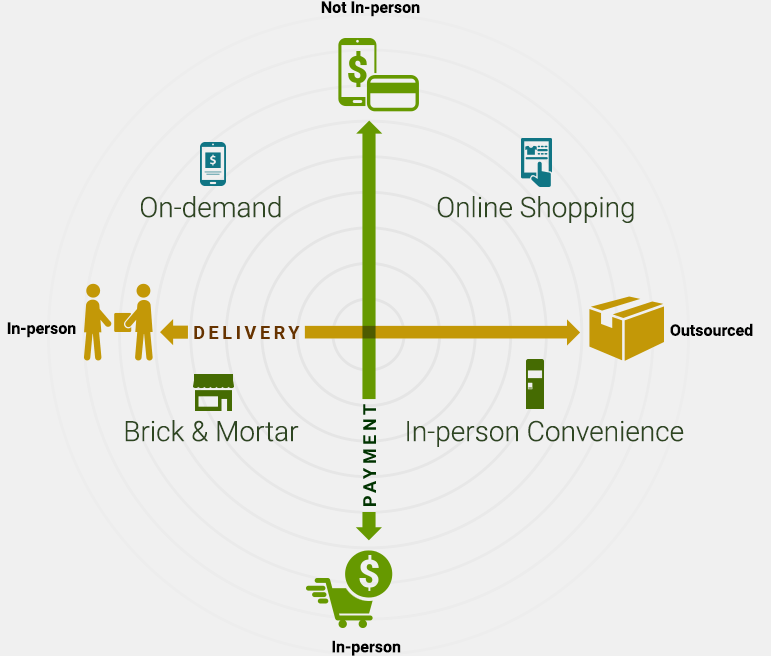

There are four ways to shop based on how you pay and how you acquire the good or service.

On-demand

Order and payment are conducted via an online platform. Good/service is delivered in person by the merchant to the consumer.

Online Shopping

Order and payment are conducted entirely online. Good/service is delivered by a third-party shipping service, not the merchant directly.

Brick & Mortar

Order and payment are in person. Good/service is delivered in-person by the merchant to the consumer.

In-person Convenience

Order and payment are in person. Good/service is delivered by automated machine or third-party.

On-demand

Order and payment are conducted via an online platform. Good/service is delivered in person by the merchant to the consumer.

Online Shopping

Order and payment are conducted entirely online. Good/service is delivered by a third-party shipping service, not the merchant directly.

Brick & Mortar

Order and payment are in person. Good/service is delivered in-person by the merchant to the consumer.

In-person Convenience

Order and payment are in person. Good/service is delivered by automated machine or third-party.

MOST PURCHASES ARE IN PERSON

of total retail sales are in-store purchases*

…and cash plays an important role in this setting

of total retail sales are in-store purchases*

…and cash plays an important role in this setting

* Omnichannel Shopping Preferences study, A.T. Kearney, July 2014

THE “UBER” EFFECT ON CASH

Transportation purchases made up 2.2% of all cash transactions in the U.S. in 2012.

If 65% of all transportation services converted to on-demand, total cash transactions would decline an estimated 1.4%.

CONCLUSION

While we see shopping experiences change, CASH’s role may evolve, but its sizeable presence will remain.

Federal Reserve National Cash Product Office

© 2016 Federal Reserve Bank of San Francisco

Federal Reserve Cash Product Office

© 2016 Federal Reserve Bank of San Francisco

Download the infographic (png, 102 kb)