The banking shock of 2023 stemmed from banks’ exposure to interest rate risk by gathering short-term funds to invest in long-term assets. When interest rates rose rapidly during the monetary tightening cycle, banks incurred significant capital losses on their long-term assets, some of which were unrealized on their financial statements. However, bank franchise value—the present value of all future excess profits—which is also unrecognized, could hedge against the losses and provide some stability. Moreover, the potential loss of franchise value could discourage risk-taking, further stabilizing the banking system.

Despite the distress and failure of multiple banks over a short time during the banking shock of 2023, the banking system remained resilient. Speedy policy interventions, including the Federal Reserve’s Bank Term Funding Program and the extension of deposit insurance coverage to uninsured depositors, played an important role in containing the shock (Board of Governors 2023).

Exposure to interest rate risk was a key driver in this episode, which was different from most previous banking crises when credit risk was the underlying cause. Banking research has shown that a bank’s franchise value—the present value of all future excess profits—can hedge against interest rate risk (Drechsler, Savov, and Schnabl 2021). In this Economic Letter, we discuss how the value of a bank franchise can contribute to the stability of the banking system in a volatile interest rate environment, as well as its limitations if depositors decide to run.

The banking shock of 2023

The sudden failure of Silicon Valley Bank (SVB), the 16th largest bank in the United States, in the spring of 2023 raised questions about the safety and soundness of other banks. The stress quickly spread to domestic and international banking systems. Within days, Signature Bank in New York was closed by its regulator. First Republic Bank in San Francisco was under intense market scrutiny and was eventually acquired by JPMorgan Chase Bank. Internationally, Credit Suisse, the second largest bank in Switzerland and a global systemically important bank designated by the Financial Stability Board, came under renewed pressure and was ultimately merged into UBS (Board of Governors 2023).

At the most basic level, the business of banking is about managing risk, including credit risk, interest rate risk, liquidity risk, and operational risk. SVB failed because of mismanagement of interest rate risk and liquidity risk (Barr 2023). Interest rate risk arises when banks borrow short-term money, such as deposits, to invest in long-term assets, including loans and securities. When interest rates rise, the value of long-term assets that banks acquired at lower interest rates falls because the cash flows of these assets must be discounted to present values at a higher interest rate. At the same time, banks need to pay higher interest rates to roll over their short-term borrowings as interest rates rise. The capital losses on long-term assets and the potential squeeze on the interest rate margin diminish the economic value of banks and, at the extreme, can make a bank insolvent if the bank’s capital is insufficient to absorb the losses.

This was what happened to SVB. It used its large inflow of deposits during the pandemic to invest extensively in long-term bonds when interest rates were low. When the Federal Reserve tightened monetary policy to combat inflation after the pandemic, SVB was left with insufficient capital to absorb the huge losses in its securities portfolio. Compounding SVB’s mismanagement of interest rate risk was its heavy reliance on uninsured deposits as a source of funding. When depositors realized that their uninsured deposits could suffer losses if the bank were to fail, they withdrew funds en masse from SVB, which eventually succumbed to the bank run.

The sudden collapse of SVB prompted market participants to scrutinize other banks’ exposure to interest rate risk. Because the sharp rise in interest rates was an economy-wide phenomenon that affected all banks, the potential for contagion could not be dismissed (Board of Governors 2023). At the end of 2022, the total unrealized losses in banks’ securities portfolios exceeded $600 billion (Board of Governors 2024).

While recognizing the unrealized capital losses is important in determining the economic solvency of a bank, it is equally important to recognize any hidden assets the bank can use to offset those losses. One of these hidden assets is the bank’s franchise value.

The value of bank franchise

Banks derive a franchise value from regulatory restrictions on entry and competition that add to the normal profit from banking activities. Moreover, banks are protected by a government-sponsored safety net that includes deposit insurance and access to the Federal Reserve discount window, while they are supervised by regulators.

Furthermore, at the micro level, banks produce information about borrowers’ creditworthiness and can use their proprietary information to profit from their lending relationship when a borrower may not be able to switch lenders easily. Borrowers in return may find a relationship lender more reliable in supplying credit. Banks gather deposits at below-market interest rates by providing safety, liquidity, and banking services to depositors—the so-called deposit franchise. The value of the deposit franchise can be determined by among other things, the extent of branch and ATM networks, online banking interfaces, and branding. The bank’s franchise value—the present value of all future excess profits—accrues to bank shareholders and is reflected in the bank’s stock price in an efficient capital market.

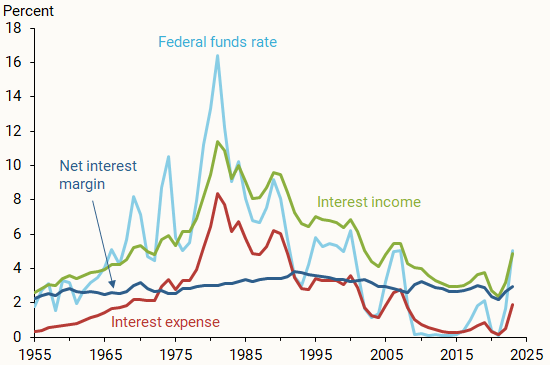

To show how the deposit spread between the market interest rate and the deposit rate moves with the level of interest rates, Figure 1 charts the federal funds rate and aggregate bank interest income, interest expense, and net interest margin from 1955 to 2023. Despite large movements in the federal funds rate (light blue line), especially during the 1970s and 1980s, banks’ interest expense (red line) has been less variable than the market interest rate and tracks banks’ interest income (green line) fairly well. As a result, banks’ net interest margin (dark blue line) has been remarkably stable over time, regardless of the level of market interest rates.

Figure 1

Bank interest income, expense, and net margin

Franchise value changes over time

Banks incur operating costs to maintain their deposit franchise. These include physical branches, ATM networks, bank employees, marketing, and various banking services to depositors. These costs are recurring and relatively stable compared with the level of interest rates. Thus, during the recent low interest rate periods when the federal funds rate was near its zero lower bound, the deposit franchise held little value, as banks profited little from low-cost deposits but continued to incur fixed operating costs. As interest rates rose after the pandemic, when the Federal Reserve tightened monetary policy to combat inflation, banks’ deposit franchise regained value when deposit rates climbed more slowly than market interest rates.

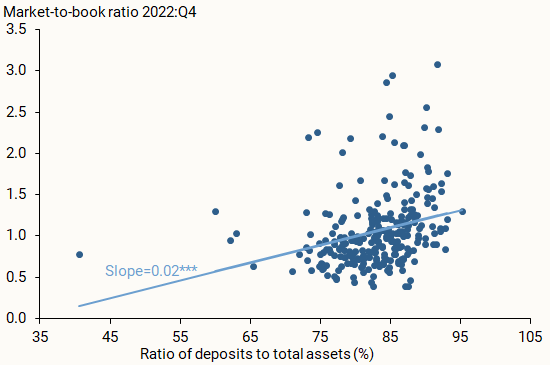

In a rising rate environment, investors value the ability of banks to use their deposit franchise to partially insulate themselves against higher funding costs. Figure 2 shows the relation between publicly traded banks’ market-to-book equity ratios and deposit-to-asset ratios. The market-to-book equity ratio measures the premium over book value that investors are willing to pay for owning bank stocks. The upward sloping fitted regression line in Figure 2 indicates that this market premium is positively related to deposit-to-asset ratios, which measure banks’ ability to gather low-cost deposits. This suggests that investors indeed value banks’ deposit franchise.

Figure 2

Market-to-book ratio versus deposit-to-asset ratio

Source: Bloomberg Call Report data.

The value of a bank franchise also changes with banking regulations. For example, entry restrictions to banking changed when interstate banking and universal banking regulations were relaxed, which altered the competitive landscape in banking markets and their associated profits. More broadly, banks were permitted to offer other services, including securities dealing, underwriting, and insurance, which gave banks new profit opportunities.

Beyond the bank balance sheet

While a bank’s franchise value is reflected in its stock price, it is an off-balance-sheet asset that is not recognized in the accounting statement nor by regulators. Thus, to determine the true economic value of a bank, we need to account for not only the unrealized losses in loans and securities but also the bank franchise value. However, the bank franchise value cannot be observed and must be estimated.

Looking at banks’ ability to gather deposits at below-market interest rates, Drechsler, Savov, and Schnabl (2023) estimated that the deposit franchise alone in the banking system was worth about $1.7 trillion as of 2023. This is comparable to their estimated $1.75 trillion of unrealized losses in loans and securities as a result of banks’ exposure to interest rate risk. To the extent that the deposit franchise accounts for only a portion of the total bank franchise value, the net effect on bank valuations due to rising interest rates would be small. Thus, bank franchise value can provide stability for the banking system amid a volatile interest rate environment.

Some additional insights are important to note. A banking franchise is valuable when a bank is expected to continue operating indefinitely. When a bank fails, its ability to earn profits disappears, rendering the franchise worthless.

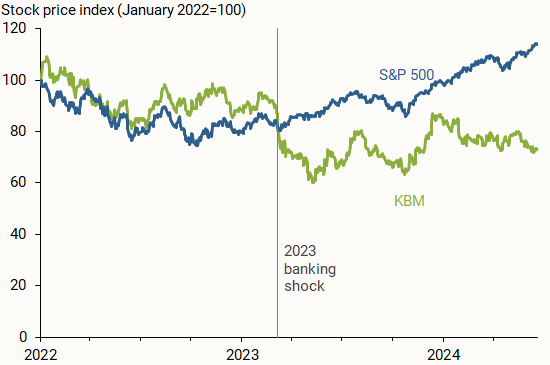

Figure 3 compares the Keefe, Bruyette & Woods (KBW) bank stock price index (green line), reflecting how investors value banking firms, with the Standard & Poor’s (S&P) 500 index (blue line), reflecting overall valuation. We show data from 2022 through July 2024, indexed to 100 at the beginning of 2022 for ease of comparison.

Figure 3

Bank stocks relative to overall stock performance

When interest rates rose rapidly in 2022, bank stocks outperformed the broad stock market in part because investors valued the deposit franchise in a rising interest rate environment. Following the demise of SVB in March 2023, bank stocks plummeted and continued to lag the broad stock market. This likely reflects the fragility of the bank franchise as perceived by market participants, taking the possibility of bank runs into consideration.

Precisely because a bank loses its franchise value upon failure, bank franchise value therefore could discourage bank risk-taking. In theory, banks should take on less risk to avoid losing their valuable franchise. This role of franchise value to maintain a disciplined approach to bank risk provides yet another source of stability in the banking system (Demsetz, Saidenberg, and Strahan 1996).

Conclusions

Banks were exposed to interest rate risk when interest rates increased rapidly in 2022-23, with some banks incurring significant losses in their asset portfolios. The losses at some banks were so large that depositors ran, especially uninsured depositors. In this Letter, we consider how the value of bank franchise, which is unrecognized in bank balance sheets, can hedge against banks’ exposure to interest rate risk if depositors choose not to withdraw their funds. Thus, banks’ franchise value can be a stabilizing force in a rising interest rate environment. Moreover, to the extent that a bank loses its valuable franchise upon failure, bank franchise value could help guard against bank risk-taking.

References

Barr, Michael S. 2023. Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank. Board of Governors of the Federal Reserve System.

Board of Governors of the Federal Reserve System. 2023. Financial Stability Report – May 2023.

Board of Governors of the Federal Reserve System. 2024. Financial Stability Report – April 2024.

Demsetz, Rebecca S., Marc R. Saidenberg, and Philip E. Strahan. 1996. “Banks with Something to Lose: The Disciplinary Role of Franchise Value.” FRB New York Economic Policy Review 2(2, October), pp. 1-14.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl. 2021. “Banking on Deposits: Maturity Transformation without Interest Rate Risk.” Journal of Finance 76(3, June), pp. 1,091–1,143.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl. 2023. “How to Value the Deposit Franchise.” Memorandum, New York University.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org