Inflation still lies somewhat above the Federal Reserve’s 2% goal after slowing significantly since its spring 2022 peak. Analysis shows that two labor market indicators—the ratios of job vacancies to unemployed workers and of vacancies to effective job seekers—are particularly informative in determining excess demand’s impact on recent inflation. The measures suggest that declines in excess demand pushed inflation down almost three-quarters of a percentage point over the past two years. However, elevated demand continued to contribute 0.3 to 0.4 percentage point to inflation as of September 2024.

The well-known Phillips curve explains the relationship between inflation and unemployment—specifically that inflation is high when overall demand exceeds overall supply. With current inflation still somewhat above the Federal Reserve’s 2% goal, it is plausible that excess demand remains in the economy. Our prior research found that labor market tightness as measured by the ratio of job vacancies to unemployment (V–U ratio) outperformed other common measure of excess demand in forecasting inflation (Barnichon and Shapiro 2022).

In this Economic Letter, we assess the impact of excess demand on inflation through the lens of the V–U ratio. The V–U ratio captures labor market tightness and serves as a gauge of the overall “temperature” of the economy: As the economy heats up, businesses struggle to find workers, prompting them to raise wages and prices. Our analysis also incorporates a more comprehensive measure, the vacancy-to-effective searchers ratio (V–S), developed by Abraham, Haltiwanger, and Rendell (2020). This measure goes beyond the unemployed by including people outside the labor force who want jobs as well as employed individuals looking to switch jobs. We find that the V–S ratio is even more effective than the standard V–U ratio in forecasting inflation.

Our estimates using these two ratios imply that excess demand peaked in the first quarter of 2022, contributing between 0.75 and 1.15 percentage points to inflation. Both ratios have declined since their 2022 peak, indicating that excess demand has eased over the past two years. However, as of September 2024, both ratios implied that excess demand was still contributing between 0.3 to 0.4 percentage point to inflation.

Different measures of excess demand

We focus on three measures of labor market tightness as proxies for excess demand. First, we use the unemployment rate as our baseline measure since it is commonly used in estimating the Phillips curve. It represents the number of nonemployed people actively looking for work relative to the size of the labor force. A drawback of using the unemployment rate to measure labor-market tightness, and hence excess demand, is that it focuses narrowly on the supply of one set of available workers. It does not directly account for employers’ demand for labor or, more specifically, their marginal cost of labor—the cost of hiring an additional worker.

Our second measure is the V–U ratio, which serves as a more accurate proxy of hiring costs because it reflects the challenges of hiring when labor demand is high or the supply of available workers is low. The V–U ratio also accounts for changes in how easily individuals can find and match with potential employers. A decline in this matching efficiency would require employers to post more vacancies for a given number of job seekers.

Our third measure is the V–S ratio developed by Abraham, Haltiwanger, and Rendell (2020). This measure broadens the set of available workers to account for individuals who want a job but either already have one or are not currently in the labor force. Previous research shows that individuals in the latter group tend to return to the labor market as active job seekers when economic conditions improve (Hobijn and Şahin 2021). Furthermore, as economic conditions improve, a larger share of workers may choose to switch jobs for higher wages.

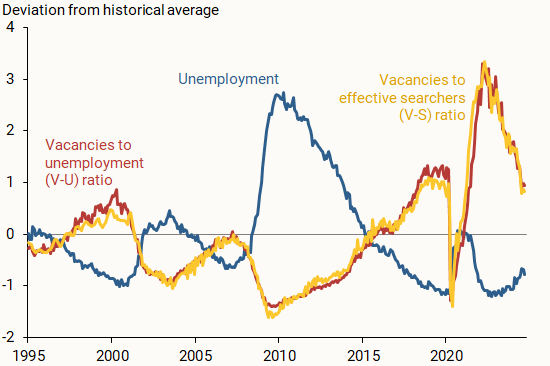

Figure 1 illustrates these three measures over the past 30 years. Since unemployment (blue line) captures labor market slack while the V—U and V—S ratios (gold and red lines) capture labor market tightness, the series move in opposite directions. While all three indicate that demand for labor has softened over the past two years, it remained relatively strong. As of September 2024, the unemployment rate was well below its historical average, and the V–U and V–S ratios were both well above historical levels. While unemployment stayed relatively constant over the past two years—increasing just 0.5 percentage point—the V–U and V–S ratios both declined significantly. Crust, Lansing, and Petrosky-Nadeau (2024) conclude that this sizable drop in the V–U ratio, spurred by a decline in job vacancies, contributed to the recent decline in inflation. This tighter link with inflation suggests that the V–U or V–S ratios may be more informative about excess demand than the unemployment rate.

Figure 1

Measures of labor market tightness, 1995–2024

Source: Bureau of Labor Statistics, Abraham et al. (2020), and authors’ calculations.

Which measure of excess demand best predicts inflation?

As in Barnichon and Shapiro (2024), we assess which measure of excess demand best predicts inflation. For each measure, we run 10-year rolling-window regressions, repeatedly estimating the same Phillips curve specification but with a different 10-year sample each time. The first window begins in the first quarter of 1995 and ends in the first quarter of 2005. This generates inflation predictions one year ahead—for the first quarter of 1996 in this case. The difference between this prediction and the actual value reported for that date is the forecast error. We then roll the data window forward one quarter and repeat the process, constructing another forecast error. Our final sample window covers January 2015 to September 2024. We then calculate the squared values of the forecast errors across all the windows. The larger the mean-squared errors, the further away the predictions of one-year-ahead inflation were, on average, from actual values.

We find that both the V–U and V–S ratios provide more accurate estimates than the unemployment rate. The V–S ratio does slightly better, with a mean-squared error of 0.85, compared with 0.90 for the V–U ratio. These results corroborate previous findings that the V–U ratio outperforms numerous other tightness measures including the output gap in predicting future inflation (Barnichon and Shapiro 2022). However, our results that the V–S ratio performs even better reveal the importance of accounting for all effective job seekers beyond unemployed individuals.

Estimating the Phillips curve

The V–U and V–S measures are effective at forecasting future inflation. However, this may be because they are correlated with other factors that drive inflation, rather than directly causing it. Namely, supply-side factors—such as changes in energy prices, weather conditions, or supply-chain disruptions—could be influencing inflation alongside excess demand. In other words, one might mistakenly attribute higher inflation to excess demand rather than to supply-side factors.

To explore the relationship between labor market tightness and inflation, we estimate the Phillips curve using the San Francisco Fed’s cyclical core personal consumption expenditures inflation measure (Shapiro 2022). This measure includes only categories with prices that are highly responsive to the overall business cycle. It excludes categories where prices tend to be driven by industry-specific or supply-related factors. Since the cyclical inflation measure is calibrated using pre-2007 data, we estimate the Phillips curve using post-2006 out-of-sample data to avoid any biases associated with the measure’s construction.

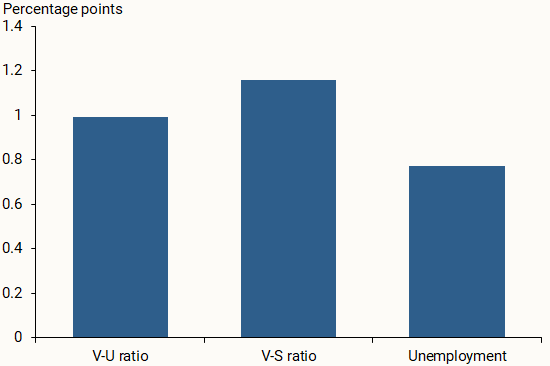

The estimates in Figure 2 show the impact of a one-standard-deviation change in the tightness measure on inflation. The larger estimates for the V–U and V–S ratios indicate that they have more explanatory power for inflation fluctuations than the unemployment rate. Specifically, a one-standard-deviation increase in the V–U ratio raises cyclical core inflation by 1.0 percentage point, while the same size decline in the unemployment rate raises inflation by only 0.8 percentage point. The V–S ratio has an even larger effect—a one-standard-deviation increase raises inflation by 1.2 percentage points. These results imply that changes in the V–U and V–S ratios cause larger movements in inflation than the unemployment rate.

Figure 2

Phillips curve relationship estimates

Source: Bureau of Labor Statistics, Abraham et al. (2020), and authors’ calculations.

How much has excess demand contributed to inflation recently?

Next, we use our estimates of the causal effects of tightness, or excess demand, on inflation to help understand the recent evolution of inflation. In particular, we use the estimates from Figure 2 to estimate how much of the recent decline in inflation can be attributed to reductions in excess demand.

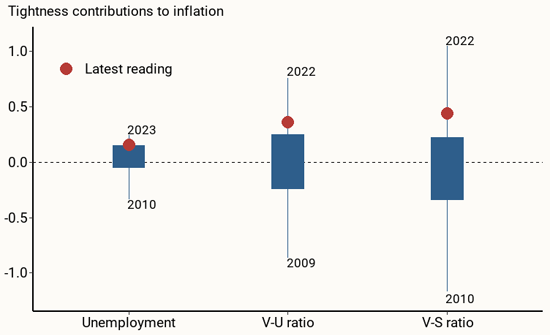

Figure 3 shows the contribution of labor market tightness as measured by the unemployment rate and the V–U and V–S ratios to excess inflation over 1995–2024. Labor market tightness had its strongest impact in 2022 and 2023. By contrast, relatively loose labor markets during the financial crisis in 2009 and during 2010 pushed inflation down.

The figure highlights that the V–U and V–S ratios explain a much larger portion of the variance of inflation than the unemployment rate. At their peak in the first quarter of 2022, the V–S ratio and V–U ratios implied that labor market tightness contributed 0.75 and 1.15 percentage points to inflation, respectively. At their low points, implied labor market looseness reduced inflation by 0.86 percentage point for the V-U ratio in 2009 and 1.16 percentage points for the V-S ratio in 2010. By contrast, the unemployment rate explains a much smaller share of inflation movements since 1995.

The red dots in Figure 3 show the contributions to inflation as of the latest data, corresponding to September 2024. The latest V–U ratio indicates that labor market tightness is contributing 0.4 percentage point, while the V–S ratio implies the contribution is 0.6 percentage point. The estimates imply that excess demand, measured by labor market tightness, is contributing significantly less to inflation now than it was two years ago. However, it is still contributing to elevated inflation levels.

Figure 3

Contributions of labor market tightness to inflation

Source: Bureau of Labor Statistics, Abraham et al. (2020), and authors’ calculations.

Conclusion

Our analysis in this Letter shows that the V–U and V–S ratios are better measures for explaining inflation dynamics than the unemployment rate—a traditional measure of demand. Estimates using these measures imply that excess demand peaked in the first quarter of 2022, and both measures have declined since. As of September 2024, the V–U and V–S ratios implied that excess demand was lower but continued to contribute 0.4 to 0.6 percentage point to inflation. Our results imply that fluctuations in overall demand have played a significant role in explaining inflation dynamics over the recent inflation surge.

References

Abraham, Katharine G., John C. Haltiwanger, and Lea E. Rendell. 2020. “How Tight Is the U.S. Labor Market?” Brookings Papers on Economic Activity 2020(1), pp. 97–165.

Crust, Erin E., Kevin J. Lansing, and Nicolas Petrosky-Nadeau. 2023. “Reducing Inflation along a Nonlinear Phillips Curve.” FRBSF Economic Letter 2023-17 (July 10).

Barnichon, Regis, and Adam Hale Shapiro. 2022. “What’s the Best Measure of Economic Slack?” FRBSF Economic Letter 2022-04 (February 22).

Barnichon, Regis, and Adam Hale Shapiro. 2024. “Phillips Meets Beveridge.” FRB San Francisco Working Paper 2024-22.

Hobijn, Bart, and Ayşegül Şahin. 2021 “Maximum Employment and the Participation Cycle.” NBER Working Paper 29222.

Shapiro, Adam Hale. 2020. “A Simple Framework to Monitor Inflation.” FRB San Francisco Working Paper 2020-29.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org