Inflation has remained at levels well above the Federal Reserve’s inflation goal of 2% for over a year. Separating the underlying data from the personal consumption expenditures price index into supply- versus demand-driven categories reveals that supply factors explain about half of the run-up in current inflation levels. Demand factors are responsible for about one-third, with the remainder resulting from ambiguous factors. While supply disruptions are widely expected to ease this year, this outcome is highly uncertain.

Inflation declined rapidly at the onset of the pandemic in the spring of 2020 before taking a dramatic turn upward in early 2021, rising to levels that remain well above the Federal Reserve’s longer-run goal of 2% on average. Researchers and policymakers have pointed to both supply and demand factors as being responsible for elevated inflation. For instance, Barnichon and Shapiro (2022) showed the impact of supply-related factors such as labor shortages, while Barnichon, Oliveira, and Shapiro (2021) and Jordà et al. (2022) demonstrated the importance of heightened demand stemming from pandemic-related fiscal relief. The extent to which either supply or demand factors are responsible for higher inflation levels has important implications for monetary policy. As Fed Chair Powell stated in a recent interview, “What [the Fed] can control is demand, we can’t really affect supply with our policies…so the question whether we can execute a soft landing or not, it may actually depend on factors that we don’t control” (Marketplace 2022).

In this Economic Letter, I quantify and track the impact of supply- and demand-related factors on personal consumption expenditures (PCE) inflation. Similar to the methodology introduced in Mahedy and Shapiro (2017), and outlined in Shapiro (2022), I assess inflation rates by spending category. I divide categories in the PCE basket into supply- and demand-driven groups. Demand-driven categories are identified as those where an unexpected change in price moves in the same direction as the unexpected change in quantity in a given month; supply-driven categories are identified as those where unexpected changes in price and quantity move in opposite directions. This methodology accounts for the evolving impact of supply- versus demand-driven factors on inflation from month to month. To help monitor these changes, the San Francisco Fed has launched a new Supply- and Demand-Driven PCE Inflation data page with monthly data updates.

My analysis highlights that both supply and demand factors are responsible for current elevated inflation levels. Supply factors explain about half of the difference between current 12-month PCE inflation and pre-pandemic inflation levels, and the effects appear to be rising more recently. Demand factors are responsible for about a third of the difference, and those effects appear to be diminishing more recently. The remainder is due to factors that cannot be definitively labeled as supply or demand. The large impact of supply factors implies that inflationary pressures will not completely subside until labor shortages, production constraints, and shipping delays are resolved. Although supply disruptions are widely expected to ease this year, this outcome is highly uncertain.

Separating supply and demand drivers

This analysis uses the more than 100 goods and services categories in the PCE index. For each month of data, I separate the categories where prices moved due to a change in demand from those where prices moved due to a change in supply. To do so, I rely on simple microeconomic theory: Shifts in demand move both prices and quantities in the same direction along the upward-sloping supply curve, meaning prices rise as demand increases. Shifts in supply move prices and quantities in opposite directions along the downward-sloping demand curve, meaning prices rise when supplies decline.

Each month I estimate the changes in the price level and quantity level of each category. It is important to isolate the unexpected components of the changes in prices and quantities, as opposed to the simple change itself. This is because prices and quantities generally continue an existing trend. These expected trend components are not likely to represent a shift in demand or supply, but instead reflect longer-run factors such as technological improvements, cost-of-living adjustments to wages, or demographic changes like population aging.

Extracting the unexpected components of the monthly changes in price and quantity for each category is an iterative process. I run 10-year-window rolling regressions for both price and quantity. For example, the first window begins in January 1988, the first period PCE data are available at the detailed level, and ends in December 1997. This generates predicted values for price and quantity in January 1998, which I then compare to the actual values of price and quantity in that same month. If the actual values of price and quantity are both above or both below their predicted values, the category is labeled as “demand-driven” in January 1998. If the difference between the actual and predicted values are of opposite signs, the category is labeled as “supply-driven” in that month. If either of the actual values is close enough to its predicted value that the difference is statistically indistinguishable from zero, the category is labeled as “ambiguous” in that month. I then roll the data window forward one month and repeat the process. I iterate this process for each month until I reach the last window of data, which for this Letter begins in May 2012 and ends in April 2022.

Categories that experience frequent supply-driven price changes include food and household products such as dishes, linens, and household paper items. Categories that experience frequent demand-driven price changes include motor vehicle-related products, used cars, and electricity. However, assessing the past two years of data reveals some changes in which categories experienced demand and supply shocks in the post-pandemic period. Specifically, categories with extraordinarily frequent supply-driven price changes in 2021 and 2022 include products with known supply constraints during the pandemic, such as new automobiles, fuel, and repair services. Categories with extraordinarily frequent demand-driven price changes during this period include many goods consumed at home—for example, furniture, clothing, toys, video equipment, and cookware—as well as services related to reopening from pandemic-related closures, such as restaurants and museums.

Figure 1 shows the contributions to 12-month headline PCE inflation from supply- (green) and demand-driven (blue) inflation between 1998 and 2022. Yellow sections show the ambiguous portion of PCE inflation that is not labeled as either demand or supply driven. I calculate the monthly contributions to inflation by multiplying the change in price for a given category by its most recent respective weight in the PCE index. The monthly contributions for demand-driven, supply-driven, and ambiguous categories are then calculated as the sum of contributions from all items within that category. The contributions for demand-driven and supply-driven inflation are then calculated as the 12-month trailing sum of their respective monthly contributions. This generates a series that can be directly compared to the year-over-year PCE inflation rate.

Figure 1

Supply-driven and demand-driven contributions to year-over-year PCE inflation

Note: Data available at Supply- and Demand-Driven PCE Inflation. Gray shading indicates NBER recession dates.

The changes in patterns over time show some intuitive dynamics. The contribution of demand-driven factors to headline PCE inflation declines during recessions. The collapse in airline travel immediately after September 11, 2001, is labeled as demand-driven and the sharp energy price declines in 2014 and 2015 are identified as supply-driven.

Inflation drivers over the pandemic period

To get a sense of whether supply or demand factors are responsible for current elevated inflation levels, I compare current supply- and demand-driven inflation to their average levels from the 10 years before the pandemic. During the pre-pandemic period, PCE inflation averaged 1.5%, considerably below the April 2022 rate of 6.3%. Figure 2 compares the most recent contributions of supply-driven inflation in panel A and demand-driven inflation in panel B against their respective 2010–2019 averages. Supply-driven inflation is currently contributing 2.5 percentage points (pp) more than its pre-pandemic average, while demand-driven inflation is currently contributing 1.4pp more. Thus, supply-driven inflation explains a little more than half of the 4.8pp gap between current levels of year-over-year PCE inflation and its pre-pandemic average level. Demand factors explain a smaller share of elevated inflation levels, accounting for about one-third of the difference. The ambiguous category, which is not shown, explains the remainder of the difference.

Figure 2

Contributions of supply- and demand-driven factors to headline PCE inflation

Note: Gray shading indicates NBER recession dates.

Repeating the same exercise with core PCE inflation, which excludes historically volatile food and energy categories, results in somewhat similar patterns. However, supply and demand factors each explain about half of elevated core inflation levels. Specifically, supply- and demand-driven factors each explain about 45% of the 3.3pp gap between current levels of year-over-year core PCE inflation and its pre-pandemic average level. Monthly results of these contributions to core PCE inflation are available on the data page.

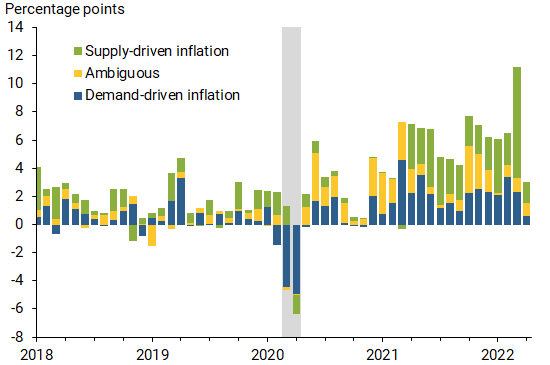

Finally, I assess the contributions to annualized monthly changes in headline PCE inflation. This provides a higher frequency depiction of how supply and demand factors affected inflation over the pandemic period. Figure 3 breaks down these contributions over past five years, showing the one-month changes used to construct the 12-month trailing sums shown in Figure 1.

Figure 3

Contributions to annualized monthly changes in inflation

Note: Gray shading indicates NBER recession dates.

The decline in inflation at the onset of the pandemic was driven by a decrease in demand factors, while the surge in inflation in March 2021 was mainly due to the increase in demand-driven factors. During this period the economy began to reopen from pandemic-related public health policies, and the American Rescue Plan enacted in March 2021 further stimulated demand factors. These factors began to slow in the summer of 2021 with an increase COVID-19 infections associated with the Delta variant, but demand reemerged in the fall as the Delta wave subsided.

Meanwhile, supply factors began to arise in April 2021, indicating a slightly delayed response from the economy reopening. Supply-driven inflation has remained elevated since then and has accelerated more recently. This acceleration is attributable to food and energy supply disruptions, including those associated with the invasion of Ukraine.

Conclusion

Analysis in this Letter shows that supply factors are responsible for more than half of the current elevated level of 12-month PCE inflation. This in part reflects supply constraints from continued labor shortages and global supply disruptions related to the pandemic and the war in Ukraine. While demand factors played a large role in the spring of 2021, they explain only about a third of recent elevated inflation levels. Factors that cannot be labeled as either demand or supply are also playing a nontrivial role.

These results showing that factors other than demand account for about two-thirds of recent elevated inflation highlight some risks for the economy. Because supply shocks raise prices and suppress economic activity, the prevalence of supply-related factors raises the risk of entering a period of low growth and elevated inflation levels. This risk depends crucially on how long labor shortages and global supply disruptions persist. While supply disruptions are widely expected to ease this year, this outcome is highly uncertain.

Adam Hale Shapiro is a vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Jordà, Òscar, Celeste Liu, Fernanda Nechio, and Fabian Rivera-Reyes. 2022. “Why Is U.S. Inflation Higher than in Other Countries?” FRBSF Economic Letter 2022-07 (March 28).

Barnichon, Regis, Luiz E. Oliveira, and Adam Hale Shapiro. 2021. “Is the American Rescue Plan Taking Us Back to the’60s?” FRBSF Economic Letter 2021-27 (October 18).

Barnichon, Regis, and Adam Hale Shapiro. 2022. “What’s the Best Measure of Economic Slack?” FRBSF Economic Letter 2022-04 (February 22).

Mahedy, Tim, and Adam Hale Shapiro. 2017. “What’s Down with Inflation?” FRBSF Economic Letter 2017-35 (November 27).

Powell, Jerome. 2022. “Inflation, Soft Landings and the Federal Reserve.” Interview by Kai Ryssdal, Marketplace Business News Podcast, NPR, May 12. Audio, 27:38.

Shapiro, Adam Hale. 2022. “A Simple Framework to Monitor Inflation.” FRB San Francisco Working Paper 2020-29.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org