Rising rents account for a significant portion of recent inflation. Estimates of how rent inflation typically responds to two leading indicators—current asking rents and current house prices—can help forecast the path of overall inflation for the next two years. This method predicts that higher rent inflation could add about 0.5 percentage point to personal consumption expenditures price inflation for both 2022 and 2023. These potential additions are important in light of the Federal Reserve’s 2% inflation target.

Shelter and housing costs account for a significant portion of the basket of goods used to measure inflation in the consumer price index (CPI) and the personal consumption expenditures price index (PCEPI). Two leading indicators of future shelter and housing costs are current asking rents and current house prices. These leading indicators have been rising rapidly since the pandemic began, posing the risk of higher future inflation. When asking rents rise, they push up the average rent of the entire stock of rental units as new contracts are signed and enter the database used to compute the rent component of overall inflation. When current house prices rise, they signal that owners or landlords expect the potential rental value of the house to be higher in the future.

In this Economic Letter, we develop an empirical model to predict future rent inflation using data on current asking rents and current house prices in 15 metropolitan statistical areas (MSAs). Our panel model predicts that future rent inflation could increase by about 3.4 percentage points (pp) in both 2022 and 2023 relative to the pre-pandemic five-year average. This prediction translates into an additional 1.1pp increase in overall CPI inflation for both 2022 and 2023. In terms of overall PCE inflation, the measure used by the Federal Reserve to assess price stability, our prediction translates into an additional 0.5pp increase for both 2022 and 2023. The smaller predicted additions for PCE inflation reflect the fact that housing costs make up a smaller fraction of the basket of goods in the PCEPI than in the CPI.

Rent inflation

“Rent of primary residence,” hereafter simply “rent,” measures the price of the current stock of rental units across U.S. cities. Rent is a component of the broader “shelter” and “housing” categories in the CPI and PCEPI, respectively. The other major component of these categories is “owner’s equivalent rent” (OER), which estimates the monthly rent a house that is currently owned would command on the rental market. OER is computed by the Bureau of Labor Statistics using the same underlying data as rental units but with an alternative formula to estimate the equivalent rent of owner-occupied units. The percentage change in rent, which we refer to as “rent inflation,” is highly correlated with the percentage change in OER; the correlation coefficient between 12-month rent inflation and 12-month OER inflation is 0.83. While the CPI and the PCEPI use the same underlying data on rental units, the combination of rent and OER comprises 32% of the basket of goods in the CPI but only 15% of the PCEPI consumption basket.

Figure 1 plots the 12-month rent inflation component of the CPI (blue line) from December 1988 to December 2021. Rent inflation declined substantially during 2020 as the economy was hit by a severe recession induced by the COVID-19 pandemic. More generally, rent inflation is highly procyclical, showing a strong positive correlation with the inverse of the unemployment rate (red line). The intuition for this procyclical relationship is that landlords can ask for higher rents during an economic expansion, when prospective tenants are more likely to be employed and earning higher incomes. Rent inflation bottomed out in early 2021 at 1.8% and has since rebounded to 3.3% in December 2021, just below the pre-pandemic five-year average of 3.7% from 2015 to 2019.

Figure 1

Rent inflation correlates strongly with inverse of unemployment

Leading indicators of rent inflation

The asking rents of new units currently listed on the market can provide useful information about future rental rates. Persistent increases in asking rents will eventually push up the average rent of the entire stock of units on the market, which in turn feeds into the rent component of the CPI or the PCEPI. Movements in asking rents can therefore help forecast future rent inflation and future overall inflation.

The Zillow Observed Price Rent Index tracks the asking rents of new rental units currently listed on the market, based on Zillow’s database of rental properties. This index can be used to calculate an inflation rate for asking rents. Figure 2 plots the 12-month rent inflation component of the CPI in each of 15 MSAs along the vertical axis and the 1-year lagged Zillow asking rent inflation for the same MSA along the horizontal axis, using data from January 2014 to December 2021. The figure shows that current rent inflation is positively correlated with lagged asking rent inflation, indicating that MSAs with higher observed asking rent inflation in one year are more likely to have higher rent inflation over the following year.

Figure 2

Lagged Zillow asking rent inflation predicts CPI rent inflation

Research shows that movements in current house prices can also help forecast future rent inflation and future overall inflation (Brescia 2021, Zhou and Dolmas 2021). According to economic theory, the current price of a house should be linked to the present discounted value of the future service flows or rent payments that an owner or landlord could expect from the house. The Zillow Home Value Index tracks the typical house price in a given MSA, based on recent sales of comparable properties. Similar to Figure 2, current CPI rent inflation is positively correlated with 1-year lagged Zillow house price inflation, indicating that MSAs with higher Zillow house price inflation in one year are more likely to have higher rent inflation over the following year. However, this relationship is a bit weaker than the relationship with Zillow asking rent inflation shown in Figure 2.

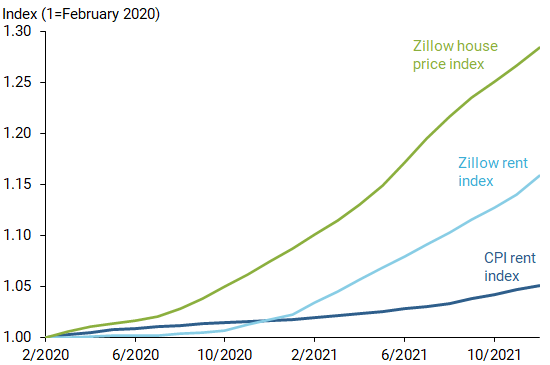

Figure 3 plots the cumulative growth in the Zillow rent and house price indexes together with the CPI rent index since February 2020, the month before the onset of the COVID-19 pandemic in the United States. Zillow’s rent index is up 15.9% over the past 23 months while Zillow’s house price index is up 28.4%. In contrast, the CPI rent index is up only 5.0% over the same period. Given that current asking rents and current house prices are leading indicators of future rents, the pattern in Figure 3 suggests some risk that the CPI rent index could rise faster, which in turn would push up future overall inflation.

Figure 3

Asking rents, house prices up by more than CPI rent index

Predicting future inflation using asking rents and house prices

We use monthly data on asking rents and house prices from 15 MSAs to predict the path of future CPI rent inflation in the same MSAs over the subsequent 24 months. The data cover the period from January 2014 to December 2021. The prediction model considers how an individual MSA’s change in CPI rent inflation over various future horizons relates to the most recent 12-month percentage changes in Zillow asking rents and Zillow house prices for the same MSA. To isolate the predictive impact of asking rents and house prices, we account for numerous time-varying MSA-specific factors such as rent inflation trends, vacancy rates, and unemployment rates. We include time fixed effects, which account for factors that are common across all MSAs, such as the 30-year mortgage interest rate and the overall CPI inflation rate. We also include MSA fixed effects which account for factors that are common within an MSA but remain fairly constant over time, such as differences in housing variety or population density.

Our model confirms that an increase in current asking rents or current house prices can push up the CPI rent index for a typical MSA for as long as 24 months into the future. Given the currently elevated levels of Zillow asking rent inflation and Zillow house price inflation averaged across all MSAs, the model predicts that CPI rent inflation will increase by about 3.4pp for both 2022 and 2023, relative to its historical average rate of 3.7%. The model predicts a similar path for future OER inflation, but this prediction is less precise.

We can translate the model’s predicted path for future rent inflation into a predicted impact on future overall inflation by using the weights that the CPI or PCEPI assign to rent and OER. In so doing, we assume that the predicted paths for future rent inflation and future OER inflation are identical. Applied to CPI inflation, our results imply an additional increase of 1.1pp for both 2022 and 2023. Applied to PCE inflation, which is the measure used by the Federal Reserve to gauge its 2% inflation target, our results imply an additional increase of 0.5pp for both 2022 and 2023. Before the pandemic, PCE inflation historically averaged about 0.5pp below CPI inflation when measured on a 12-month basis.

Figure 4 reports the separate predicted contributions to future PCE inflation coming from either rising asking rents or rising house prices for both 2022 and 2023. By construction, the two implied contributions are independent of one another, meaning that they represent two distinct causal effects. The impact of changes in asking rents on future PCE inflation is stronger in 2023 than in 2022, reflecting the long time that it takes for movements in asking rents to flow through to movements in the average rent of the entire stock of rental units in U.S. cities. In contrast, changes in house prices affect future PCE inflation over a shorter time horizon, with nearly all of the impact occurring in 2022. These results show that changes in asking rents have a much more persistent impact on future PCE inflation than do changes in house prices. As a caveat, it should be noted that the model predictions about future inflation plotted in Figure 4 are based solely on past observed movements in asking rents and house prices; we do not try to take into account the effects of possible future monetary policy actions or movements in other macro variables in 2022 and 2023.

Figure 4

Impact of asking rents, house prices on future PCE inflation

Conclusion

As the U.S. economy recovers from the effects of the COVID-19 pandemic, some increase in rent inflation should be expected, given that landlords can ask for higher rents when prospective tenants are employed and earning higher incomes. However, the extraordinarily large increases in two leading indicators of future rent inflation—asking rent inflation and house price inflation—point to significant upside risks to the overall inflation outlook. The potential increases are particularly significant for CPI inflation, which places a larger weight on shelter costs. Still, the potential additions to PCE inflation of about 0.5pp for both 2022 and 2023 are important to consider in light of the Federal Reserve’s 2% inflation target.

Kevin J. Lansing is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Luiz E. Oliveira is a senior associate economist in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Adam Hale Shapiro is a vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Brescia, Eric. 2021. “Housing Insights: Housing Poised to Become Strong Driver of Inflation.” Fannie Mae Research Publication (June 9).

Zhou, Xiaoqing, and Jim Dolmas. 2021. “Surging House Prices Expected to Propel Rent Increases, Push Up Inflation.” FRB Dallas Economics (August 24).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org