Financial market discipline, in the form of movements in yields charged on sovereign debt of emerging economies, during the 2021 onset of U.S. monetary policy tightening depended heavily on domestic economic conditions. This pattern matches yield movements during the 2013 taper tantrum. The pattern suggests that, while advanced economy policies can influence emerging market financial conditions, domestic policies such as government spending levels are also important. However, the differing responses for pandemic-related spending versus the overall current account suggest that markets distinguished between needed COVID-19 fiscal support and other spending.

In May 2013, Federal Reserve Chair Ben Bernanke suggested that the Federal Reserve could begin to tighten its accommodative monetary policy stance earlier than financial markets expected. The announcement was followed by a disruptive reversal of capital investments away from emerging market economies (EMEs) and towards advanced economies. Yield spreads on EME assets, such as local and sovereign bonds, also widened dramatically in an incident referred to as the taper tantrum.

This incident illustrates a common pattern of investment flows among open market economies. Before tightening episodes, easy monetary policies among advanced economies lower global interest rates. This encourages investors to move their money abroad to earn higher yields on EME assets, which are typically considered riskier than assets in advanced economies. Those capital movements often reverse when global interest rates return to normal as advanced economies remove monetary accommodation.

Abrupt reversals of capital investment away from EMEs, commonly referred to as sudden stops, have often proved disruptive. Some researchers have argued that the volatility of capital flows during periods of sharp interest rate movements left EME policymakers with an undesirable choice between independent monetary policies or closed capital accounts to limit domestic volatility (Rey 2015). In a 2013 speech, then-Fed Governor Jerome Powell examined the taper tantrum and concluded that, while the imminent removal of U.S. accommodative policy likely played a role, the degree to which an EME faced global market discipline in the form of increased yields on sovereign debt was strongly influenced by its domestic conditions. Powell showed that lower market capital flows across EMEs during the taper tantrum were systematically related to “large current account deficits, high inflation, and fiscal problems” (Powell 2013). In other words, the relative impact of the policy shock across EMEs depended on how well a country had maintained its domestic economic fundamentals. Other research has found similar patterns for EME bank lending during that period (see, for example, Avdjiev and Takáts 2014).

In this Economic Letter, we reassess the role played by local EME fundamentals in their vulnerability to U.S. monetary policy tightening, focusing on the recent post-pandemic tightening episode. While the recent policy tightening was not as disruptive as the 2013 taper tantrum, U.S. Treasury yields rose rapidly, which likely prompted investors to pull away from the higher yields of presumably riskier EME assets. We use this episode to evaluate whether domestic policy in EMEs continues to play a role in how vulnerable they are to U.S. monetary policy shocks.

The onset of policy tightening

We take the September 22, 2021, Federal Open Market Committee (FOMC) meeting as the timing of the onset of removal of policy accommodation. The statement following that meeting said that the Federal Reserve had made progress towards its maximum employment and price stability goals, and that, if “progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.” The announcement was widely taken as an indication that the accommodative monetary policy stance the Federal Reserve had followed since the onset of the COVID-19 pandemic was ending.

The September 2021 announcement was followed by additional announcements and statements by policymakers that initiated the process of policy tightening and simultaneously reinforced beliefs that policy tightening was forthcoming. These included several incremental reductions in the pace of asset purchases, followed by the liftoff of the federal funds rate from the zero lower bound. Over this roughly half-year period, financial conditions significantly tightened. For example, one-year and two-year U.S. Treasury rates rose approximately 1.5 and 2.0 percentage points, respectively. Similarly, the yield spread on Moody’s Seasoned Baa Corporate Bonds relative to the 10-year U.S. Treasury rose approximately 0.5 percentage point.

Market discipline of EME current account deficits

To evaluate the global market response to the onset of policy tightening in the United States, we examine changes in yields on 10-year government bonds for 16 EMEs over the half year following the September 2021 announcement. We select our sample from the set of countries that have data for 10-year domestic currency sovereign bonds available on the Bloomberg trading facility. We exclude Turkey, Ukraine, and Russia, which had crises leading to outlier investment changes, and offshore financial centers. Our proxy for the degree of market discipline is the cumulative changes in yield spreads between an EME’s bonds and U.S. Treasuries of the same maturity over the fourth quarter of 2021 and the first quarter of 2022. These movements are related to changes in market perceptions of the relative attractiveness of EME assets following the U.S. policy changes.

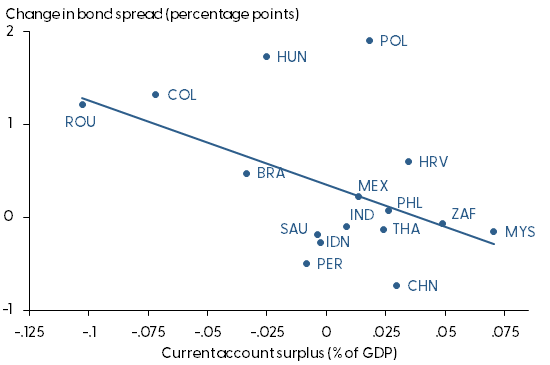

Following the methodology of Powell (2013), we plot the changes in 10-year bond yield spreads against cumulative current account deficits experienced by our sample of EMEs before the Fed’s announcement from the first quarter of 2020 through the fourth quarter of 2021.

Our results in Figure 1 show a strong negative relationship between national current account deficits before the onset of the Fed’s monetary policy tightening and the market discipline experienced by those countries after the onset of policy tightening. A regression line fitted to the sample reveals that a one-standard-deviation increase in national current account deficits was associated with an increase of 0.4 percentage point in the 10-year government bond yield spreads over the first half year after the onset of policy tightening.

Figure 1

EME current accounts vs. long-term bond spreads

Source: International Monetary Fund Balance of Payments and Bloomberg.

Our results confirm that the relationship Powell (2013) demonstrated for the taper tantrum is still prevalent. Our estimates indicate that this relationship also is statistically significant at a 95% confidence level. While the onset of recent U.S. monetary policy tightening restricted global financial conditions and raised the cost of borrowing externally on average for EMEs, countries maintained considerable ability to influence their individual terms through domestic economic conditions. The countries that retained positive current account balances tended to have lower changes in bond yield spreads than countries with current account deficits. To the extent that those fundamentals could be influenced by domestic policy, EMEs retained autonomy in their capacity to influence their borrowing conditions.

Adjustment for the pandemic

An important distinction between the tightening episodes in 2013 and 2021 is that the more recent one directly followed a devastating global pandemic. The pandemic curtailed the degree of policy discretion that EME countries enjoyed in the period before the United States began tightening its monetary policy. Because much economic activity was shut down at the onset of the pandemic to address health concerns, many components of U.S. government spending associated with keeping businesses viable through this difficult episode were necessarily focused on health and social welfare policies.

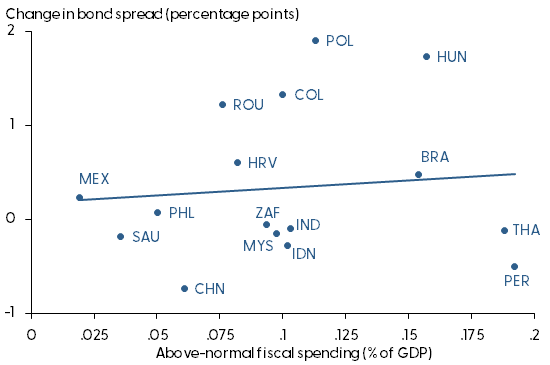

As such, investors may have viewed EME spending associated with addressing the challenges raised by the pandemic with more lenience. To investigate this, we compare the same movements in bond spreads at the onset of tightening with total fiscal spending related to COVID-19 as a percent of each country’s GDP. We use GDP numbers from the International Monetary Fund’s Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic. As Aizenman, Jinjarak, and Spiegel (2023) discuss, this measure reports above-normal spending to health and nonhealth sectors, while excluding accelerated spending and deferred revenue from country budget plans. We view this measure as an indicator of government discretionary measures associated with the COVID-19 pandemic.

Figure 2 plots this measure against movements in bond spreads after the onset of monetary policy tightening, again over the half year including the fourth quarter of 2021 and the first quarter of 2022. Unlike the pattern for current account deficits in Figure 1, we find no significant relationship between reported extraordinary pandemic-related fiscal spending and changes in 10-year bond spreads over the half year following the onset of tightening. We conclude that movements in global markets distinguished between needed pandemic-related spending and overall deficits when pricing EME assets.

Figure 2

EME extraordinary COVID-19 spending vs. bond spreads

Source: International Monetary Fund and Bloomberg.

Conclusion

Our results in this Letter confirm that the pattern found by Powell (2013) for the relationship between market discipline during U.S. monetary policy-tightening episodes and previous behavior as proxied by current account deficits for the 2013 policy-tightening period continues to hold. These results suggest that, while financial conditions faced by emerging market economies are influenced by advanced economy monetary policies, EMEs still have substantial power to shape their conditions by pursuing policies that leave local fundamentals more attractive to foreign investors when tightening does occur.

Because the global situation during the pandemic differed from the policy tightening that began in 2013, we also found limits to the degree of market discipline faced by EMEs. The pandemic caused governments to shut down many local businesses to pursue health-care goals. It is therefore less clear whether increased fiscal deficits during this period indicated poor policy. As such, it is not surprising that, while we find markets disciplining countries that ran large current account deficits, we do not see such discipline being applied to COVID-related extraordinary fiscal spending during the pandemic.

One qualification of our findings is that the extraordinary pandemic-related fiscal spending likely was influenced by the capacity of countries to pursue such spending. As such, the lack of a relationship between above-normal spending and market discipline during the recent tightening period may be attributable to countries spending less because they lacked fiscal space. Similarly, large current account deficits that call into question future financial conditions even before the onset of monetary policy tightening may indicate deeper structural problems with emerging economies. Those structural problems, rather than policies pursued during the period before U.S. policy tightening, may be driving the patterns we found in the data.

References

Aizenman, Joshua, Yothin Jinjarak, and Mark M. Spiegel. 2023. “Fiscal Capacity and Commercial Bank Lending under COVID-19.” Journal of the Japanese and International Economies 68 (101261).

Avdjiev, Stefan, and Elöd Takáts. 2014. “Cross-Border Bank Lending during the Taper Tantrum.” BIS Quarterly Review, September 14.

Powell, Jerome H. 2013. “Advanced Economy Monetary Policy and Emerging Market Economies.” In Prospects for Asia and the Global Economy, Proceedings from the Asia Economic Policy Conference, eds. R. Glick and M. M. Spiegel. San Francisco: Federal Reserve Bank of San Franciso, pp. 15–30.

Rey, Hélène. 2015. “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence.” NBER Working Paper 21162.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org