An enduring consequence of the COVID-19 pandemic is a notable shift toward remote and hybrid work. This has raised questions regarding whether the shift had a significant effect on the growth rate of U.S. productivity. Analyzing the relationship between GDP per hour growth and the ability to telework across industries shows that industries that are more adaptable to remote work did not experience a bigger decline or boost in productivity growth since 2020 than less adaptable industries. Thus, teleworking most likely has neither substantially held back nor boosted productivity growth.

The U.S. labor market experienced a massive increase in remote and hybrid work during the COVID-19 pandemic. At its peak, more than 60% of paid workdays were done remotely—compared with only 5% before the pandemic. As of December 2023, about 30% of paid workdays are still done remotely (Barrero, Bloom, and Davis 2021).

Some reports have suggested that teleworking might either boost or harm overall productivity in the economy. And certainly, overall productivity statistics have been volatile. In 2020, U.S. productivity growth surged. This led to optimistic views in the media about the gains from forced digital innovation and the productivity benefits of remote work. However, the surge ended, and productivity growth has retreated to roughly its pre-pandemic trend. Fernald and Li (2022) find from aggregate data that this pattern was largely explained by a predictable cyclical effect from the economy’s downturn and recovery.

In aggregate data, it thus appears difficult to see a large cumulative effect—either positive or negative—from the pandemic so far. But it is possible that aggregate data obscure the effects of teleworking. For example, factors beyond telework could have affected the overall pace of productivity growth. Surveys of businesses have found mixed effects from the pandemic, with many businesses reporting substantial productivity disruptions.

In this Economic Letter, we ask whether we can detect the effects of remote work in the productivity performance of different industries. There are large differences across sectors in how easy it is to work off-site. Thus, if remote work boosts productivity in a substantial way, then it should improve productivity performance, especially in those industries where teleworking is easy to arrange and widely adopted, such as professional services, compared with those where tasks need to be performed in person, such as restaurants.

After controlling for pre-pandemic trends in industry productivity growth rates, we find little statistical relationship between telework and pandemic productivity performance. We conclude that the shift to remote work, on its own, is unlikely to be a major factor explaining differences across sectors in productivity performance. By extension, despite the important social and cultural effects of increased telework, the shift is unlikely to be a major factor explaining changes in aggregate productivity.

Possible productivity effects of telework

Teleworking might affect output per hour in different ways. For example, in surveys, many workers claim to be more productive remotely (Barrero et al 2021). That said, some workers might face more disruptions, such as childcare demands or inferior equipment. In addition, idea sharing may be more difficult online, and workers may need to devote time to learning new skills. Alternatively, any association between the ability to telework and productivity performance could reflect other factors. For example, industries where the majority of work needs to be done in person could have faced more disruptions from social-distancing requirements or supply chain bottlenecks.

Thus, in theory the relationship between telework and productivity balances both positive and negative effects. The net effect may also change over time as businesses and workers adjust to new modes of working.

Empirical evidence tends to involve relatively narrow sets of tasks, such as call centers, where output can be easily measured. For example, Bloom et al. (2015) find that workers in a call center in China who were randomly assigned to remote work were more productive than in-person workers. In contrast, Emanuel and Harrington (2023) find that call-center workers at a Fortune 500 company were slightly less productive after they were forced to work remotely at the onset of the pandemic. Emanuel and Harrington (2023) discuss other literature that finds a mix of productivity gains and costs. Because of the narrow scope of the empirical evidence, we turn to industry data to provide more insight.

Measuring productivity growth by industry

In this Letter, we measure industry productivity by output, using value added, per hour. We focus on 43 industries that span the private economy, including, for example, chemical manufacturing, retail trade, and accommodation and food services. We exclude the real estate, rental, and leasing industry because a large fraction of output in this industry is imputed rather than directly measured.

We construct industry-level productivity by combining national accounts measures of output by industry from the Bureau of Economic Analysis (BEA) and all-employee aggregate weekly hours from the Bureau of Labor Statistics (BLS). Our industry-level productivity data set is available quarterly starting in the second quarter of 2006 and ending in the first quarter of 2023. For each industry, we calculate the average annualized growth in quarterly productivity to measure changes in industry productivity over the pandemic.

We measure teleworkability by industry using the occupational mix of different industries and the teleworkability of different occupations. For the latter, we rely on occupational teleworkability scores from Dingel and Neiman (2020), which assigns 462 occupations a score between zero and one based on the job characteristics reported in the O*NET survey. Occupations that cannot be done remotely, such as custodial workers and waiters, were given a score of zero, while entirely teleworkable jobs, such as mathematicians and research scientists, received scores of one. Occupations that fall between the poles include counselors and medical records technicians, which receive scores of 0.5. Bick, Blandin, and Mertens (2020) report that actual teleworking shares are highly related to the Dingel and Neiman measures.

We aggregate these occupation-level scores to an industry-level average by weighing the teleworkability score for each occupation by the 2018 share of industry employment from the BLS Occupational Employment and Wage Statistics. For example, we assign the data processing industry a score of 0.88 because most of the workers in this industry are in highly teleworkable occupations, such as software developers and programmers.

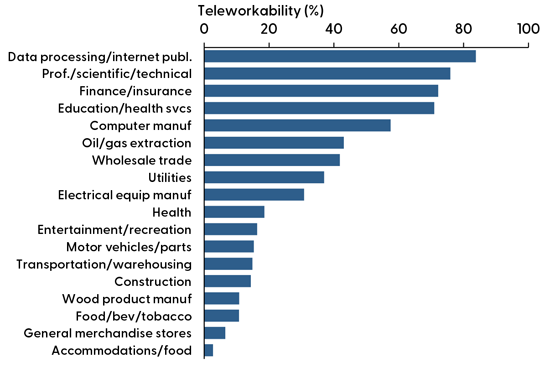

Figure 1 displays scores for a subset of industries ordered from the most teleworkable on the top to the least teleworkable on the bottom. The most teleworkable industries are data processing and professional services. The least teleworkable industries are accommodation and food services and some retailers. The figure demonstrates that teleworkability varies widely across industries, ranging from less than 10% to close to 90% of an industry’s workers.

Figure 1

Teleworkability by industry

Industry productivity and teleworkability

Since industries differ considerably in their adaptability to remote work, one would imagine that the shift to telework during the pandemic would affect industries differently. For example, if teleworking offered an important way to circumvent production disruptions brought on by the pandemic, teleworkable industries would have performed better because they faced lower costs to adopting teleworking.

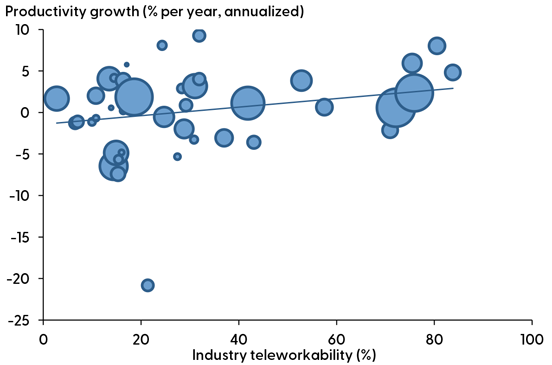

We next examine this relationship between teleworkability and industry productivity growth during and following the pandemic, shown in Figure 2. The horizontal axis measures teleworkability by industry, constructed from the Dingel and Neiman measures in Figure 1. The vertical axis is annualized quarterly productivity growth from the fourth quarter of 2019 to the first quarter of 2023, measured in percentage points. The size of the bubbles conveys the pre-pandemic share of an industry’s contribution to total output, measured as industry value-added, as of the fourth quarter of 2019.

Figure 2

Industry productivity growth versus teleworkability

Note: Productivity growth measured from 2019:Q4 to 2023:Q1, annualized.

The blue fitted line reflects the average relationship between the two variables. The figure shows that more-teleworkable industries grew somewhat faster during the pandemic than less-teleworkable industries. A 1 percentage point increase in teleworkability is associated with a 0.05 percentage point increase in an industry’s predicted pandemic productivity growth rate. The relationship is statistically significant.

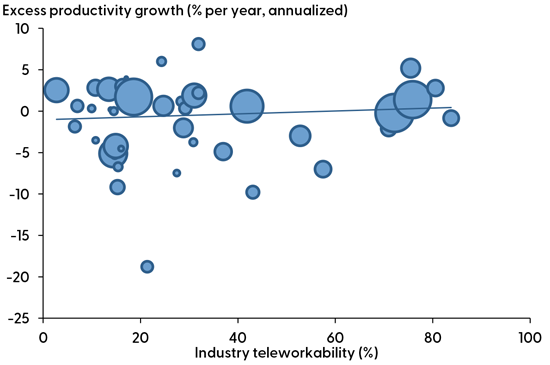

However, it turns out that more-teleworkable industries also grew faster before the pandemic. To better isolate the association with the shift to remote work during the pandemic, Figure 3 controls for pre-pandemic trends by removing each industry’s average annualized productivity growth for 2006–2019 from its pandemic average. Hence, the vertical axis now captures the amount by which an industry’s pandemic productivity growth exceeded or fell short of its pre-pandemic pace.

In Figure 3, the nearly flat blue line reflects that there is essentially no relationship between teleworkability and excess pandemic productivity growth. Although the association is still slightly positive, the relationship is much weaker than in Figure 2 and is not statistically significant.

Figure 3

Productivity growth, accounting for pre-pandemic trends

Note: Productivity growth measured from 2019:Q4 to 2023:Q1, annualized.

Both Figures 2 and 3, show that productivity growth varied significantly across industries. But based on Figure 3, it appears unlikely that the differences in performance during the pandemic across industries have much to do with differences in teleworking. Fernald and Li (2022) take the analysis one step further by considering that growth in work hours might be mismeasured to the extent that people are working more “off the clock” (Barrero et al. 2021). That analysis reinforces the conclusion from Figure 3, that there is essentially no relationship between teleworkability and pandemic productivity growth. We found similar results using only data during 2020 when firms were first adjusting to new work arrangements. The results are also similar for 2021-23, when firms had more experience with remote work and were also shifting to reopening office workspaces and, increasingly, to hybrid work.

Conclusion

The shift to remote and hybrid work has reshaped society in important ways, and these effects are likely to continue to evolve. For example, with less time spent commuting, some people have moved out of cities, and the lines between work and home life have blurred. Despite these noteworthy effects, in this Letter we find little evidence in industry data that the shift to remote and hybrid work has either substantially held back or boosted the rate of productivity growth.

Our findings do not rule out possible future changes in productivity growth from the spread of remote work. The economic environment has changed in many ways during and since the pandemic, which could have masked the longer-run effects of teleworking. Continuous innovation is the key to sustained productivity growth. Working remotely could foster innovation through a reduction in communication costs and improved talent allocation across geographic areas. However, working off-site could also hamper innovation by reducing in-person office interactions that foster idea generation and diffusion. The future of work is likely to be a hybrid format that balances the benefits and limitations of remote work.

References

Barrero, Jose Maria, Nicolas Bloom, and Steven J. Davis. 2021. “Why Working from Home Will Stick.” National Bureau of Economic Research Working Paper 28731. Updated survey results available from https://wfhresearch.com/.

Bick, Alexander, Adam Blandin, and Karel Mertens. 2020. “Work from Home before and after the COVID-19 Outbreak.” American Economic Journal: Macroeconomics 15(4), pp. 1-39.

Bloom, Nicholas, James Liang, John Roberts, and Zhichun Jenny Ying. 2015. “Does Working from Home Work? Evidence from a Chinese Experiment.” Quarterly Journal of Economics 130(1), pp. 165¬-218.

Dingel, Jonathan I., and Brent Neiman. 2020. “How Many Jobs Can Be Done at Home?” Journal of Public Economics 189(104235).

Emanuel, Natalia, and Emma Harrington. 2023. “Working Remotely? Selection, Treatment, and the Market for Remote Work.” FRB New York Staff Report 1061 (May).

Fernald, John, and Huiyu Li. 2022. “The Impact of COVID on Productivity and Potential Output.” Paper presented at the Federal Reserve Bank of Kansas City’s Economic Policy Symposium, Jackson Hole, WY, August 25.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org