Extreme weather can have negative, minimal, or even positive effects on business performance—creating significant uncertainty about outcomes for those businesses. Financial markets show heightened uncertainty among investors for companies that have been hit by hurricanes. This uncertainty persists for several months after a hurricane’s landfall, as reflected by continued discussion of hurricanes in analyst calls. Comparing expected volatility to actual volatility shows that markets have underreacted to the uncertainty caused by hurricanes. After Hurricane Sandy, a particularly salient hurricane for investors, this market underreaction appears to have diminished.

Extreme weather events like hurricanes have caused hundreds of billions of dollars in damages in recent years, affecting not only households and public infrastructure but also businesses (Smith 2022). The unpredictable impacts of extreme weather events on a company’s capital, operations, and business environment can create significant uncertainty for firms and investors. Mispricing of such events in asset markets could lead to sudden sharp price corrections. Yet in the emerging research about potential financial effects from climate risk, little is known about the uncertainty that extreme weather events generate for firms or how financial markets reflect such uncertainty in prices.

In this Economic Letter, based on research by Kruttli, Roth Tran, and Watugala (2023), we use firm-level exposures to hurricanes from 1996 to 2019 to understand how extreme weather events affect firm performance in financial markets as measured by option and stock prices. We show that asset prices in financial markets adjust to account for significant uncertainty for companies that have been hit by hurricanes. We then show that investors historically underreacted to the volatility arising from the uncertain impacts of a hurricane and did not efficiently update their volatility expectations based on the information available in real time. We find that investor underreaction to hurricanes diminished after Hurricane Sandy, suggesting that the informational efficiency of markets improved after this particularly salient extreme weather event that many investors experienced personally.

Hurricanes increase uncertainty for affected firms

Extreme weather events can affect businesses in a variety of ways. In addition to damaging physical assets, such events can disrupt normal business activities, imposing costs like lost sales, evacuations, or shutting down and restarting of plant operations. Extreme weather events can also upset supply chains or slow demand for products. However, for some companies, such events can present opportunities, such as higher demand for products like power generators or construction supplies. Also, some firms may be able to mitigate the negative impacts of extreme weather events through insurance or adaptation. For example, companies could relocate to less vulnerable areas. However, because adaptation and insurance are costly and not always available, incomplete insurance or adaptation can leave some firms facing significant losses after extreme weather events. This can lead to investor uncertainty about how firms will fare after being hit by such events, which can be reflected in market valuations.

Considering the wide range of potential effects to businesses from extreme weather, markets may not reflect the full impact of hurricanes in real time. Researchers commonly use stock and option prices to assess market beliefs regarding a public firm’s current and expected performance. An option, a financial instrument that gives investors the right to sell or purchase a firm’s stock at a particular price in the future, allows investors to hedge, that is insure, against potential stock price changes. For example, investors who are concerned that a stock price could plummet may purchase an option that enables them in the future to sell that stock at a price that is above the low prices they are concerned about. When investors become more uncertain about a firm’s stock price, their willingness to buy the option increases, which in turn drives up the option price. With these dynamics in mind, researchers have used option prices to study the uncertainty of financial market participants regarding firm outcomes (see Bloom 2009; Pástor and Veronesi 2012, 2013; and Jurado, Ludvigson, and Ng 2015).

To estimate how hurricanes affect investor uncertainty about a firm’s performance, we use regression analysis to compare the change in uncertainty after a hurricane for firms that were hit relative to those that were not. We consider how uncertainty changes over time relative to the level before the first forecast of a hurricane landfall. We use the share of a firm’s establishments in a 200-mile radius around the eye of a hurricane to determine whether a firm was hit and how large its exposure was.

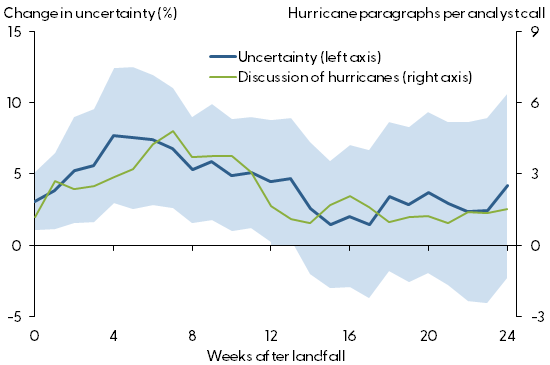

The thick blue line in Figure 1 shows our estimated average impact of hurricane exposure on uncertainty for a business over the months following landfall. The figure shows that market uncertainty is higher for affected firms once landfall occurs. It also shows that uncertainty increases over the next few weeks and remains elevated for an extended period before dropping substantially in the third month and beyond to a level that is not statistically distinguishable from the pre-hurricane level.

Figure 1

Change in uncertainty after hurricane landfall

Note: Uncertainty (thick blue line) is measured by implied volatility in options markets for firms hit by a hurricane relative to firms not hit; blue shading reflects the 95% confidence band around this average estimate. Exposure is determined by the share of firm establishments located within 200 miles of the hurricane path. Hurricane paragraphs (thin green line) reflect text analysis of discussions between firm managers, analysts and investors that contain “hurricane” or “tropical.” Discussion of hurricanes is shown for affected firms, with a value of 2 indicating that a firm with all of its establishments in the hit region has two paragraphs per call.

These findings suggest that firms are not fully insured or have not adapted to hurricane risk because, if they were, hurricanes would not create uncertainty for firms that are in landfall regions. This limited protection against hurricane risk could reflect the high cost or lack of availability of insurance and adaptation. For example, relocating the firm to low-risk areas could be unworkable if demand, labor supply, or natural resources that are essential to its operations are located in high-risk areas. For instance, a mining company has to operate where the oil, gas, or coal it is extracting is located. As in the examples of wildfire risk in California and hurricane risk in Florida and Louisiana, obtaining insurance against certain risks is becoming increasingly difficult. Furthermore, some impacts like declines in demand may be difficult to measure and attribute and thus may be difficult to insure against.

The finding that uncertainty remains elevated for months after a hurricane’s landfall indicates that uncertainty persists well after the resolution of questions regarding whether and where the event itself will occur. Kruttli et al. (2023) find that uncertainty also increases in response to specific hurricane forecasts, indicating that investors pay attention to forecasts. However, the persistence of uncertainty long after landfall indicates that much of the uncertainty relates to the impacts of these extreme weather events, as opposed to just uncertainty about the incidence of the hurricane event itself.

Why does it take so long for investors to understand how an extreme weather event that has already happened will impact firms? One potential explanation is that it takes time for firms to assess and then communicate the impacts to investors. The thin green line in Figure 1 shows the frequency of hurricane discussions in calls between firm managers, investment analysts, and investors. This line shows that the hurricane discussion frequency rises steadily after a hurricane makes landfall and remains quite elevated for several months.

A systematic evaluation of these discussions reveals five key topics arising for firms that have been hit by hurricanes: physical damages, business disruption, insurance, supply, and demand. The call transcripts also reveal that companies can be negatively or positively affected or relatively unaffected. Thus, the wide range of potential impacts that hurricanes can have on businesses, combined with the time required for learning about and disseminating this information, explain the persistent uncertainty.

Efficiency and learning

One concern with physical risks like extreme weather events is that investor inattention or lack of information could cause mispricing of risks that could lead to sudden sharp price corrections in the future. Although our findings show that investors react to hurricanes by pricing in more uncertainty for firms that have been hit, those results do not indicate whether the price responses are biased or accurately reflect increased volatility. We next examine the volatility risk premium, defined as the difference in the expected volatility implied by options markets after a hurricane landfall and the subsequent realized volatility of the underlying stock returns over the period covered by those options. A negative volatility risk premium indicates that the actual volatility is greater than the volatility anticipated by options markets.

In assessing potential market underreactions to extreme weather uncertainty, we are interested in not only the average response over the course of our sample but also in whether investors could have learned from a major event in a way that might have shifted their responses. We consider Hurricane Sandy, which in 2012 caused unprecedented damage in the New York City metro area, the financial capital of the United States. This hurricane led to numerous emergency actions, including a two-day closure of the New York Stock Exchange. As such, Sandy not only affected many people and businesses but was also a particularly salient hurricane for investors.

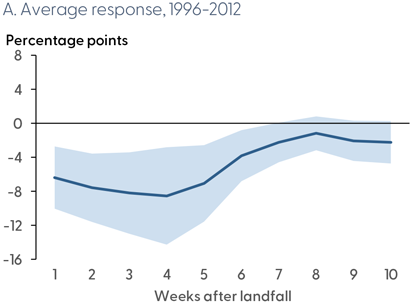

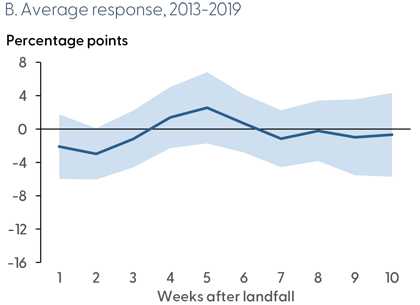

Panel A of Figure 2 shows that through 2012, the year Hurricane Sandy hit, the typical post-hurricane landfall volatility risk premium was negative, consistent with investor underreaction. In contrast, panel B shows that, in the years since Hurricane Sandy, the typical post-hurricane landfall volatility risk premium is higher than before and is no longer statistically distinguishable from zero, depicted by the zero line being inside the shaded confidence band. This indicates that investors have underreacted less to hurricanes after Hurricane Sandy.

Figure 2

Changes in volatility risk premium in weeks after hurricane landfall

Source: Calculations in Kruttli, Roth Tran, and Watugala (2023) based on NOAA, OptionMetrics, CRSP, Compustat, and NETS data.

Note: Lines show the volatility risk premium, defined as the difference in the expected volatility implied by options markets after a hurricane landfall and the subsequent realized volatility of the underlying stock returns over the period covered by those options. Shaded blue regions indicate 95% confidence bands.

Conclusion

The analysis in this Economic Letter shows that hurricanes can introduce spikes in uncertainty that can linger in financial markets for affected firms. Such bouts of uncertainty are likely to arise in response to future extreme weather events due to questions about both the likelihood of those events and the wide range of potential impacts. The channels driving this uncertainty are complex and may be difficult to mitigate fully. Fortunately, investors appear to have become more aware after experiencing Hurricane Sandy, a particularly salient event, and have, over time, reduced their underreaction to immediate hurricane risk. However, the historical underreaction to uncertainty arising from hurricanes suggests that market inefficiencies around physical risks could persist.

References

Bloom, Nicholas. 2009. “The Impact of Uncertainty Shocks.” Econometrica 77(3), pp. 623–685.

Jurado, Kyle, Sydney C. Ludvigson, and Serena Ng. 2015. “Measuring Uncertainty.” American Economic Review 105(3), pp. 1,177–1,216.

Kruttli, Mathias S., Brigitte Roth Tran, and Sumudu W. Watugala. 2023. “Pricing Poseidon: Extreme Weather Uncertainty and Firm Return Dynamics.” FRB San Francisco Working Paper 2021-23, forthcoming in Journal of Finance.

Pástor, Luboš, and Pietro Veronesi. 2012. “Uncertainty about Government Policy and Stock Prices.” Journal of Finance 67, pp. 1,219–1,264.

Pástor, Luboš, and Pietro Veronesi. 2013. “Political Uncertainty and Risk Premia.” Journal of Financial Economics 110, pp. 520–545.

Smith, Adam B. 2022. “2021 U.S. Billion-Dollar Weather and Climate Disasters in Historical Context.” Beyond the Data, National Oceanographic and Atmospheric Administration blog, January 24.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org