Surveys of professional economic forecasters and financial market data can reveal public perceptions about the future conduct of monetary policy. Current estimates suggest that both professional forecasters and investors expect the Federal Reserve to respond strongly and systematically to changes in economic conditions. The current perceived responsiveness to inflation is particularly high relative to past responsiveness. Furthermore, the perceived importance of employment as a driver of future policy interest rates has strengthened since 2024.

How effective monetary policy is at stabilizing prices and economic activity depends in large part on the public’s understanding of the policy framework and strategy. For example, if investors understand how monetary policy will react to changes in the economic outlook, markets can, to some extent, “do the central bank’s work for it” as financial conditions adjust to new economic data even before the central bank changes policy rates (Woodford 2005).

A simple way to characterize public perceptions about monetary policy is with a policy rule, following Taylor (1993), that relates the policy interest rate to inflation and economic activity. Simple rules capture and quantify the idea that central banks respond to higher inflation and stronger economic activity by raising interest rates. When monetary policy is described using a policy rule, the crucial question about public perceptions then becomes: What policy rule does the public think the central bank will follow going forward?

Such a perceived policy rule can be estimated using forward-looking data, such as surveys of professional forecasters that contain forecasts for future interest rates, inflation, and economic activity (Bauer, Pflueger, and Sunderam 2024a). Financial markets are another source of forward-looking data, with the response of long-term interest rates to economic news capturing changing expectations for the future course of monetary policy (Bauer, Pflueger, and Sunderam, 2024b). In this Economic Letter, we present survey-based and market-based analysis to shed light on the perceived response of monetary policy to both inflation and real activity.

Monetary policy perceptions from expectations of professional forecasters

We first study monetary policy perceptions using surveys of professional forecasters. Based on all the responses across institutions and forecast horizons in each survey, we estimate the perceived policy rule by relating forecasts of the short-term interest rate to forecasts of inflation and real activity. The resulting policy rule describes, at each point in time, the expected future response of monetary policy to changes in inflation and real activity (Bauer et al. 2024a).

We focus on two widely studied surveys: the Blue Chip Financial Forecasts (BCFF) and the Survey of Professional Forecasters (SPF). The BCFF asks respondents for forecasts of interest rates, including the federal funds rate and various Treasury yields, and for the “macroeconomic assumptions underlying the rate forecasts,” a wording that suggests the logic of a policy rule. We estimate the perceived policy rule in each monthly BCFF survey, using forecasts for the federal funds rate, consumer price index (CPI) inflation, and the output gap, across all forecasters and all quarterly horizons from 0 to 5 quarters; for details, refer to Bauer et al. 2024a. For the SPF, the policy rule relates forecasts for the three-month Treasury bill rate to forecasts for core personal consumption expenditures (PCE) inflation and the unemployment rate. The SPF is a quarterly survey, and we use quarterly forecast horizons from the current quarter to eight quarters in the future, interpolating forecasts for the longer horizons of five to eight quarters from annual forecasts.

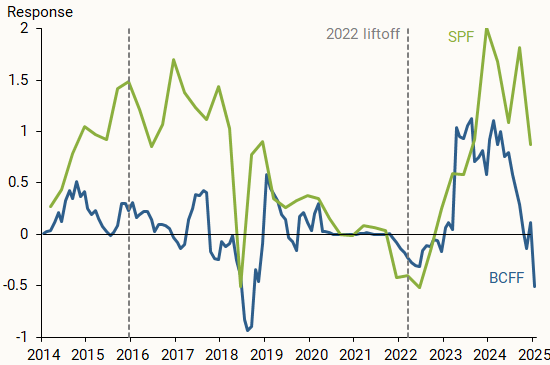

Figure 1 plots the inflation coefficients in the survey-based policy rules, based on the BCFF and SPF, which measure the expected future responsiveness of future short-term interest rates to inflation at each point in time. Both estimates are positive on average, vary substantially, and show broadly similar patterns. Because we can draw from a large number of projections across professional forecasters and horizons in each individual survey, the coefficients in the perceived policy rules are estimated quite precisely.

Figure 1

Perceived response to inflation in survey-based policy rules

Source: Philadelphia Fed, Wolters Kluwer, FRED, and authors’ calculations.

One might wonder why the expected inflation response sometimes turned negative, such as in early 2022. This occurred because the policy rate was expected to rise while inflation was projected to decline. Inflation and interest rate projections thus pointed in opposite directions, leading to a negative coefficient on inflation in the perceived policy rule.

According to the BCFF estimate, the inflation coefficient was mostly close to zero before the pandemic in 2020 and remained low throughout 2021. Even as inflation rose to levels not seen in 40 years, forecasters did not anticipate a systematic monetary policy response to inflation in the near term. Only after the Federal Reserve began raising the policy rate from its zero lower bound in 2022, known as “liftoff” (right-hand vertical dashed line), did the perceived inflation response coefficient rise substantially. A possible explanation for the delay is that the public was uncertain about the likely monetary policy response to inflation and only learned about it from observing actual rate hikes (Bauer et al. 2024b). After rate hikes started, the estimated inflation response ultimately rose to levels that were higher than at any earlier point in the sample.

The inflation response coefficient in the SPF rule also rose after liftoff. However, unlike the BCFF estimate, this value remained more elevated at the end of the sample period: Since the second half of 2023, it has fluctuated roughly between 1 and 2, consistent with a strong expected policy rate response to changes in inflation. The stronger response estimated using the SPF survey arises because it is based on core inflation forecasts that eliminate volatile food and energy prices and thus give a more accurate read on underlying price pressures than headline inflation in the BCFF.

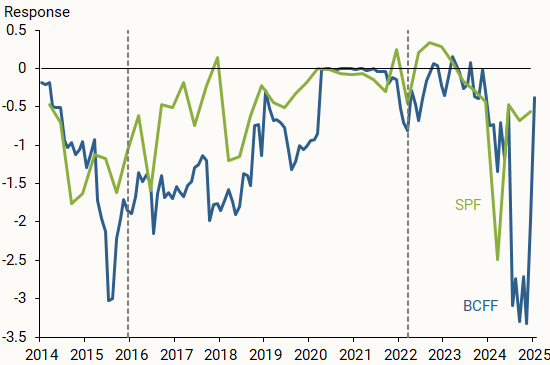

Figure 2 plots coefficients on real activity, measured with the unemployment rate or the output gap, in the two survey-based policy rules. According to forecaster perceptions, the importance of real activity increased in 2024, when both coefficients turned significantly negative. At that time, inflation was getting closer to the Fed’s longer-run goal of 2%, and the January 31, 2024, policy statement by the Federal Open Market Committee indicated that “the risks to achieving its employment and inflation goals are moving into better balance.” For the most recent observations, the estimated real activity response has diminished somewhat, but it is too early to tell whether this lessening will be persistent.

Figure 2

Perceived response to real activity in survey-based policy rules

Source: Philadelphia Fed, Wolters Kluwer, FRED, and authors’ calculations.

Bond market sensitivity to macroeconomic news

We now turn to financial market responses to economic news, which provide another valuable source of forward-looking information about the perceived monetary policy response. Yields on Treasury securities are determined by investor expectations for the future path of short-term interest rates over the life of a bond, in addition to other factors. Event studies of Treasury yields around macroeconomic data releases hence provide evidence of the expected response of future monetary policy to data surprises. For example, when the released inflation number is above consensus forecasts, bond yields should rise more if investors expect the Fed to be highly responsive to changes in inflation.

In our analysis, we estimate the response of 2-year and 10-year Treasury yields to the unexpected or surprise component in the data releases of core CPI inflation and nonfarm payroll employment. Following a methodology similar to Arnaut and Bauer (2024), who studied the time-varying importance of inflation news for financial conditions, we estimate the time-varying Treasury yield sensitivity at each point in time using rolling windows of 24 months.

The surprise is calculated as the difference between the released number and the median expectation before the announcements, measured in percentage points for inflation and thousands of jobs for payroll employment. We assume that inflation surprises affect mainly inflation forecasts and that employment surprises affect mainly the labor market outlook. Thus, the estimated yield responses can be interpreted as the market-perceived responsiveness of monetary policy to inflation and employment.

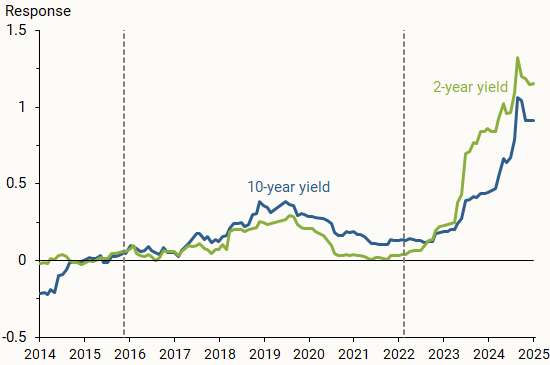

Figure 3 plots the sensitivity of Treasury yields to core CPI surprises. Yields responded very little to the large inflation surprises of 2021 and 2022. But their sensitivity to inflation news surged in 2023 to levels far above those seen over the last decade. Yields have remained highly sensitive to inflation news since then.

Figure 3

Treasury yield responses to core CPI news

Source: Haver, FRED, and authors’ calculations.

Figure 4 shows the estimated yield responses to labor market news in the form of nonfarm payroll surprises. This sensitivity also increased in the most recent post-liftoff period, but somewhat later than the responses to inflation news, rising steeply in early 2024 and persisting since then. This new evidence indicates that bond market investors, like professional forecasters, viewed the employment side of the Fed’s mandate as gaining importance in 2024.

Figure 4

Treasury yield responses to nonfarm payroll news

Source: Haver, FRED, and authors’ calculations.

While the broad patterns in market-based estimates are similar to the survey estimates, there are some differences. In particular, the most recent estimates in Figure 4 suggest a somewhat stronger perceived weight on employment than survey-based estimates in Figure 2. These differences are not surprising given the different estimation methodologies. For example, the market-based estimates are based on rolling regressions using data over the last 24 months, which naturally leads to smoother estimates. Overall, both market-based and survey-based approaches indicate a high perceived Fed responsiveness to inflation and employment in 2024.

Conclusion

In this Letter, we show that the monetary policy inflation response perceived by professional forecasters and financial markets has risen during the Fed’s most recent cycle of interest rate hikes starting in 2022. The perceived importance of the labor market also increased beginning in 2024. These conclusions, supported by both survey-based and financial market-based evidence, suggest that the public currently expects a strong systematic response of the Fed’s monetary policy to inflation and labor market conditions.

A key driver of changes in perceptions about monetary policy is the public’s learning from observed policy actions (Bauer, Pflueger, and Sunderam 2024a,b). This suggests that future policy actions are likely to shape the responsiveness of bond yields to inflation and employment news, perceptions about the Fed’s perceived reaction to changes in the economic outlook, and ultimately the transmission of monetary policy through financial markets.

References

Arnaut, Zoë, and Michael D. Bauer. 2024. “Monetary Policy and Financial Conditions.” FRBSF Economic Letter 2024-07 (March 4).

Bauer, Michael D., Carolin E. Pflueger, and Adi Sunderam. 2024a. “Perceptions about Monetary Policy.” Quarterly Journal of Economics 139(4, November), pp. 2,227–2,278.

Bauer, Michael D., Carolin E. Pflueger, and Adi Sunderam. 2024b. “Changing Perceptions and Post-Pandemic Monetary Policy.” Forthcoming in Proceedings of Jackson Hole Economic Policy Symposium, August 2024.

Taylor, John B. 1993. “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Conference Series on Public Policy 39(1, December).

Woodford, Michael. 2005. “Central Bank Communication and Policy Effectiveness.” Proceedings of 2005 Jackson Hole Economy Symposium.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org