After a prolonged decline, U.S. inflation-adjusted interest rates have increased somewhat since the pandemic—possibly implying a higher new normal. As central banks attempt to tame the post-pandemic inflationary bout, whether real rates will fall back closer to pre-pandemic levels will ultimately depend on the trends in their long-term underlying determinants. Estimates suggest that the pre-pandemic downward pressures from global factors and from U.S. population aging have faded, while fiscal conditions continue to put upward pressure on U.S. real rates.

Interest rates in advanced economies exhibited a pronounced and persistent decline between 1990 and the onset of the COVID-19 pandemic. Since then, however, short-term real rates have remained much higher, as central banks worldwide have tightened monetary policy to fight the post-pandemic inflationary bout. Whether advanced economies will return to low interest rates once central banks bring inflation back to their goals is a key economic question, with important implications for monetary policy.

An answer to this question ultimately depends on the underlying long-term trends that determine the movements of interest rates. In this Economic Letter, we study one set of such trends, focusing on the role of changing demographics as a potential driver of long-term movements in U.S. interest rates. Our estimates also consider the important interplay between demographic trends in the United States and abroad. This interaction accounts for how much the flow of investment from other countries, along with trends in its underlying long-term rate determinants, can affect U.S. interest rates. While our analysis aims to focus on the role of demographics, our estimates also consider other potential long-term drivers of real interest rates highlighted by past research, most notably productivity growth and fiscal conditions.

Our findings—based on our research in Carvalho et al. 2025—suggest that demographic trends and other global factors explain the bulk of the decline in U.S. real interest rates between 1990 and 2019. Since then, however, the downward pressure from global trends and population aging has declined, while fiscal variables have put upward pressure on interest rates.

Underlying trends driving real interest rates

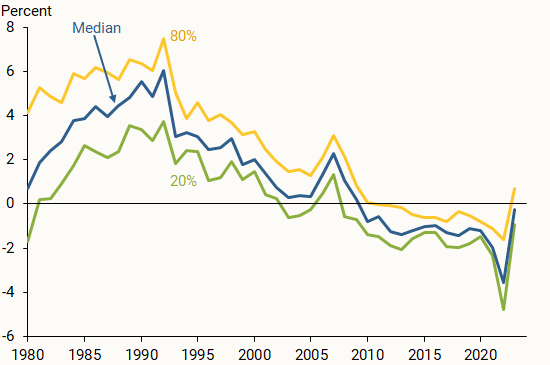

Figure 1 reports inflation-adjusted, also known as real, interest rates across a range of advanced economies between 1980 and 2023. The figure shows the median real rate as well as the 20th and 80th percentiles in our sample. The patterns are striking, with the median real rate declining from nearly 6% in the early 1990s to close to –2% by 2019. Since then, the median rate has increased somewhat to near zero.

Figure 1

Real short-term interest rates across advanced economies

The persistent decline in interest rates has been interpreted by some as evidence that the neutral rate of interest declined during the pre-pandemic period. This rate, also known as r* (r-star), is the inflation-adjusted interest rate that is consistent with the full use of economic resources and steady inflation near the Fed’s inflation goal, absent transitory business cycle shocks to the economy.

R-star is an important input for monetary policy decisions that influence interest rates through the federal funds rate (Williams 2016). Setting the real federal funds rate too high relative to r-star for an extended period could contribute to the economy falling short of the central bank’s inflation goal or cause real GDP growth to fall below potential growth. In contrast, setting the real federal funds rate too low relative to r-star for an extended period could contribute to the economy overshooting the inflation goal. Therefore, changes to r-star affect the level of the desired policy rate and, consequently, other interest rates in the economy.

Understanding the drivers behind the pre-pandemic decline in r-star is key to assessing how future real rates will behave and should give some insights into whether the recent increase in real rates is here to stay. Unfortunately, r-star is not directly observable—it must be inferred using available economic data.

Other research has used various models and empirical methodologies to infer r-star and its main economic drivers. For example, our own previous work showed how changing demographics can affect r-star and how population aging has likely put downward pressure on the U.S. natural rate (Carvalho, Ferrero, and Nechio 2017).

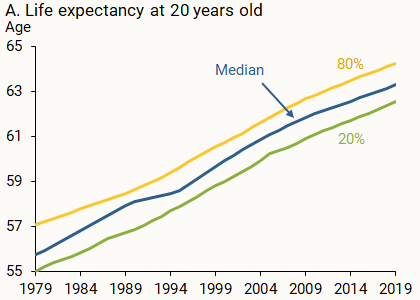

During the pre-pandemic period, the world went through a dramatic demographic transition. In most advanced economies, actual and expected longevity have generally increased steadily since the 1980s, while the median retirement age has changed little, leading to longer retirement periods. Meanwhile, population growth rates are declining and, in some countries, even becoming negative. Figure 2 reports median life expectancy and population growth, along with the 20th and 80th percentiles for the same set of advanced economies considered in Figure 1. Both panels show remarkable population aging over the past few decades.

Figure 2

Life expectancy and population growth in selected advanced economies

Source: United Nations World Population Prospects.

Intuitively, a simple way to think about how aging and other potential drivers may affect r-star is associated with their effects on saving and investment decisions made by households, businesses, and governments. An increase in savings would increase the pool of resources available in the economy, which would put downward pressure on equilibrium real rates and, hence, on r-star. In contrast, an increase in investments and spending relative to savings would tend to push up r-star.

Population aging and a lengthier retirement period may raise overall household incentives to save throughout their life cycle to better prepare for their retirement period. This effect could be even stronger if people believe that public retirement programs will not be able to bear the additional burden generated by an aging population. At the same time, a larger share of retirees in the economy could raise overall spending. Therefore, the effects of aging could, in principle, put either downward or upward pressure on r-star (see Carvalho et al. 2017 for details).

Holston, Laubach, and Williams (2017) focused on another potential driver—the role of the decline in productivity and economic growth—and found that these declines also reduced r-star domestically. In contrast, Rachel and Summers (2019) argued that pre-pandemic fiscal spending helped offset the effects of demographics and productivity by putting upward pressure on r-star. Lower productivity and GDP growth could limit investment opportunities and put downward pressure on r-star, while increasing public spending and debt means that the government has less savings, which would put upward pressure on r-star.

In a world with open economies, where savings and investments can flow from one country to another, policymakers need to consider both domestic and international trends behind desired savings and investments. For example, population aging abroad could help raise foreign savings, which may be redirected to the United States, raising the pool of domestic savings and helping push U.S. r-star down. Therefore, estimates of the relationship between these and other economic trends on r-star in any country must also consider developments and trends abroad.

Contributions of trends to the U.S. real rate before and since the pandemic

To estimate the effects of underlying trends on U.S. interest rates, we rely on estimates reported in Carvalho et al. (2025). That paper uses a statistical model, known as an error correction model, to estimate long-run relationships between real rates and their underlying trends across a panel of advanced open economies. Our sample includes annual data from 1979 to 2019 for Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Spain, Sweden, Switzerland, the United Kingdom, and the United States. Because savings and investments can flow across borders in open economies, both domestic and international factors are likely to have an impact on domestic real interest rates. Therefore, our estimates include potential domestic drivers of r-star and rely on a weighting scheme to account for the degree of each country’s financial integration. Moreover, the estimates also include a “global rate,” which corresponds to the average real interest rate faced by each country in the sample. The average global rate is meant to summarize and proxy for the effects of potential international trends.

We apply the estimated average relationships between real rates and the potential drivers of r-star from Carvalho et al. (2025) to the changes in real rates and potential drivers in the United States before and since the pandemic, while also accounting for the degree of U.S. financial integration. This approach allows us to calculate the contributions of each potential driver to the movements of U.S. real rates in the long term. For brevity, we focus here on population aging, productivity growth, and fiscal spending.

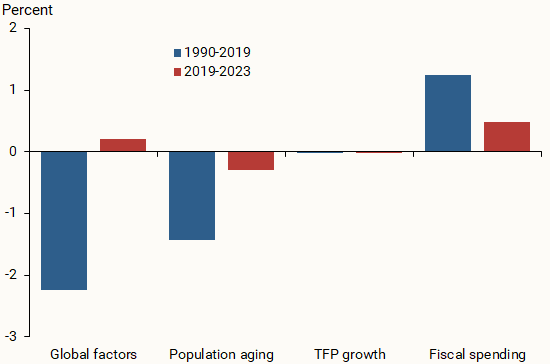

Figure 3 reports the contributions of potential trends behind U.S. r-star before the pandemic (blue bars) and since the pandemic (red bars). The bulk of the pre-pandemic decline in U.S. real rates can be associated with both domestic and foreign developments. International factors, as captured by the global rate, and U.S. population aging contributed significantly to pushing U.S. real rates down. In contrast, fiscal spending put upward pressure on U.S. real rates.

Figure 3

Estimated contributions to U.S. real interest rate changes

Since 2019, however, international factors have put upward pressure on U.S. real rates. Population aging has continued to put a modest downward pressure on U.S. real rates, while fiscal spending has continued to put upward pressure on U.S. rates. In both periods, the estimates suggest that TFP has played a very minor role in driving r-star.

Comparing the blue and red bars suggests some important changes to the dynamics of underlying drivers of U.S. r-star. However, some caveats to this comparison are worth mentioning. First, the empirical method of Carvalho et al. (2025) is meant to uncover long-term relationships, so the short number of years since the pandemic makes the recent comparisons more sensitive to temporary influences. Second, the pandemic likely affected some of the underlying trends we focus on. For example, health challenges related to the pandemic could have some impact on population aging statistics. Similarly, government spending increased worldwide through policies aimed to mitigate the economic effects of the pandemic. Third, for simplicity, we considered only a few potential drivers of r-star here. Carvalho et al. (2025) provide an extensive discussion of other factors and a brief summary of other research on these issues. Finally, our findings may not fully reflect future trends behind r-star because those trends can be affected by shocks and changes to countries’ financial integration.

Conclusion

The estimates reported in this Letter suggest that both domestic and foreign factors have contributed to the persistent pre-pandemic decline in r-star, the long-run U.S. neutral interest rate. U.S. population aging was an important factor pushing r-star down. Global trends also contributed to this persistent decline, while fiscal spending somewhat offset the downward trend. Following a decline that lasted approximately three decades, the evidence suggests a recent shift in the key factors driving r-star, potentially raising its post-pandemic estimates. In an environment of high uncertainty, however, only time will tell whether these shifts will persist and whether r-star will remain elevated.

References

Carvalho, Carlos, Andrea Ferrero, and Fernanda Nechio. 2017. “Demographic Transition and Low U.S. Interest Rates.” FRBSF Economic Letter 2017-27 (September 25).

Carvalho, Carlos, Andrea Ferrero, Fernanda Nechio, and Felipe Mazin. 2025. “Demographics and Real Interest Rates Across Countries and Over Time.” Forthcoming in Journal of International Economics, available as FRB San Francisco Working Paper 2023-32.

Holston, Kathryn, Thomas Laubach, and John C. Williams 2017. “Measuring the Natural Rate of Interest: International Trends and Determinants.” Journal of International Economics 108, pp. S59–S75.

Rachel, Lukasz, and Lawrence H. Summers. 2019. “On Secular Stagnation in the Industrialized World.” Brookings Papers on Economic Activity 50, pp. 1–54.

Williams, John C. 2016. “Monetary Policy in a Low R-star World.” FRBSF Economic Letter 2016-23 (August 15).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org